Chicago PMI SEP – What to Expect – 30.9.25

On Tuesday, 30 September 2025 at 14:45 UK (09:45 ET), the MNI Chicago Business Barometer (Chicago PMI) offers an early read on Midwest activity across manufacturing-adjacent firms and services-facing suppliers, often a tone-setter ahead of national PMIs.

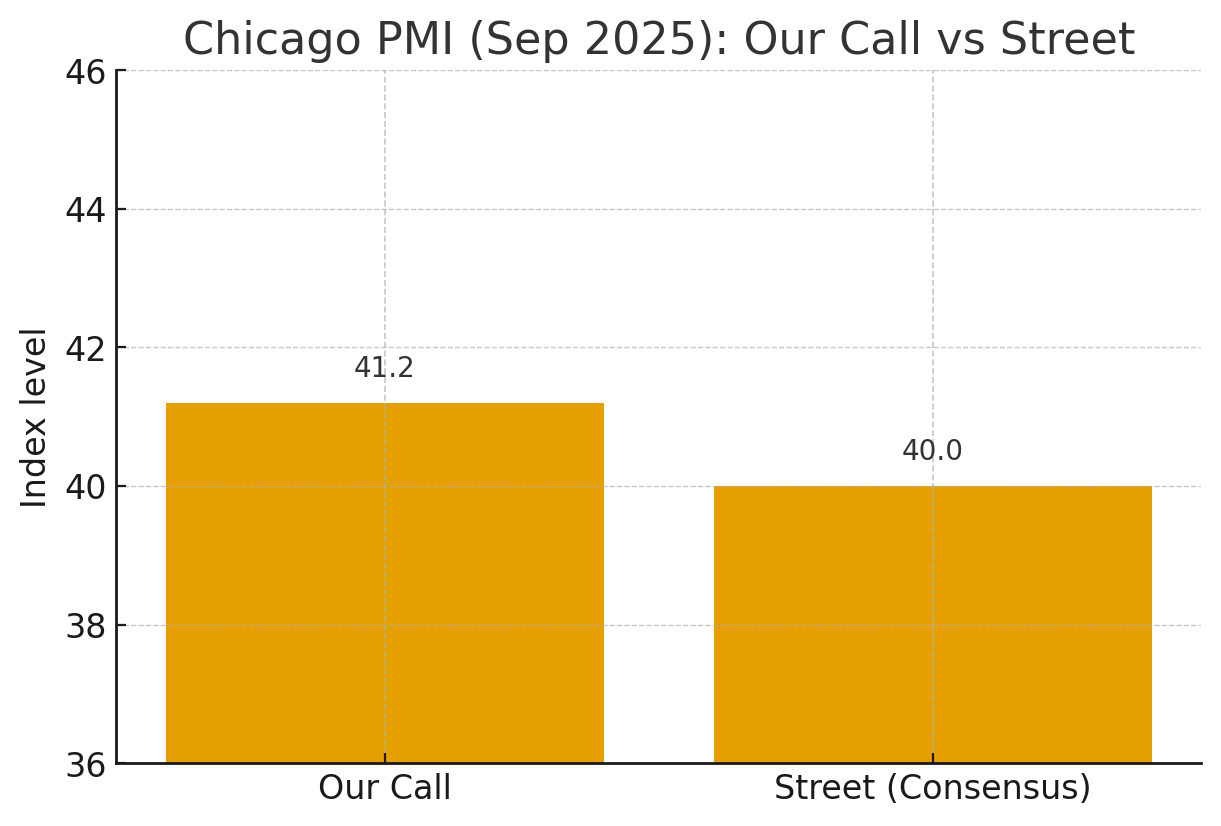

After August’s drop to 41.5, signaling a deep contraction), consensus expectation are sitting at 40.0 while we are looking for a modest stabilization near 41.2.

The balance of signals, mixed regional Fed surveys, a softer but still expanding national flash output picture, and firmer August durables orders, argues against a collapse into the 30s but not for a return to mid-40s. Focus on New Orders and Production for direction, Employment for demand caution, and Prices/Supplier Deliveries for any tariff-related cost pressure.

