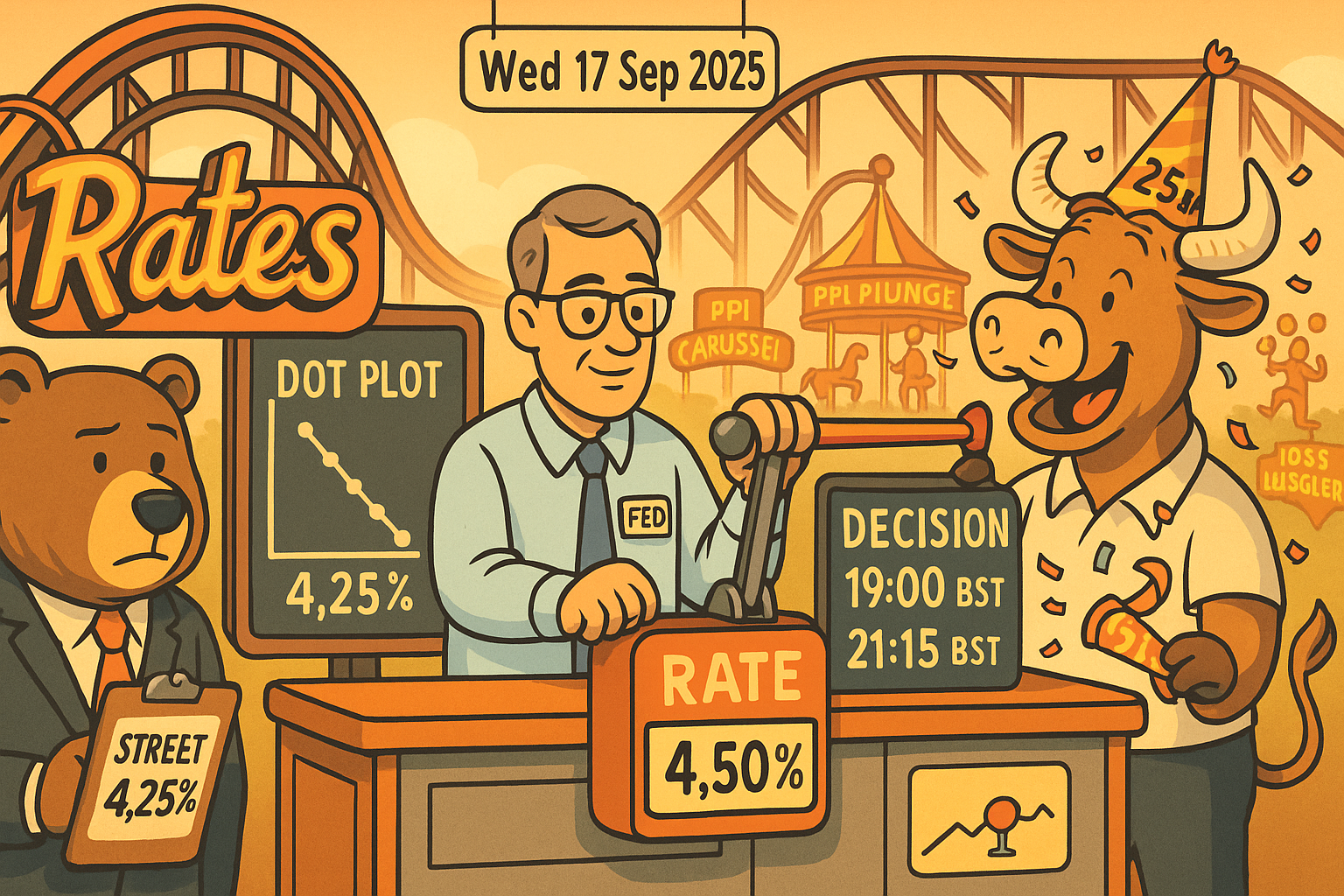

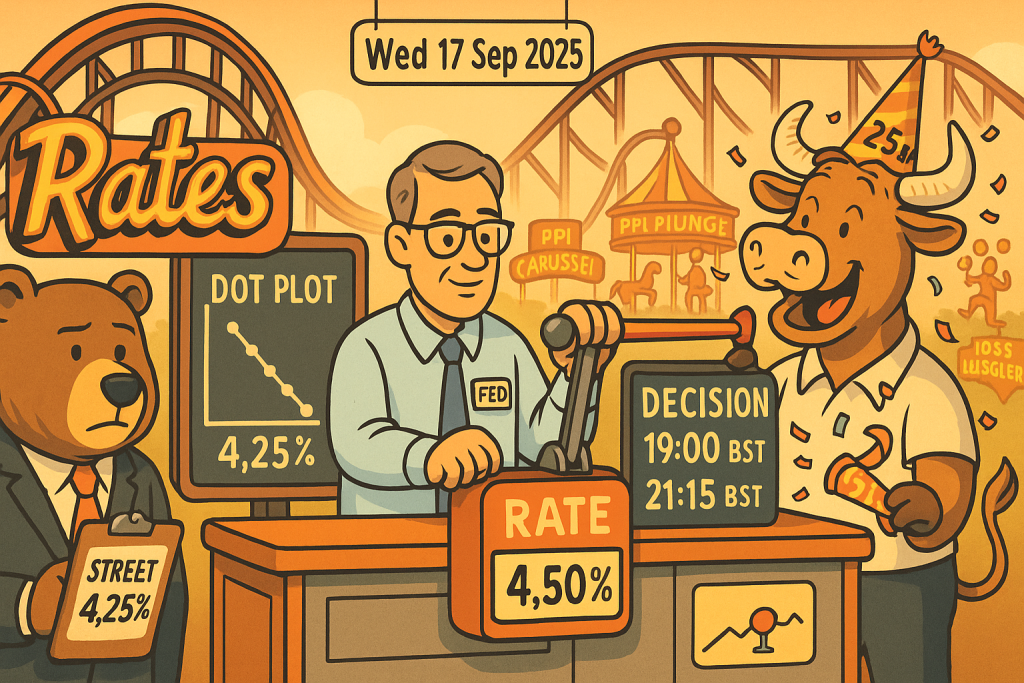

Fed Rate Decision – Our Call vs The Street

U.S. monetary policy returns to the spotlight on Wednesday, 17 September 2025 (19:00 BST), when the Federal Reserve delivers its rate decision and updated projections, followed by Chair Powell’s press conference at 21:15 BST.

With the policy rate currently at 4.50%, consensus is looking for a 25 bp cut to 4.25%, reflecting cooler labor momentum and continued, if uneven, disinflation. This article frames what matters most for markets, the statement language, the new dot plot, and any signals on the pace of easing, while contrasting our base case with the street’s expectations and outlining the likely cross-asset reaction.

Fed Rate Decision – Our Call:

Cut 25bp to 4.00–4.25% (upper bound 4.25%). Guidance: cautious-dovish, not a “go big” pivot. September (dots) likely to keep two cuts for 2025 in total (including this one), with the long-run dot at 3.0% unchanged. This aligns with consensus on the move but we’re slightly less dovish than market pricing on the path.

Why a 25bp cut (not 50bp)

- Labor market has cooled notably: August payrolls were essentially flat (+22k), jobless rate 4.3%, hours steady and wage growth +0.3% m/m—the softest mix this year and consistent with easing demand for labor. That keeps “insurance” easing on the table.

- Inflation isn’t re-accelerating: Core CPI +0.3% m/m (3.1% y/y) in August; headline +0.4% m/m (2.9% y/y). Producer prices −0.1% m/m. Core PCE was 2.9% y/y in July (next update after the meeting). Enough progress to trim restriction, not enough to justify a 50bp cut.

- Growth/spending are mixed, not collapsing: July retail sales +0.5% m/m; consumer momentum is cooler but holding up, supporting a measured step rather than an emergency move.

- Financial-conditions & liquidity backdrop: The Fed already slowed QT (Treasury runoff cap to $5B/month from April), signaling caution around reserves. Yesterday’s record SRF usage ($18.5B) points to transient funding tightness around taxes/settlements—another reason to ease policy gradually, not aggressively.

