Core PCE – What To Expect – 26.9.25

On Friday, 26 September 2025 at 13:30 UK time, the BEA releases the August personal income and outlays report, the Fed’s preferred inflation gauge and the cleanest read on consumer momentum. Our base case is Core PCE +0.2% m/m, Personal Income +0.3% m/m, and Personal Spending +0.6% m/m. This view reflects the August CPI–to–PCE translation (lighter shelter weight in PCE, mixed airfare/medical dynamics), the drag from weaker PPI trade margins on goods prices, steady but unspectacular labor-income growth, and firm nominal spending signals from retail sales/control. The aim here is to frame where consensus may be leaning too hard (risk of core PCE printing 0.2% not 0.3%) and where demand may surprise to the upside (spending closer to 0.6% than 0.3%–0.5%), with an eye to the policy and market implications.

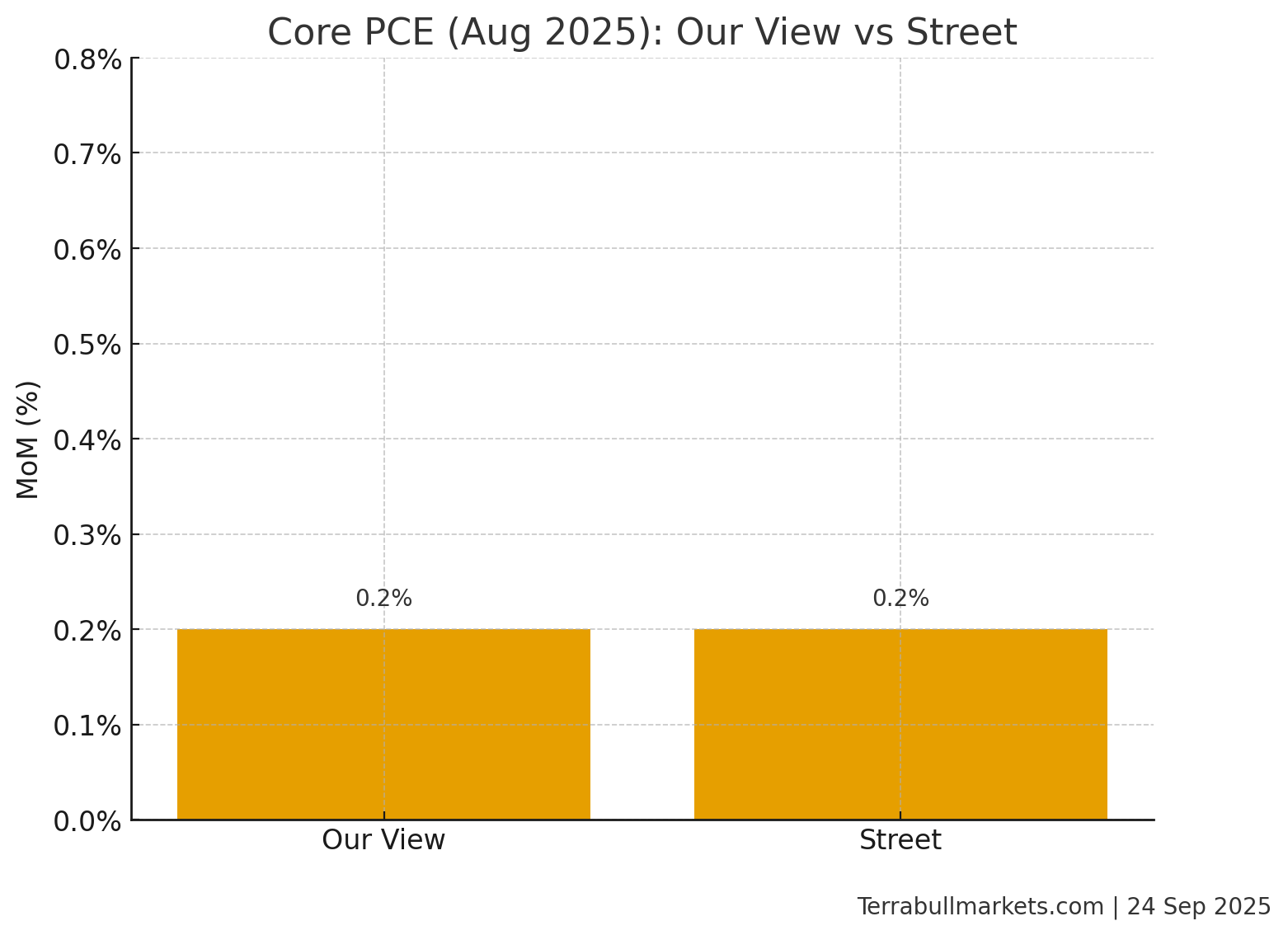

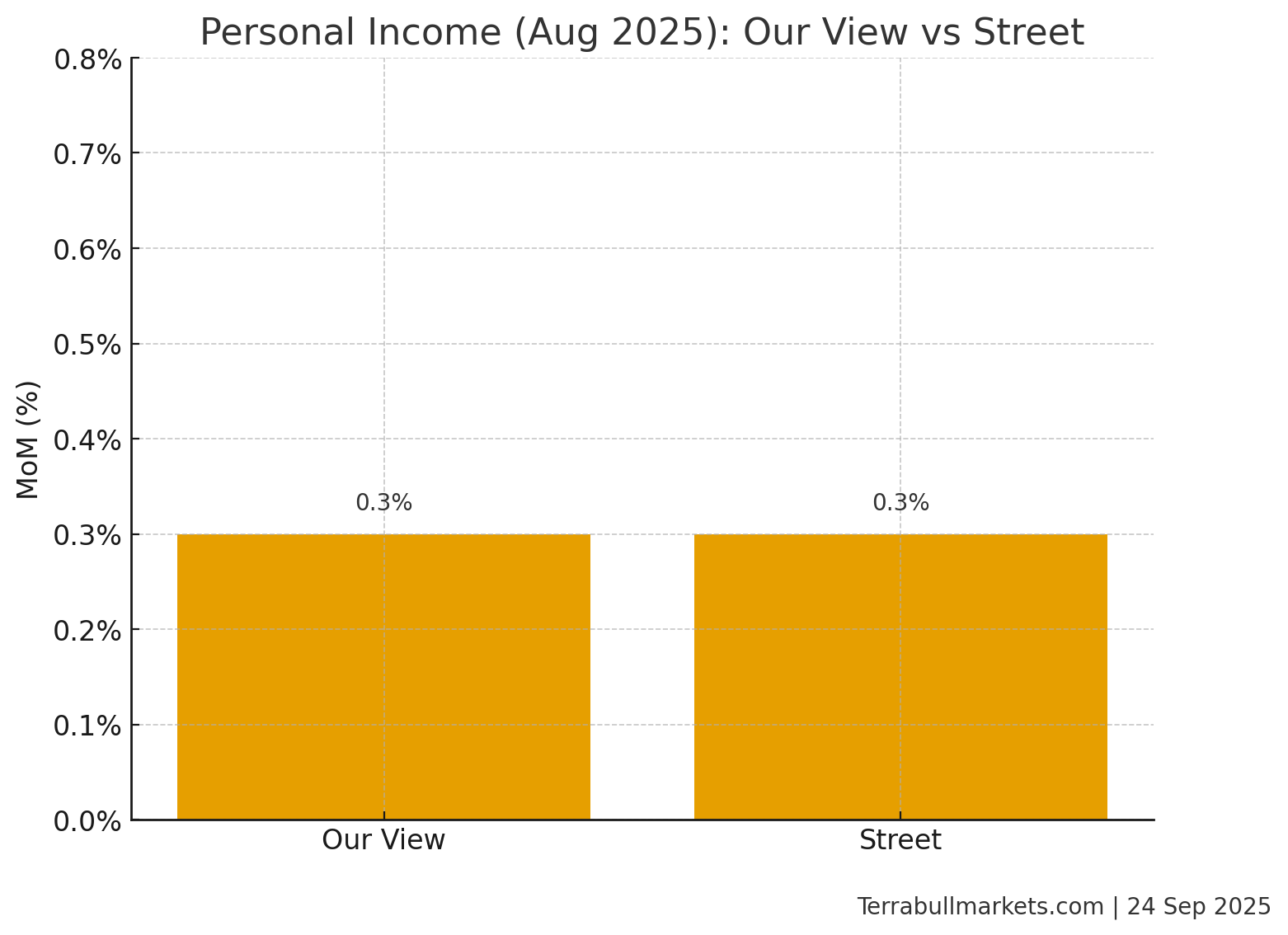

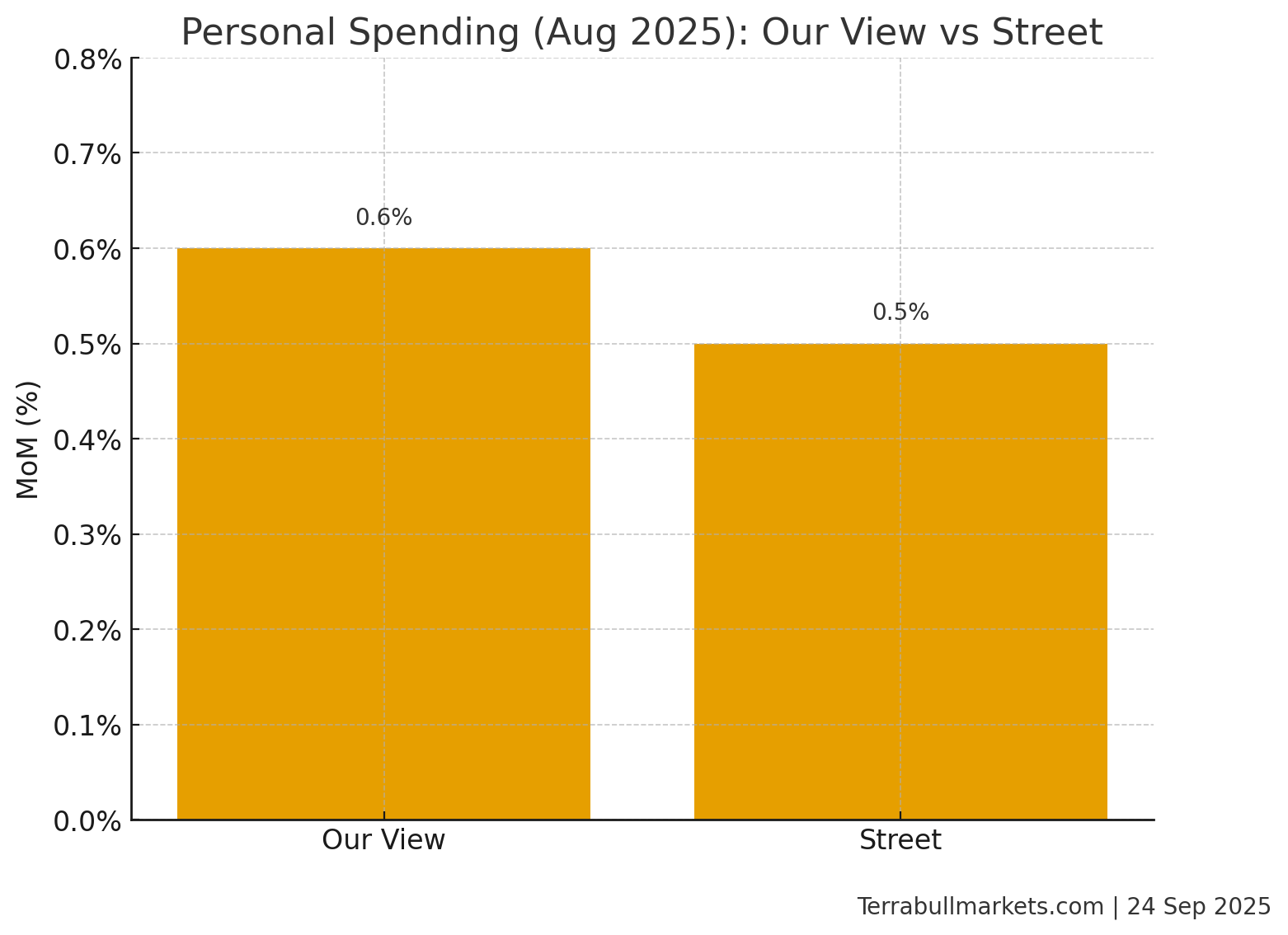

Our call (MoM, seasonally adjusted)

- Core PCE: 0.2% (street 0.2%, forecast 0.3%)

- Personal income: 0.3% (street 0.3%)

- Personal spending: 0.6% (street 0.5%, forecast 0.3%)

Why:

