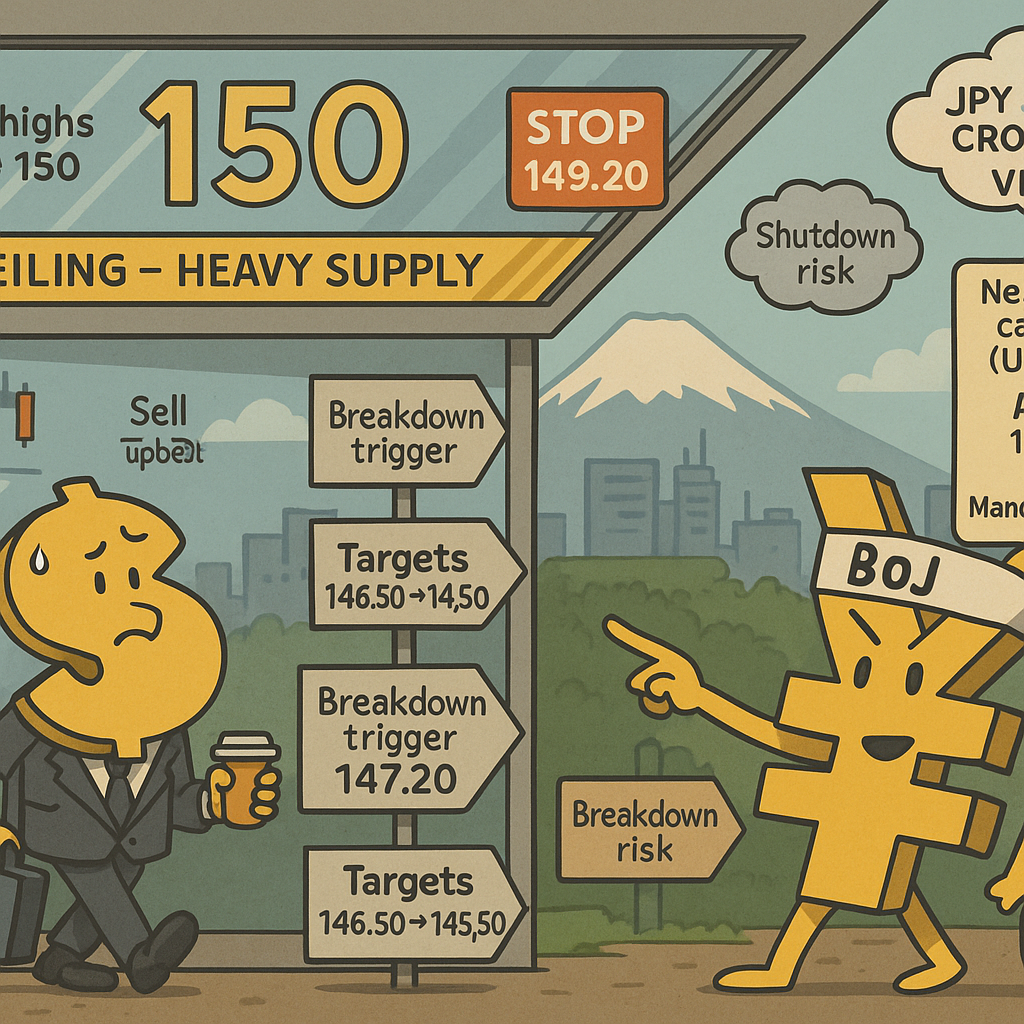

USDJPY Trade Setup – 01.10.25 As of Wednesday, 1 Oct 2025 (06:55 UK), USD/JPY is trading in the 147s, having faded repeatedly below the 150 ceiling. Our plan is a tactical short, selling 147.90–148.30 into supply and adding on a break below 147.20. The edge comes from the three-way alignment of drivers: Fundamentals: BoJ’s trajectory toward further normalization versus U.S. growth/data uncertainty and shutdown noise Technicals: a series of lower highs under 150 with 147.20 the pivot that unlocks downside Sentiment / positioning: elevated speculative JPY shorts that are vulnerable to a squeeze if U.S. data underwhelms or risk appetite softens. With ADP (13:15 UK) and ISM Manufacturing (15:00 UK) ahead, the setup aims to capture continuation lower toward well-mapped liquidity pockets at 146.50 and 145.50 while using the nearby 148–149 supply to define risk tightly. USDJPY Trade Setup: Pair / Asset Bias & Entries Stop / Invalidation Targets Why A+ (fundamentals, technicals, sentiment/positioning) Near-term catalysts (UK time) USD/JPY 147.56 Short: fade 147.90 – 148.30; add on a break <147.20. 149.20 (above supply / failed 150 push). 146.50 – 145.50. Fundamentals: Overnight Tankan improved again (+14 for large mfrs) and BoJ’s Sept summary showed open debate on a near-term hike – supports JPY on rallies. U.S. shutdown raises growth/data risks, dampening USD. Technicals: Multiple failures below 150; roll over into the 147s with support pockets next 146.5/145.5. Sentiment: IMM shows sizeable JPY net shorts, vulnerable to squeeze on weak U.S. prints. (Reuters) Today: ADP 13:15, ISM Mfg 15:00. Fri: NFP at risk of delay if shutdown persists. Chart by TradingView – USDJPY Trade Setup – 01.10.25 Conclusion We rate this an A+ (3/3) opportunity because fundamentals, technicals, and positioning all point the same way: BoJ normalization risk supports the yen on rallies; price action confirms a turn from 150; and crowded JPY shorts can amplify a downside break. Execute by selling 147.90–148.30, adding <147.20, placing a stop at 149.20, and targeting 146.50 – 145.50. Manage around today’s data: if the pair hasn’t moved in our favor into ADP/ISM, consider trimming to reduce event gap risk; on a daily close below 147.20, consider trailing stops above successive lower highs to lock in gains. Invalidation is a decisive daily close above 149.20 or a material shift that removes BoJ’s normalization bias and restores USD carry appeal. Absent that, the path of least resistance this week remains lower. For similar Forex Trade Signals please visit our forex trade ideas page. Please visit our Disclaimer page. Disclaimer Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page. TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted. The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice. TerraBullMarkets...