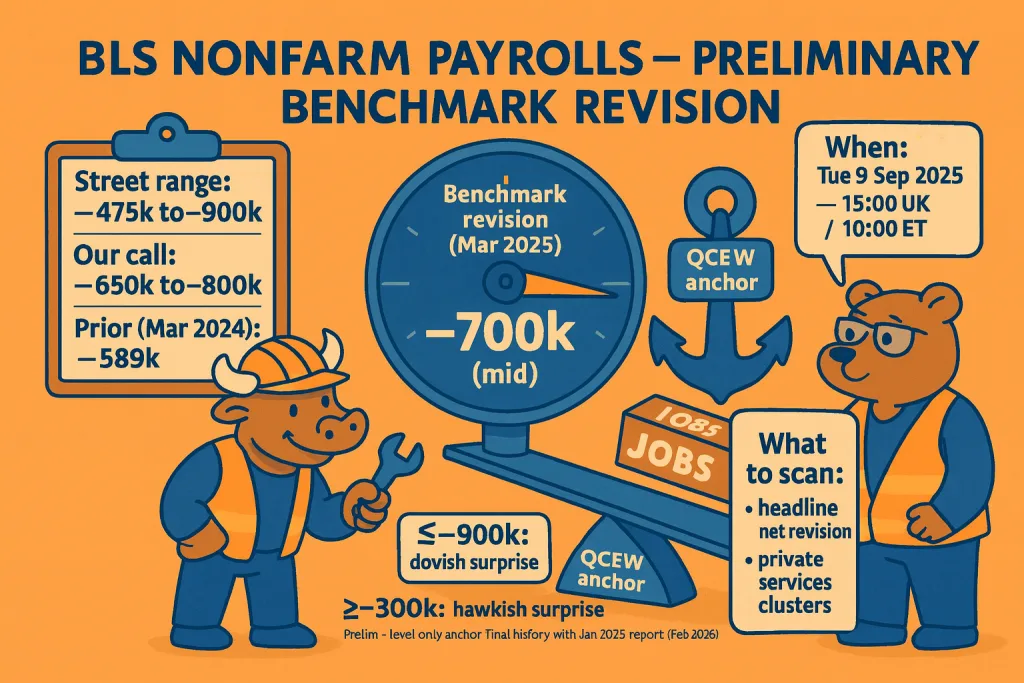

BLS Nonfarm Payrolls – Preliminary Benchmark Revision

On Tuesday, 9 September 2025 at 15:00 UK / 10:00 ET, the Bureau of Labor Statistics will release its BLS Nonfarm Payrolls preliminary annual benchmark revision, an annual re-anchor of the CES survey to unemployment-insurance tax records (QCEW) at the March 2025 benchmark. This is a level adjustment at a single date and not a republication of the full monthly path; the full history will be revised with the January 2026 Employment Situation released in February 2026. Street previews lean toward a material downward revision (−0.3% to −0.6%), and our base case is a -650k to -800k cut at the March 2025 anchor.

Our call reflects the prior QCEW-CES gap, softer small business indicators (NFIB openings/hiring plans), vacancy trackers, and the weak August payroll print alongside a higher unemployment rate signals that the survey level was likely overstated through mid-2024/early-2025. Given the timing, just after a soft August NFP, this prelim read has outsized signaling value for the underlying labor trend and near-term rates/FX pricing, even though it doesn’t alter published levels immediately.

What this release is (and isn’t)

- What it is: The BLS will publish its preliminary estimate of the annual benchmark revision that re-anchors CES payrolls to QCEW unemployment-insurance tax records for March 2025 (the benchmark month). It’s a level adjustment at that date; it does not re-publish the full monthly path yet.

- When the “final” hits: The January 2026 Employment Situation in Feb 2026 final national benchmark will be incorporated with the ; that’s when monthly history is fully revised.

Street Expectations VS Our Call

- Street chatter: Multiple previews flag a material downward revision to the March 2025 level, commonly in a −0.3% to −0.6% range (roughly −475k to −900k jobs).