Core PCE – 0.2%

- CPI core was +0.3% m/m, but the mix argues for a softer PCE translation: shelter rose +0.4% and was the biggest CPI driver; PCE gives shelter a much smaller weight than CPI, so that oomph fades in PCE. Offsets: medical care fell in CPI (-0.2% m/m), and airfares jumped, but airfares in PCE lean on PPI where prices were softer in August. Bureau of Labor Statistics

- PPI trade margins fell -1.7% m/m and headline PPI was -0.1% m/m. That tends to pull down PCE goods prices via distribution margins. Net of food/energy/trade, PPI was +0.3%, but the margins drop is the swing factor keeping core PCE nearer 0.2 than 0.3. Bureau of Labor Statistics

- Cleveland Fed’s mapping (conceptually) points the same way: with CPI core at +0.3% and PPI signals mixed, the nowcast drifts toward 0.2% for core PCE.

Personal income – 0.3%

- Wage & salary proxy: payrolls were +22k in Aug, average hourly earnings +0.3%, and hours were flat – private aggregate payrolls roughly +0.3%. That usually lines up with PI +0.3%, with upside risk from interest/dividend income but some offset from softer proprietors’ income.

Personal Income

Personal spending – 0.6%

- Nominal goods momentum was firm: retail sales +0.6% m/m, and the control group +0.7%, both stronger than expected. That’s a decent guide to PCE goods in current dollars.

- Services prices/volumes likely positive: CPI showed food away from home +0.3%, lodging +2.3%, and airfares +5.9% (with PPI airfares softer, but nominal PCE still likely supported). Net: PCE current-dollar spending looks closer to 0.5–0.6%, not 0.3%. I’ll print 0.6% with a small downside tail to 0.5%.

Cross-checks & Context

- CPI August: headline +0.4% m/m; core +0.3%; shelter +0.4%; food at home +0.6%; gasoline +1.9%; medical care −0.2%. These specifics explain the softer CPI – PCE translation this month. Bureau of Labor Statistics

- PPI August: final demand −0.1% m/m on lower trade margins (−1.7%); “core” (ex-food/energy/trade) +0.3%, again, a mix that points to lower core PCE than CPI core. Bureau of Labor Statistics

- Labor income: AHE +0.3% m/m, hours flat, payrolls +22k – modest wage bill growth (in line with income +0.3%). Bureau of Labor Statistics+1

- Consumer sentiment/inflation expectations: University of Michigan prelim September sentiment dipped; 1-yr inflation expectations 4.8%, long-run 3.9%—doesn’t preclude spending, but flags sensitivity to price levels.

- Fed backdrop: FOMC cut 25 bps last week; a 0.2% core PCE would validate the “glide path” narrative; a surprise 0.3% would complicate it.

Market Take

- Baseline (core PCE 0.2 / spend 0.6): mixed: inflation-friendly but demand-firm. Front-end yields slightly lower to flat, belly steadier, USD mildly bid vs. low-beta FX on growth resilience but softer vs. JPY/CHF on the disinflation read.

- Disappointment risk: if core PCE 0.3%, expect a hawkish wobble—2s up, belly bear-flattening, USD firmer; equities less cheerful.

- Weak demand scenario: if spending ≤0.3% with core 0.2%, duration bid and USD softer broadly on growth concerns.

Bottom line

- We disagree with a 0.3% core PCE call; the CPI/PPI mix argues 0.2%.

- We’re in line with income +0.3%.

- We disagree with a soft spending +0.3% – retail/control and services pricing point to 0.6%.

Conclusion

Netting everything up, the most probable tape is inflation-friendly but demand-resilient: Core PCE at 0.2% (in line with consensus, softer than some desk calls), income at 0.3%, and spending at 0.6% (above consensus). If realized, that mix supports the Fed’s disinflation glide path while signaling that consumption remains healthy—typically a modest bull-flattener or steady belly in rates, USD mixed (firmer vs. cyclicals on growth, softer vs. JPY/CHF on disinflation), and a constructive backdrop for risk unless core surprises at 0.3%. The key things to watch in the release tables: (1) supercore services (ex-housing) momentum, (2) trade margins within PCE goods, (3) healthcare services and imputed components, (4) real PCE and the savings rate, and (5) any revisions to prior months. Upside risk is a stickier 0.3% core; downside risk is spending ≤0.3%. Barring those tails, Friday’s print should validate a “slower inflation, steady demand” narrative.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.