Euro Area Retail Sales Aug – Preview – 10.6.25

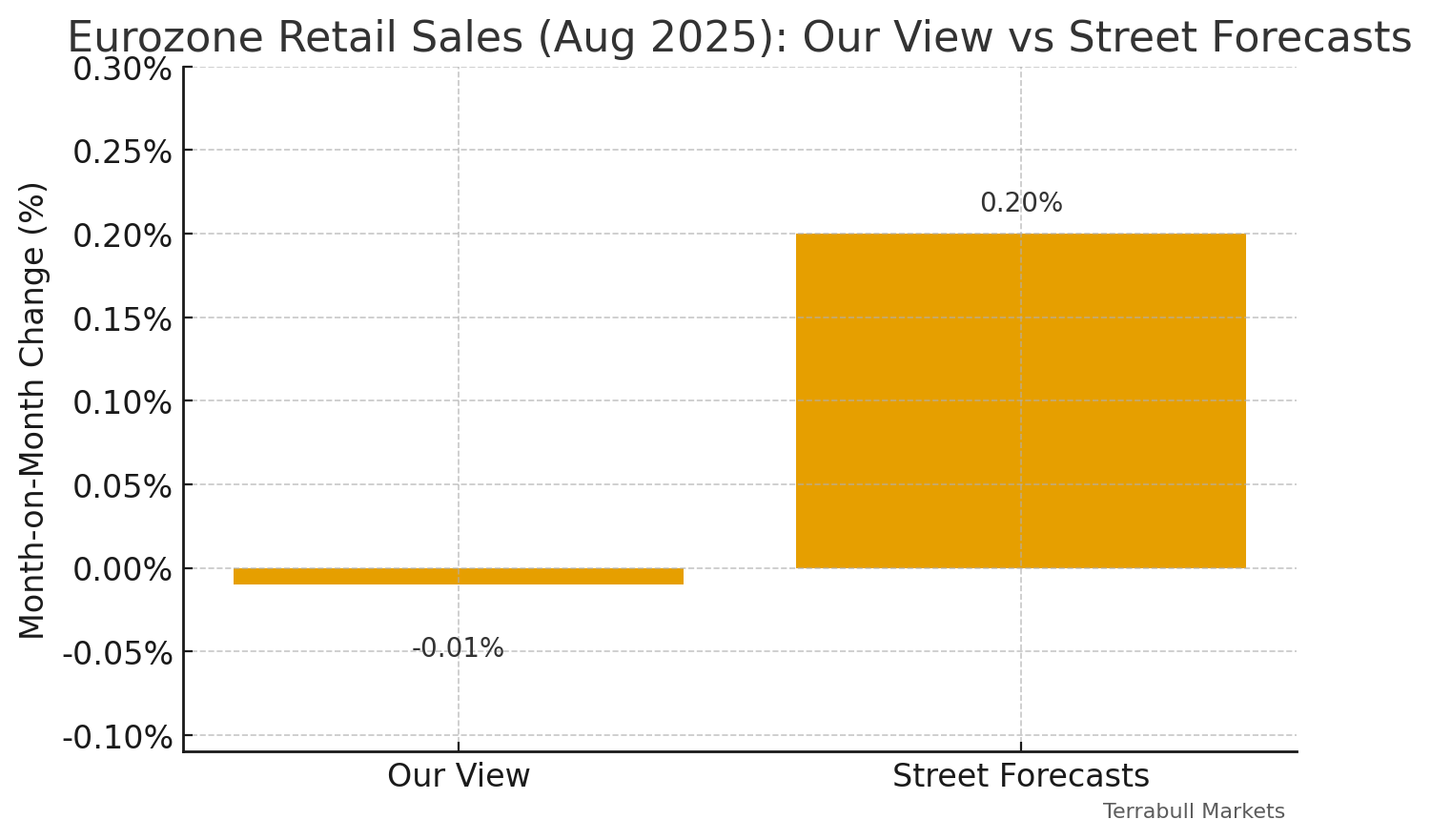

Euro Area Retail Sales (Aug) prints on Monday, 06 October 2025 at 10:00 UK time, offering a high-frequency read on household demand heading into Q4. Against a backdrop of softer consumer confidence and uneven country data, our base case is –0.1% m/m (prior –0.5%), modestly below consensus (+0.1%) and street forecasts of (+0.2%).