- Positioning & expectations: Futures pricing is heavily skewed to 25bp (90%+), with chatter about more cuts into 2026. The Committee has little incentive to shock with 50bp given the CPI backdrop.

What we’ll watch in the statement and Powell’s press conference:

- Risk balance language: Expect stronger acknowledgement that “labour conditions have cooled,” while “inflation has eased but remains elevated.” Any hint that risks are “more balanced” would be dovish. (June SEP medians showed 50bp cuts in 2025 and 25bp in 2026; a median shifting to more than two 2025 cuts would be a dovish surprise.)

- Dots: Base case: year-end 2025 midpoint 3.9% (i.e., two cuts total this year), 2026 3.6%, 2027 3.4%, long-run 3.0%. If the new median shows only one more cut this year (i.e., today’s cut and then pause), that’s hawkish vs market.

- QT paragraph: No change to the slowed runoff plan; watch Q&A for “endgame” reserves language.

Market Scenarios (FX & Rates)

- Base case (our call): 25bp + cautious-dovish dots (two cuts in ’25).

- Rates: 2y yields drift lower; curve steepens modestly as long rates hold on fiscal/term-premium.

- USD: mild knee-jerk weaker; EUR/USD and GBP/USD pop; USD/JPY dips if 2y leads lower.

- Hawkish cut: 25bp but dots show no additional 2025 cut / Powell leans on sticky inflation.

- Rates: front-end higher; USD firmer, especially vs JPY. Risk assets will likely wobble.

- Low-probability surprise: 50bp.

- Would require the Committee to put heavy weight on labour slack and financial-stability caution; with core CPI 0.3% m/m, odds are small. If it happened: sharp front-end rally, USD lower, gold higher.

Fed Rate Decision – Bottom line

- Decision: Cut 25bp to 4.00–4.25% at 19:00 BST; Powell careful not to pre-commit to back-to-back large moves.

- Where we differ from the street: We’re in line on the cut, but less dovish on the path than markets that are leaning toward a multi-meeting easing cycle; we believe the dots will still show just two cuts in 2025 (including tomorrow).

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.