Oil Trade Setup – April 28

Market Overview:

Oil prices are under pressure early this week as traders balance rising geopolitical risks, looming OPEC+ supply increases, and persistent global economic uncertainty. West Texas Intermediate (WTI) crude for June delivery is hovering near $62.94 per barrel after slipping slightly in early trading.

Sentiment remains cautious:

-

OPEC+ is preparing to release an additional 2.2 million barrels per day starting June, weighing on prices.

-

U.S.-China trade tensions are worsening, denting growth and demand outlooks, even as hopes for a resolution occasionally offer support.

-

Recent data also shows China’s crude imports surging, but questions remain about the sustainability of demand.

Technically, WTI crude is trading near key support levels, with the 50-EMA at $62.83 and the 200-EMA overhead at $63.31. A bearish trend line continues to cap advances, while RSI indicators are starting to turn lower from overbought territory.

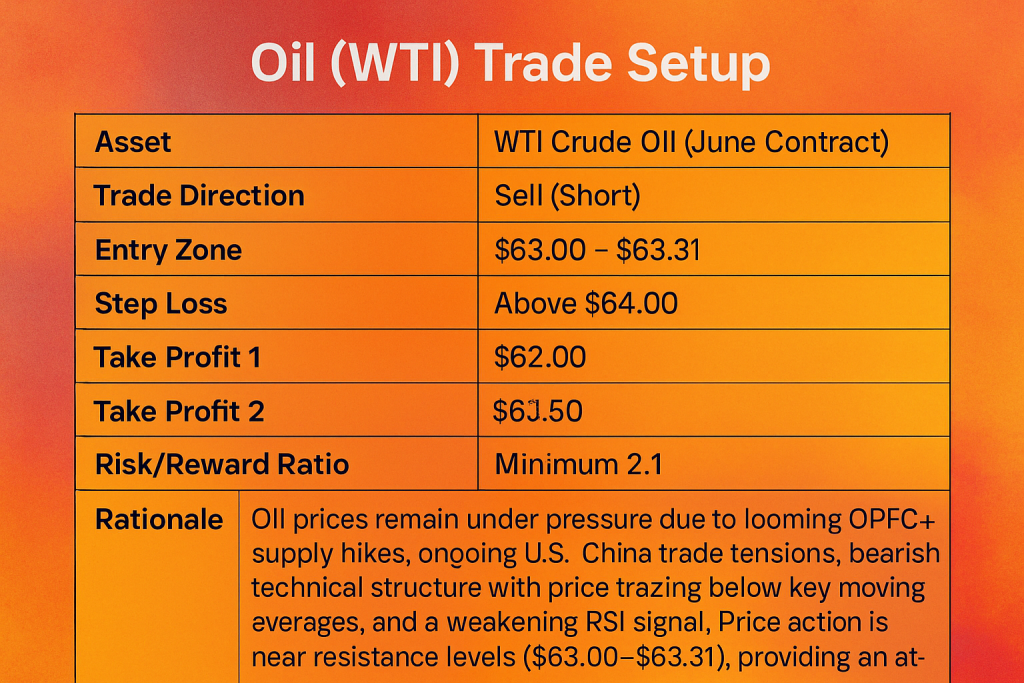

Oil Trade Setup

| Parameter | Details |

|---|---|

| Asset | WTI Crude Oil (June Contract) |

| Trade Direction | Sell (Short) |

| Entry Zone | $63.00 – $63.31 |

| Stop Loss | Above $64.00 |

| Take Profit 1 | $62.00 |

| Take Profit 2 | $61.50 |

| Risk/Reward Ratio | Minimum 2:1 |

| Rationale | Oil prices remain under pressure due to looming OPEC+ production hikes, ongoing U.S.-China trade tensions, bearish technical structure with price trading below key moving averages, and a weakening RSI signal. Price action is near resistance levels ($63.00–$63.31), providing an attractive area to initiate short positions with controlled risk. |

| Key Risk Events | OPEC+ meeting (May 5), U.S.-China trade developments, U.S. macro data releases. |

Technical Setup:

-

Current Price: $62.81

-

Support Levels: $62.79 (pivot) ➔ $61.53 ➔ $60.23

-

Resistance Levels: $63.31 ➔ $64.83 ➔ $65.97

Trade Idea:

-

Bias: Bearish below $63.31.

-

Entry (Sell): Near $63.00–$63.31 resistance zone, depending on price action confirmation.

-

Target 1: $62.00

-

Target 2: $61.50

-

Stop Loss: Above $64.00 (above trendline resistance and minor highs).

-

Risk Management: Aim for at least a 2:1 reward-to-risk ratio, given ongoing volatility around macro headlines.

Key Risk Events:

-

May 5 OPEC+ meeting (possible further production increase announcement)

-

Developments in U.S.-China trade negotiations

-

U.S. economic data releases impacting growth expectations

Summary:

Crude oil remains in a vulnerable position as macroeconomic headwinds, OPEC+ supply increases, and technical weakness weigh on sentiment. A confirmed break below $62.79 support could trigger a move toward $61.50 and lower. However, if geopolitical tensions ease or supply fears moderate unexpectedly, a short squeeze toward $64.83–$65.97 could unfold.

Caution is warranted as price action remains headline-driven.

Check out more FX Trade Setups on our forex page.