April 11th – Forex Trade SetupsIntroductionApril 11th – Forex Trade Setups – This report outlines high-confidence FX trade setups for April 11, 2025, derived from a comprehensive analysis of macroeconomic developments, central bank policy signals, technical indicators, and geopolitical tensions. The focus is on G10 currency pairs most affected by the sharp deterioration in U.S. dollar sentiment due to escalating trade tensions with China, plunging Treasury market confidence, and shifting interest rate expectations. With the DXY index testing multi-year lows and market narratives shifting toward a broad “sell USD” regime, these setups aim to identify strategic opportunities with clearly defined entry levels, target zones, and rationales backed by both fundamental and technical insights.The selection of trades has been ranked by confidence, with priority given to setups where macro and technical alignment is strongest, and where volatility offers asymmetric risk-reward potential. Key drivers include recent dovish rhetoric from central banks (RBNZ, BoE), the potential for CPI and PPI data surprises, and the significant repositioning of global capital in light of tariff escalations and declining confidence in U.S. assets.PairDirectionEntry Level(s)Target Price(s)ConfidenceRationaleNZD/USDLong0.5710–0.57300.5850, 0.5910 HighUSD is crumbling amid global loss of confidence, and even dovish RBNZ signals are being ignored as Kiwi rides the USD weakness wave. DXY testing 100 support, RSI sub-30 hints at only a minor bounce. Despite rate cuts and China risk, the Kiwi has gained 3.2% on the week.EUR/USDLong1.1230–1.12501.1380, 1.1450HighEuro surging as USD drops. Eurozone macro holding up, ECB slightly hawkish. Break of 1.1370 resistance opens upside. DXY at 21-month low, USD safe-haven bid fading.AUD/USDLong0.6180–0.62000.6280, 0.6350Medium-HighAUD up 3.1% this week despite China risks. USD selling regime + possible RBA cut already priced in. Strong momentum + relief rally could extend.USD/CHFShort0.8180–0.82000.8050, 0.7950MediumCHF hit decade high vs USD. USD/CHF down 4% in 2 days. Safe haven flows into CHF amid US turmoil. Technically oversold, but not bottomed yet.USD/JPYShort144.30–144.50142.30, 140.80MediumUSD/JPY tracking lower with broad USD slide and risk-off. Yen bid on equity weakness. But BoJ still dovish, so confidence only medium here.GBP/USDLong1.3020–1.30501.3175, 1.3300MediumStrong UK GDP print (0.5% MoM) helping GBP. However, GBP still underperforms vs EUR. Tariff concerns a headwind. But technicals favor upside.ConclusionThe current FX landscape is marked by elevated volatility and macroeconomic uncertainty, largely stemming from the U.S.-China trade standoff and a fast-weakening U.S. dollar. Against this backdrop, the trade setups presented capitalize on relative strength in currencies like the EUR, GBP, AUD, and NZD while expressing caution or bearishness on the USD. Short-term opportunities are strongest where technical levels align with macro themes—particularly for pairs like EUR/USD and NZD/USD, which show strong bullish momentum following deep macro-driven rebounds.Looking ahead, upcoming U.S. economic releases, particularly inflation and growth indicators, will likely play a pivotal role in determining the sustainability of this USD sell-off. Markets are also watching for further central bank commentary and geopolitical developments. Traders should remain nimble, as sentiment can shift quickly in an environment where policy unpredictability and market fragility dominate.These setups offer a structured approach for navigating FX markets during a complex and dynamic macroeconomic moment, with clear risk management levels and scenario-based thinking at their core. TerraBullMarkets...

Premium FX & Commodities

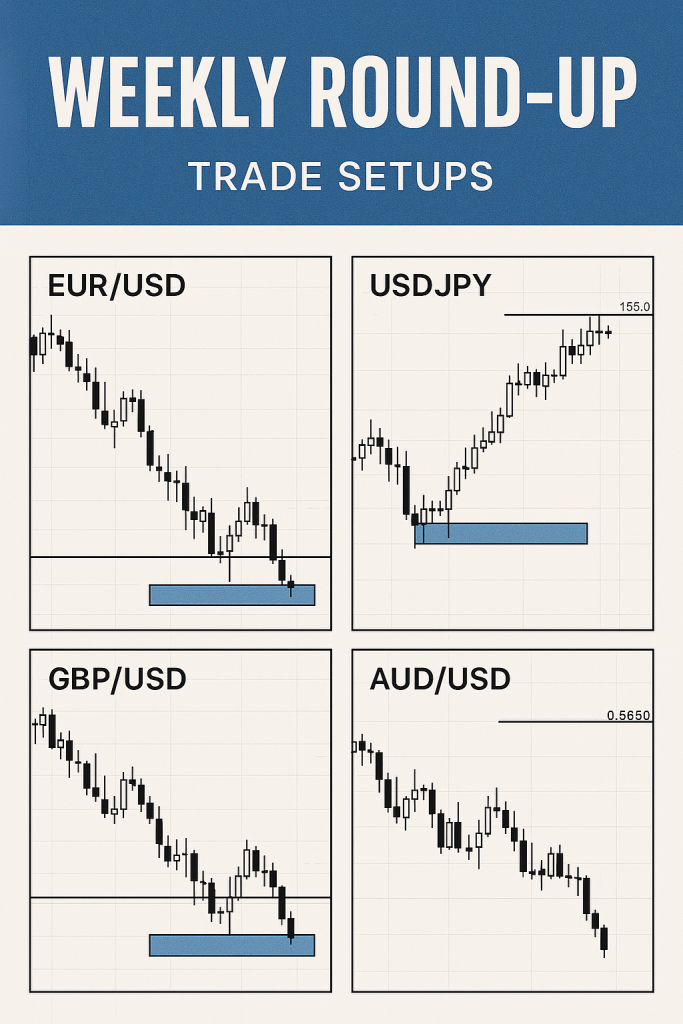

Trade Setups

Professional analysis & signals delivered daily for just