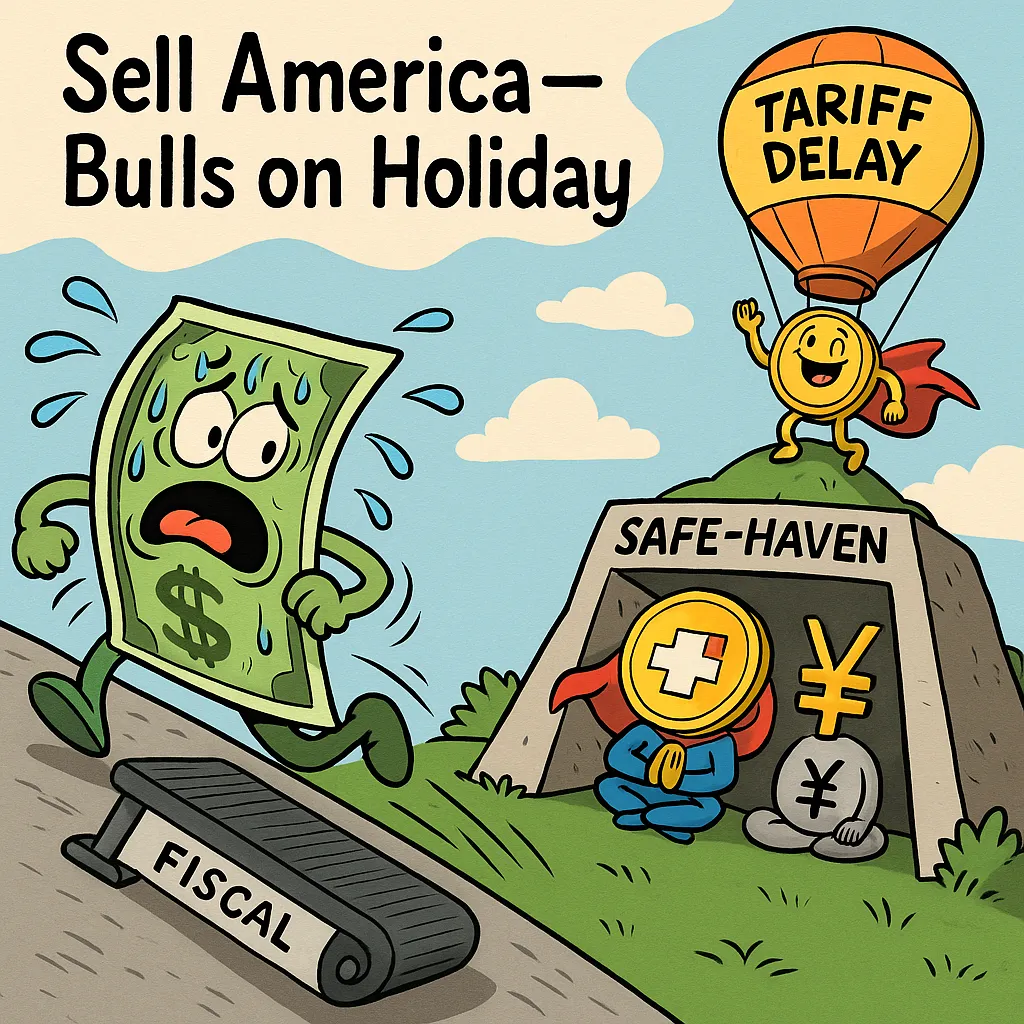

Track all markets on TradingView 26th May Trade Ideas – USDCHF Analysis Global FX flows have snapped back into “Sell-America, Buy Havens & Europe” mode after President Trump postponed the 50 % EU-tariff threat to 9 July and markets re-priced the U.S. fiscal outlook sharply lower. The result has been a broad USD slide to one-month lows, firmer safe-haven demand for the Swiss franc and yen, and a fresh breakout in the euro. With these macro tail-winds now aligned with clean technical structures, four trade ideas stand out for their high probability: Rank Pair / Direction Entry LevelStop Loss Targets Detailed Rationale 1USD/CHF – SHORT0.8195 – sell a 1-h close0.8300 (tight 0.8350)TP1 – 0.8184TP2 – 0.8100US fiscal angst + lingering war headlines keep haven-CHF in demand; structure still a fresh bear-flag break with thin support under 0.8200. Momentum (RSI < 50) intact.2USD/JPY – SHORT142.00 – sell a 4-h close146.00 (fade) / 144.80 (break)TP1 – 141.65TP2 – 141.00Divergent policy path (BoJ tightening vs. Fed cuts), fiscal worries and tech break of April up-trend keep bias lower. Fresh trade-deal hopes only slow, not reverse, down-move; 142.00 is pivot.3EUR/USD – LONG1.1425 – Dip-buy 1.3520-1.3540 (prior breakout zone1.1285 (below prior swing)TP1 – 1.1450TP2 – 1.1500Tariff delay to 9 Jul + DXY slide revive “Sell America”. Germany GDP beat, ECB only mildly dovish. Clear close through 1.1375 confirmed higher-high; momentum positive but not overbought.4GBP/USD – LONG▸ **Break** – buy a daily close **› 1.3600**.<br>▸ **Dip-buy** 1.3520-1.3540 (prior breakout zone).1.3425 (below 9-EMA)TP1 – 1.3730TP2 – 1.3900Retail-sales beat, sticky CPI, and tariff reprieve power sterling; ascending channel intact, RSI still below 70. Clean 1.3600 clearance opens un-contested air to 1.3730+. SummaryThe macro narrative (USD under fiscal and trade-policy pressure) and technical picture (clear breakouts / breakdowns with room to run) line up most cleanly in USD/CHF, USD/JPY, and EUR/USD. All three pairs offer attractive risk-reward profiles:USD/CHF is perched just above thin air—any slip through 0.8195 could accelerate toward the year-to-date low at 0.8038.USD/JPY remains a “sell-the-rally” market while it trades beneath 144, with a decisive move sub-142 likely to test 141-handle supports.EUR/USD has completed its breakout; holding above 1.1375 keeps 1.1500 and the YTD high (1.1573) squarely in view.Event risk is front-loaded this week (FOMC minutes, U.S. GDP, core-PCE), so position sizing and disciplined stop-management are crucial. But if the prevailing “Sell America” theme holds, these three trades have the greatest potential to capitalise on continuing USD weakness. Check similar High-Conviction Trade Ideas on our forex page.Please visit our Disclaimer page.DisclaimerInformation on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.You should do your own thorough research or engage the services of a registered financial markets professional before making any investment decisions. TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from TerraBullMarkets.com.TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice. TerraBullMarkets...

Premium FX & Commodities

Trade Setups

Professional analysis & signals delivered daily for just