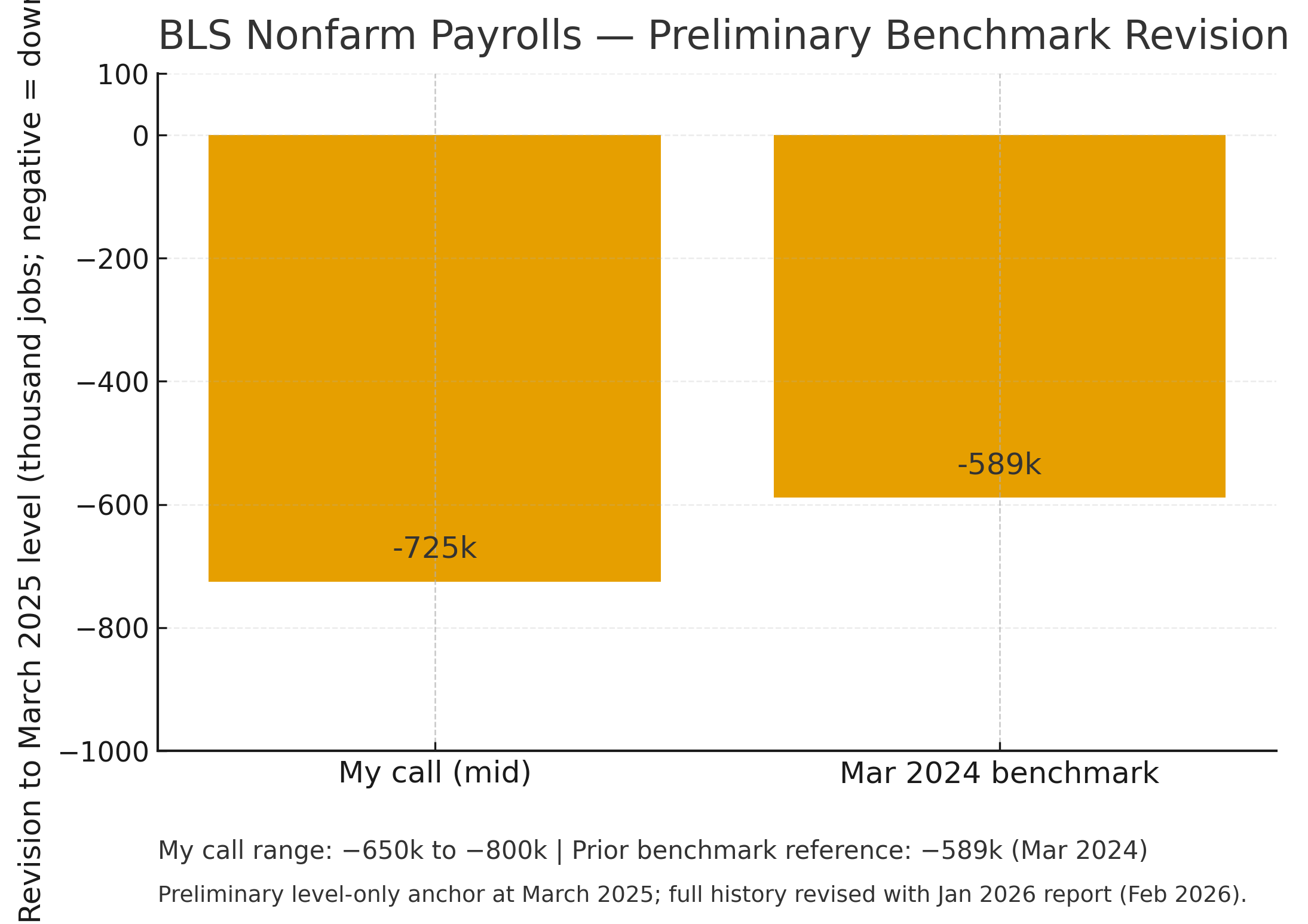

- Context: The last benchmark pass (to March 2024) was −589k on total nonfarm (SA), so sizeable negatives are not unprecedented.

- Our call: Downward, ~−650k to −800k at the March-2025 benchmark.

Why: The QCEW-vs-CES gap implied by prior quarters, softer small-business signals (NFIB openings, hiring plans) and vacancy trackers, plus the weak Aug NFP print all point to an overstated survey level through mid-2024/early-2025 that the QCEW anchor is likely to pull down. (The actual sectoral split arrives with the BLS tables.)

How to read the BLS Nonfarm Payrolls release (what to scan first)

- Headline net revision to total nonfarm (March 2025): This is the number markets will quote (e.g., “BLS prelim benchmark: −XXXk”). Large downside (≤−900k) = strong confirmation of a softer underlying labor backdrop.

- Sector breakdown: Watch private services clusters (professional & business services; leisure & hospitality; trade/transport). These are where prior benchmark downsides often reside; outsized moves here would reinforce the demand-cooling story. (BLS table will show it.)

- Birth-death model note: The prelim write-up typically comments on net business births/deaths vs model. A sizeable negative often reflects over-optimistic birth-death adjustments during the reference year.

Why this matters now (even though it’s “preliminary”)

- The revision doesn’t change published payroll levels tomorrow, but it reframes the last year’s trend just after an unusually weak Aug NFP (headline +22k) and rising unemployment (4.3%). A big negative benchmark would validate the “labor cooling” narrative already priced into rates.

Market implications

- Base case (−650k to −800k):

- Rates: modest bullish impulse at the front end (Fed cut odds stay firm); curve bull-steepening bias.

- FX: USD slightly heavier (softer) unless risk sentiment sours; USD/JPY down, EUR/USD up at the margin.

- Hawkish surprise (revision |≥| ≤ −300k or even positive):

- Weakens the “overstated jobs” story → front-end yields up, USD firmer as markets fade the labor-softening narrative.

- Dovish surprise (≤ −900k):

- Confirms material overstatement of jobs → 2-yr yields ↓, USD softer; cyclicals could wobble on growth optics, but equities may like faster-easing odds.

(Reminder: price action can be muted because no monthly history is revised yet; magnitude and media framing drive the move.)

- Confirms material overstatement of jobs → 2-yr yields ↓, USD softer; cyclicals could wobble on growth optics, but equities may like faster-easing odds.

Logistics & Receipts

- Timing confirmed: Tue, Sep 9, 2025 @ 10:00 ET / 15:00 UK.

- BLS notices & methodology: prelim benchmark announcement/schedule; benchmark article; note that the final integrates in Feb 2026.

- Preview coverage on expected downside magnitude: Investopedia (−475k to −900k), Nomura via moomoo (−600k to −900k), Reuters focus on revisions.

Conclusion

Treat this release as a signal, not a rewrite: markets will key on the headline net revision to total nonfarm at March 2025, then scan the sector mix. Especially private services (professional & business services, leisure & hospitality, trade/transport) and the birth–death model commentary for confirmation that prior growth was flattered by business-formation assumptions.

Our base case (−650k to −800k) argues for a modest front-end rally and a slightly softer USD, with risks skewed: a smaller-than-expected cut (≥−300k) would blunt the “overstated jobs” narrative, while a deeper hit (≤−900k) would validate labor cooling and firm rate-cut expectations. Price action may be muted because monthly history isn’t revised yet, so magnitude and media framing will drive the first move. The final benchmark flows through with the January 2026 report in February 2026; until then, use this prelim as a compass for the labor trend and a tactical overlay for rates, USD/JPY, and EUR/USD positioning.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.