Germany and Italy point to weaker non-food volumes, while Spain offers a tourism-boosted offset and France looks broadly flat on volume-type gauges.

Lower August energy prices help fuel volumes at the margin, but not enough to overcome core retail softness. Netting the large economies with smaller member states, the GDP-weighted mix still leans slightly negative.

Our Call

We expect Euro Area Retail Sales, m/m (Aug) to come in at –0.1% vs previous –0.5%, consensus +0.1%, street +0.2%. A mild downside vs both Consensus estimates and street forecasts.

Why:

-

Germany (largest weight): –0.2% m/m (real) – online/mail-order –2.0% and non-food –1.0% dragged; July was revised weaker (–0.5%). This alone leans the bloc lower.

-

Italy: –0.3% m/m (volume) – ISTAT shows a clean decline.

-

Spain: +0.4% m/m (volume) – tourism-heavy August gave a lift, partly offsetting core weakness.

-

France: best read is +0.1% m/m on volume-type gauges; business surveys flagged a notable deterioration in retail climate in August, limiting any upside.

-

Rest of bloc (net neutral/slightly negative):

Netherlands modestly positive (+0.1% m/m, volumes +1.4% y/y), Belgium +0.4% m/m, Portugal –0.7% m/m, Ireland –1.0% m/m (–0.3% ex-motors). These roughly net to a small drag after Germany & Italy. -

Cross-checks: Eurostat reported –0.5% m/m in July, so the base is low, but the “big four” mix for August still looks slightly negative (back-of-envelope GDP-weighted blend –0.06% m/m).

Macro Context

-

Consumer mood slipped in August (ECFIN consumer confidence –15.5, ESI lower), consistent with subdued volumes into month-end.

-

Energy/fuel: August euro-area energy price indices ticked down m/m, which helps fuel volumes at the margin but not enough to offset Germany/Italy’s broad non-food softness.

Sub-Bucket Bias – Eurostat Structure

-

Non-food (ex fuel): soft/negative – Germany & Italy weakness dominates.

-

Food: flat to slightly positive – mixed country prints.

-

Automotive fuel: mild positive on cheaper energy, but a small weight (9%) limits impact.

-

Upside tail (0.0% to +0.2% m/m): a firmer-than-signalled France print and stronger Netherlands/Belgium revisions.

-

Downside tail (–0.2% to –0.3% m/m): if Germany’s drop is revised lower again and Portugal/Ireland weakness is larger than Eurostat seasonal factors anticipate.

Market Take – FX & Rates

-

At –0.1% (base): EUR mildly offered; EUR/USD dips a few pips, EUR/GBP soft; front-end EGBs bid on consumption softness.

-

At +0.2% or better: fade the negativity. EUR squeezes higher, especially if y/y lands >2.3% (consensus is 2.2%).

Conclusion

We are expecting to see a mild downside surprise versus forecasts, with the risk skewed –0.2% to 0.0% m/m depending on revisions and the non-food bucket.

At –0.1%, the market read should be EUR-dovish at the margins (small EUR/USD dip, softer EUR/GBP) and EGB-supportive at the front end, while a +0.2% or better outcome, especially if accompanied by firmer y/y, would likely prompt a brief EUR relief pop.

We will be focusing on (1) Germany / Italy revisions, (2) the non-food component, and (3) any outsized contribution from fuel: we see those internals as determining whether to fade or follow the first EUR move after 10:00 UK time.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.