Chicago PMI SEP – Our Call:

-

Point estimate: 41.2 (vs consensus 40, Forecast 41).

-

Bias: Slight upside to consensus but still deep in contraction (<50).

-

Why: Mixed-but-not-disastrous regional surveys, a modest improvement in broader Chicago-area activity (CFNAI), and firmer August hard data (durables) temper, but don’t overturn, the weak August baseline (41.5).

Why:

1) Release logistics & baseline

-

The MNI/ISM-Chicago Business Barometer prints at 13:45 GMT (14:45 UK). August fell to 41.5 from 47.1, leaving the bar for “beat” quite low. Note Chicago PMI blends manufacturing and non-manufacturing firms, so it’s not 1-for-1 with ISM manufacturing.

2) Regional Fed surveys—mixed picture for September

-

Philly Fed jumped (general activity 23.2; new orders 12.4), a clear positive.

-

Empire State turned negative (headline −8.7) with orders/shipments weak.

-

Richmond slumped (composite −17), while Kansas City said activity “edged higher.”

Net: breadth isn’t strong enough to expect a rebound to mid-40s, but it argues against a collapse into the 30s.

3) National PMIs & costs

-

S&P Global flash (Sep): growth slowed for a second month; manufacturing output still up but much weaker than August, with the largest build in finished-goods inventories in the survey’s history—consistent with tepid orders. Input-cost pressures stayed elevated (tariffs), but selling-price inflation cooled as firms ate margins. Directionally, that caps upside for Chicago PMI.

4) Hard data tailwind (August)

-

Durable goods: headline +2.9% m/m, ex-transport +0.4%, and core capex orders +0.6%, but core shipments −0.3%. Solid orders help sentiment; softer shipments keep expectations restrained.

5) Local macro proxy

-

Chicago Fed National Activity Index (Aug) improved to −0.12 (from −0.28), hinting at a slightly better regional/national backdrop heading into September, supportive of a small bounce, not a regime shift.

What to watch inside the report

-

New Orders & Production (together 60% weight in classic frameworks): any stabilization above ~40 would validate a mild upside miss to consensus.

-

Employment: still the soft spot; a sub-40 employment sub-index would argue that firms remain cautious on staffing.

-

Supplier Deliveries & Prices Paid: tariffs kept input costs elevated in September; if deliveries lengthen and prices stay firm while orders lag, it reinforces the “cost squeeze, weak demand” mix seen in the flash PMIs.

Risk skew

-

Downside (<39): Would require Chicago-specific weakness (autos/transport suppliers or a payback from August’s drop) aligning with Empire/Richmond negatives; would set an ominous tone for ISM Manufacturing.

-

Upside (>43–45): Needs broad improvement across new orders and production, leaning on Philadelphia/KC strength and August durables momentum. Still unlikely to break 45 without a clear bounce in demand.

FX Market take

-

Base case (41.2): Marginally better than consensus but still contracting – limited market impact ahead of the heavier JOLTS release 15:00 UK; risk assets largely shrug unless sub-components surprise.

-

Downside shock (<39): Front-end yields dip; USD softens vs. low-beta FX (EUR, CHF) on manufacturing gloom.

-

Upside surprise (>45): Narrative of Midwest stabilization; USTs bear-flatten at the margin; USD firmer vs. JPY.

Conclusion

Our base case of 41.2 implies a slight upside to consensus but still a continued contraction, with limited standalone market impact unless sub-indices meaningfully improve.

A downside break below 39 would sharpen growth concerns and likely nudge front-end yields lower; a broad-based rebound into 43 – 45 would suggest nascent stabilization and a marginally firmer USD/rates bias.

In practice, price action may be tempered by the JOLTS release 15 minutes later (15:00 UK), so the bigger moves should come only if Chicago PMI’s New Orders/Production surprise decisively or Employment deteriorates further.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.