The October Chicago PMI, due Friday 31 October at 13:45 UK time, will offer a final glimpse into U.S. manufacturing momentum ahead of next week’s critical ISM and employment data.

With last month’s reading at 40.6, marking a deep contraction and the 22nd consecutive sub-50 print, markets will be watching closely for signs that the regional factory sector is stabilizing after months of weakness.

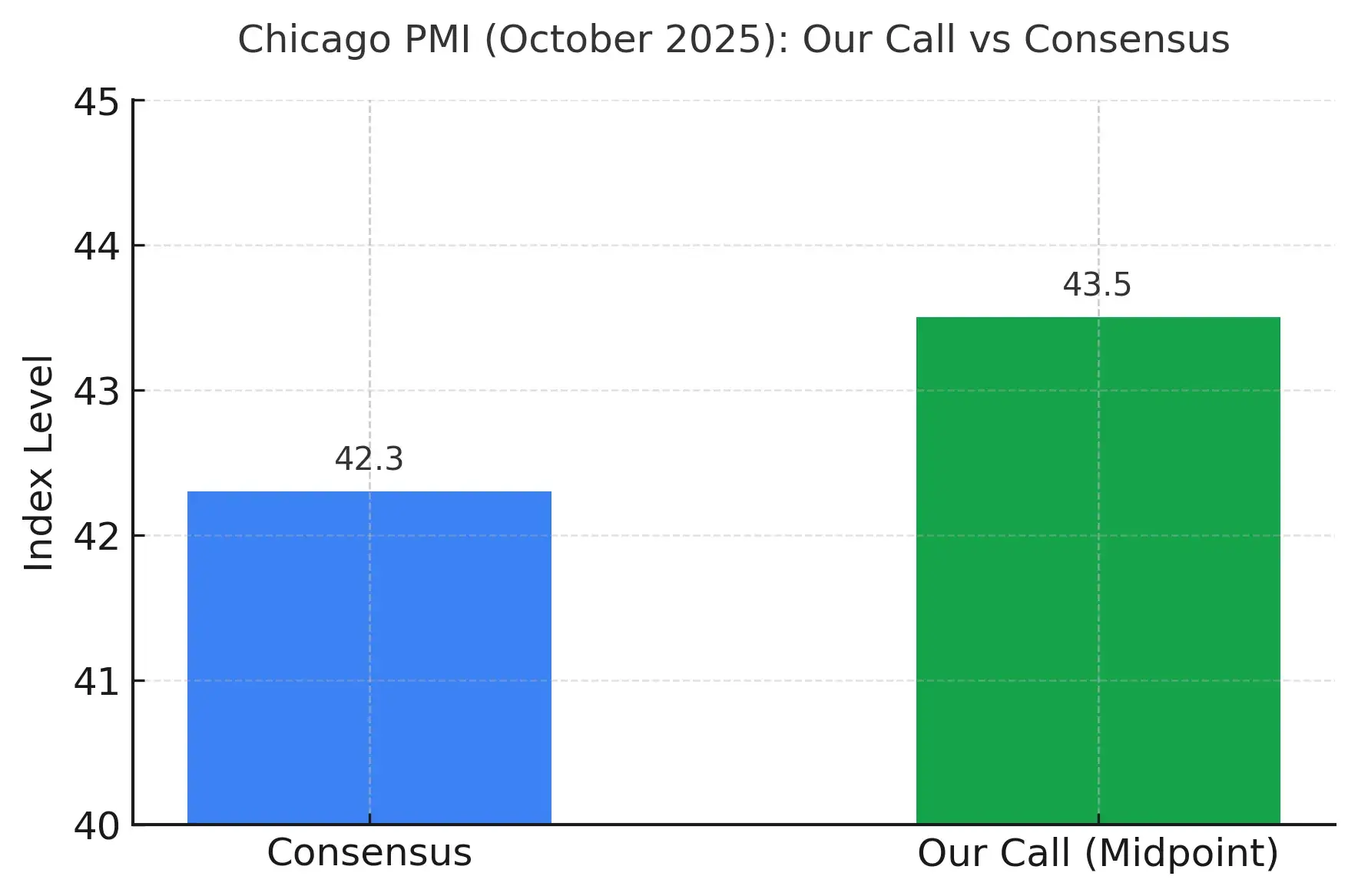

Consensus expectations point to a modest rebound to 42.3, but the risk balance remains finely poised as regional Fed surveys and flash PMI data deliver a mixed message on the health of U.S. industry.

