ISM Manufacturing PMI – What to Expect – 01.10.25

On Wednesday, 1 October 2025 (15:00 UK), the Institute for Supply Management (ISM) will release the September Manufacturing PMI and components, a market-moving gauge of U.S. factory activity that shapes views on growth momentum, inflation pressures, and interest-rate expectations.

Our base case considers the latest available data releases, including the S&P Global flash PMI, September regional Fed manufacturing surveys (New York, Philadelphia, Richmond, Dallas, Kansas City), August hard data (industrial production, durable goods/core capex), and late-September cost dynamics, most notably energy.

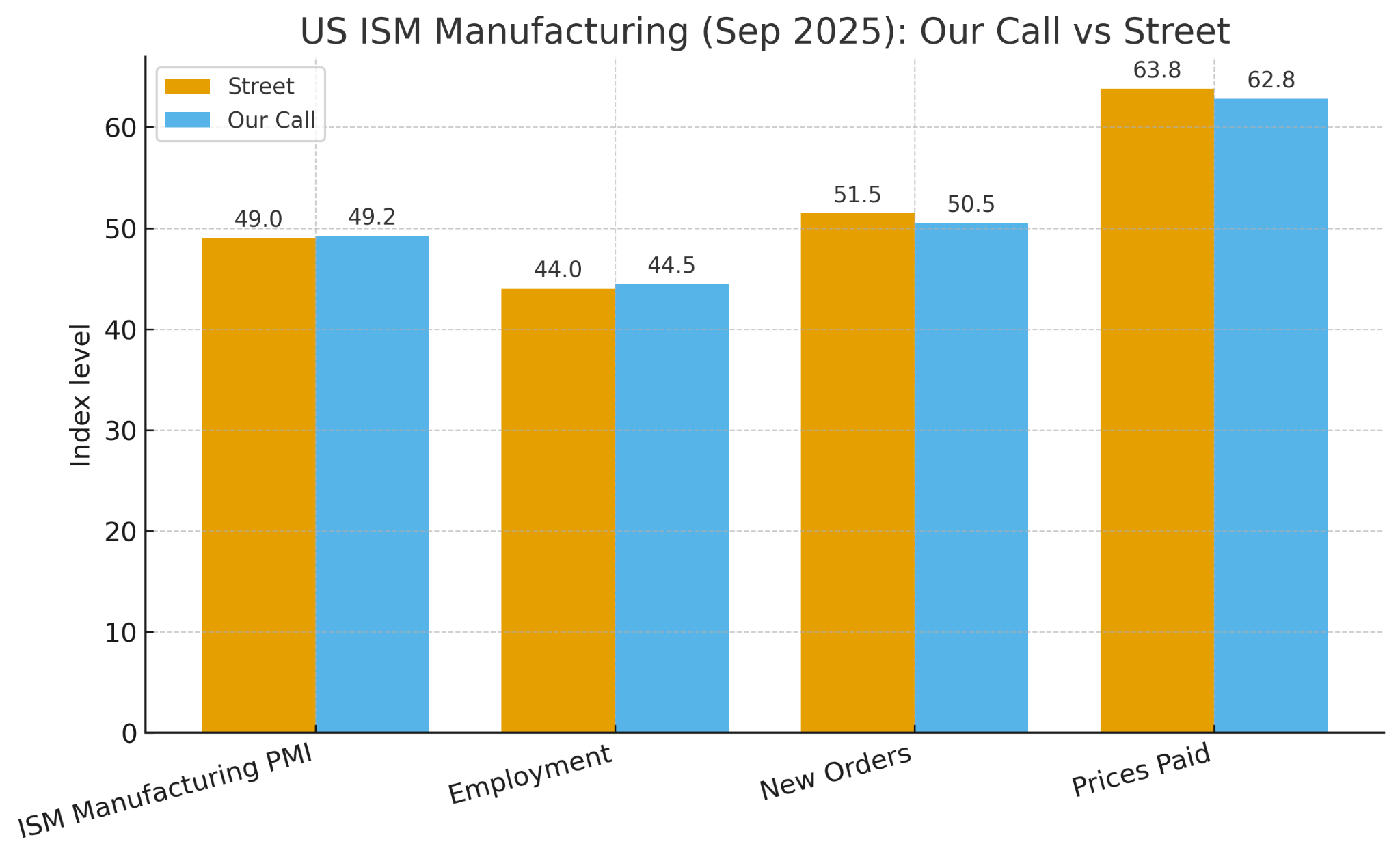

Base case – Our Call vs Street Estimates

| Series | Prev | Cons./Street | Our Call | Surprise skew |

|---|---|---|---|---|

| ISM Manufacturing PMI (Sep) | 48.7 | 49.0 | 49.2 (range 48.5 – 49.8) | Slight above street, still sub-50 |

| ISM Employment | 43.8 | 44 | 44.5 (43 – 46) | In line / marginally firmer |

| ISM New Orders | 51.4 | 51.5 | 50.5 (49 – 51.5) | Softer than street (risk dips to 50) |

| ISM Prices Paid | 63.7 | 63.8 | 62.8 (61.5 – 64.0) | Slightly softer vs Aug/consensus |

Why:

1) National PMI signals: “cooling expansion” (S&P) vs still-contracting ISM level

-

S&P Global flash US manufacturing PMI eased to 52.0 in Sep (from 53.0), with new orders only marginally higher, manufacturing job losses, record finished-goods inventory build, and supplier delays lengthening (second-largest in ~3 yrs). That mix typically lifts ISM’s supplier-deliveries subindex but caps the headline given weak employment and softer orders—i.e., points to upper-40s to ~50 on ISM, not a clean re-entry above 50.