Recent data hint at a slow recovery in new orders and production activity across several districts, contrasting with persistent softness in employment and price pressures.

As investors assess whether Chicago’s manufacturing sentiment can turn a corner, tomorrow’s report may influence short-term U.S. yield and dollar positioning into the month-end and ahead of the Fed’s next policy meeting.

Our Call

Recent manufacturing signals suggest that October’s Chicago PMI could stage a modest recovery from September’s deeply contractionary 40.6 reading, but not enough to imply a meaningful turnaround. While the national picture shows tentative improvement, regional performance remains uneven, leaving the risks to tomorrow’s release still finely balanced.

Mixed but Improving October Signals

The S&P Global flash U.S. Manufacturing PMI for October rose slightly to 52.2 (from 52.0), marking the strongest rise in new orders in almost two years and hinting at firmer production momentum heading into Q4. Several Federal Reserve district surveys also showed better tone versus September:

-

New York (Empire State): rebounded to +10.7, with orders turning positive.

-

Kansas City: climbed to +6, its third straight monthly improvement.

-

Richmond: improved sharply to −4 from −17, still contracting but far less so.

-

Dallas: remained broadly flat, with softer forward expectations.

-

Philadelphia: slumped to −12.8, underscoring lingering weakness and firmer prices.

On balance, regional data point to a patchy but stabilizing manufacturing environment, an encouraging backdrop for Chicago, though not yet enough to break decisively out of contraction territory.

How The Data Maps to Chicago PMI’s

The MNI Chicago Business Barometer tends to track the direction of national orders and production momentum, albeit with its own volatility. Given the upturn in orders signaled by the national PMI and stronger readings in New York and Kansas City, a rebound from 40.6 looks likely. However, the still-weak Richmond, Dallas, and negative Philly results argue any improvement will be moderate rather than strong.

Importantly, the Chicago series has missed median forecasts in four of the last five months, usually to the downside, a reminder that this survey often lags national trends even when broader conditions improve.

Our Forecast vs. Consensus

| Metric | Reading |

|---|---|

| Previous (Sep): | 40.6 |

| Consensus: | 42.3 |

| Street Average: | 42.0 |

| Our Call: | 43.0–44.0 (Midpoint 43.5) |

We expect a modest rebound driven by stronger orders and production components, supported by improving regional breadth. Gains will likely be capped by still-fragile employment readings and firmer price pressures, which continue to weigh on overall sentiment.

Components to Watch

-

New Orders / Production: Expected to firm month-on-month; if this sub-index remains below 42, the headline could slip back toward 41 – 42.

-

Employment: Likely to stay soft, but any surprise uptick would reinforce the case for a stronger headline near the top of our range.

-

Prices Paid: Set to firm in line with the Philly Fed’s signal, underscoring lingering input cost pressures rather than genuine demand strength.

Market Context and Scenarios (13:45 UK release)

-

Base Case (60%) – 43 – 44: Mildly risk-on tone; limited market reaction beyond a small uptick in U.S. 2s/5s yields and brief USD firmness.

-

Upside Surprise (25%) – >45: A clean rebound in orders and production would signal industrial stabilization, likely prompting USD buying vs. EUR/CHF and higher U.S. yields.

-

Downside Miss (15%) – <41: Renewed weakness would weigh on sentiment, favoring JPY outperformance and a short-term dip in yields and equities.

Key Details

-

Release time: Friday 31 October, 13:45 UK / 08:45 ET.

-

Context: The index has remained below 50 for 22 consecutive months, any improvement signals a “less-bad” contraction, not outright growth.

Our Bottom Line

We expect Chicago PMI (Oct) to print near 43.5, a touch above consensus, reflecting improved national orders and firmer production momentum but tempered by lingering Midwest weakness and inflation pressures. Overall, the data should signal stabilization, not recovery, keeping manufacturing’s contribution to U.S. growth subdued for now.

Conclusion:

Overall, the October Chicago PMI is expected to improve modestly to around the low-40s, signaling a slightly less severe contraction rather than a full recovery.

A stronger-than-expected rebound above 45 would reinforce the view that U.S. factory activity is regaining traction and could lend temporary support to the dollar and yields.

Conversely, another weak print near 40 – 41 would suggest the manufacturing slowdown remains entrenched and may revive speculation of easing demand into year-end.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.