2) Regional Fed surveys: mixed, but the orders/employment breadth leans weak

-

NY Fed (Empire): headline -8.7; new orders -19.6, prices paid down to 46.1; employment ~flat. Clear deterioration.

-

Philadelphia Fed: headline +23.2; new orders +12.4; prices paid down sharply to 46.8; employment modestly positive (5.6). Firmer, but it’s the outlier. Federal Reserve Bank of Philadelphia

-

Richmond: composite -17; new orders -15; employment -15; vendor lead time ~unchanged; prices-paid growth little changed. Weak.

-

Dallas (Texas): new orders -2.6, employment -3.4, prices paid 43.4 (elevated); general business activity -8.7. Softening.

-

Kansas City: composite +4 with production & employment up, and price growth eased slightly. Small positive.

Read-across: Averaging those regionals’ headline balances is roughly flat/slightly negative, consistent with ISM 49. The new-orders average across (NY, Philly, Richmond, Dallas) is modestly negative, consistent with ISM New Orders near 50 (vs 51.5 street).

Employment breadth remains soft (NY 0, Richmond/Dallas negative, KC positive, Philly small positive) – ISM Employment low-mid 40s. Prices indices broadly moderating (Empire & Philly down, KC “eased slightly,” Dallas still elevated), so ISM Prices Paid likely dips a touch vs Aug.

3) Hard data & macro context (Aug)

-

Manufacturing output rose 0.2% m/m in Aug (autos +2.6%); that supports ISM production stability but doesn’t guarantee a headline >50 with orders/employment soft.

-

Durables: headline orders +2.9% m/m; core capex orders +0.6% m/m but core shipments -0.3% – investment demand not collapsing, yet near-term shipments softness squares with mixed regionals & weaker orders momentum.

-

Costs/prices backdrop: S&P flash shows tariffs driving elevated input costs but selling-price inflation cooling (margin squeeze). Regionals echo prices paid moderating. Energy eased into today as well, which trims near-term input-price pressure. Net: Prices Paid high but drifting lower from 63 – 64.

Component-by-component expectations:

-

Headline PMI (call 49.2): Supplier-delivery lengthening (S&P) lends a mechanical push up, but orders 50 and employment in the mid-40s cap the recovery. Bias is slightly above 49.0 consensus but still sub-50.

-

Employment (call 44.5): S&P flags manufacturing job losses; regionals skew weak (Richmond, Dallas <0), with Philadelphia Fed / KC offsetting modestly. That maps to low-mid 40s, in line to a hair above the informal 44 street view.

-

New Orders (call 50.5): Flash PMI says only marginal growth; regionals’ breadth tilts negative ex-Philly. Expect near-neutral/softer vs 51.5 consensus. Watch for export drag (tariffs) to be cited.

-

Prices Paid (our call 62.8): Still elevated (tariffs/supply frictions) but moderating, Empire/Philadelphia down, KC eased, Dallas still high, plus a late-Sept dip in crude. Sideways-to-slightly-lower vs Aug/consensus.

What Could Swing It

-

Chicago PMI (Tue): A big upside/downside surprise often nudges ISM expectations a touch the day before; August Chicago was 41.5 (deep contraction). A weak Chicago again would argue for the low end of my headline range; a firm bounce would favor the high end. Our base case for Chicago PMI is 41.2, as outlined in yesterdays article.

-

Auto channel: Aug IP was supported by autos; if ISM respondents emphasize autos’ stabilization, that helps production but not necessarily orders.

-

Tariff/supply commentary: S&P flash flagged longer delivery times and record inventories, if ISM echoes that strongly, it can support the headline (supplier deliveries) even as demand metrics soften.

Market Take

-

Positive surprise risk: Headline >50 with new orders >52 would read as a manufacturing re-acceleration—USD & UST 2y up, risk-on (watch USD/JPY topside given your focus).

-

Negative surprise risk: Headline <49 with new orders <50 and prices paid >63 = soft growth & sticky costs (stagflationary feel), USD mixed, rates curve bull-steepens, equities wobble.

Conclusion

We expect a slightly firmer headline yet still sub-50 (ISM 49.2 vs 49.0 cons), Employment stabilizing but weak (44.5), New Orders near-neutral and a touch soft (50.5 vs 51.5), and Prices Paid elevated but easing (62.8 vs 63.8).

The risk skew tilts down via orders breadth and labor softness, with upside tethered to supplier-deliveries mechanics and any last-minute boost from Tuesday’s Chicago PMI, in which we are looking for a modest stabilization near 41.2 compared to street estimates of 40/41.

For positioning, a clean >50 with New Orders >52 argues for USD strength and pushes front-end yields higher (watch USD/JPY topside), while a <49 print with Orders <50 and Prices >63 implies growth soft/sticky costs, favoring bull-steepening and a more mixed USD.

Into the release, focus on Chicago PMI, energy/freight tone, and tariff headlines, and pre-define reaction bands (>50 / 49–50 / <49) to keep execution disciplined and aligned with your high-conviction, volatility-aware playbook.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.