Forex Markets News – 11th June

Markets on Edge Ahead of US CPI as BoJ Flags Heightened Global Uncertainty

Markets are treading cautiously midweek as investors prepare for potentially market-moving US inflation data, while Japanese central bank officials warn of ongoing global economic uncertainty. Sentiment is being shaped by three key drivers: Wednesday’s highly anticipated US Consumer Price Index (CPI) release, lackluster market response to a tentative US-China trade deal, and comments from Bank of Japan (BoJ) Governor Kazuo Ueda underscoring heightened macroeconomic uncertainty.

BoJ’s Ueda: Global and Domestic Economic Risks Remain Elevated

Bank of Japan Governor Kazuo Ueda offered a cautious tone during a government economic meeting on Wednesday. A Japanese cabinet official quoted Ueda acknowledging that while risk-averse sentiment is beginning to ease somewhat, uncertainty surrounding Japan’s domestic outlook and the global economy remains “very high.”

Ueda’s remarks reinforced the BoJ’s ongoing commitment to closely monitoring markets and economic data before adjusting policy. Despite global turbulence, Japan’s domestic financial conditions remain accommodative, suggesting no imminent tightening bias from the BoJ.

US CPI Report Looms Large Amid Tariff Pressures

The key event for global markets on Wednesday is the release of US CPI data for May at 12:30 GMT. Expectations point to a modest acceleration in both headline and core inflation:

-

Headline CPI YoY is forecast to rise to 2.5%, up from April’s 2.3%.

-

Core CPI YoY (excluding food and energy) is expected to tick up to 2.9%, from 2.8% previously.

-

Monthly CPI and Core CPI are seen rising by 0.2% and 0.3%, respectively.

Analysts at TD Securities believe core inflation likely stayed subdued, particularly in travel services, but they also flagged early signs of tariff pass-through. Falling gas prices may have kept headline inflation in check, yet sticky core inflation could unnerve the Federal Reserve.

Markets will closely scrutinize whether President Donald Trump’s latest tariffs—aimed primarily at Chinese imports—are starting to push up core inflation. A hotter-than-expected report could significantly influence Fed policy expectations and US Dollar dynamics.

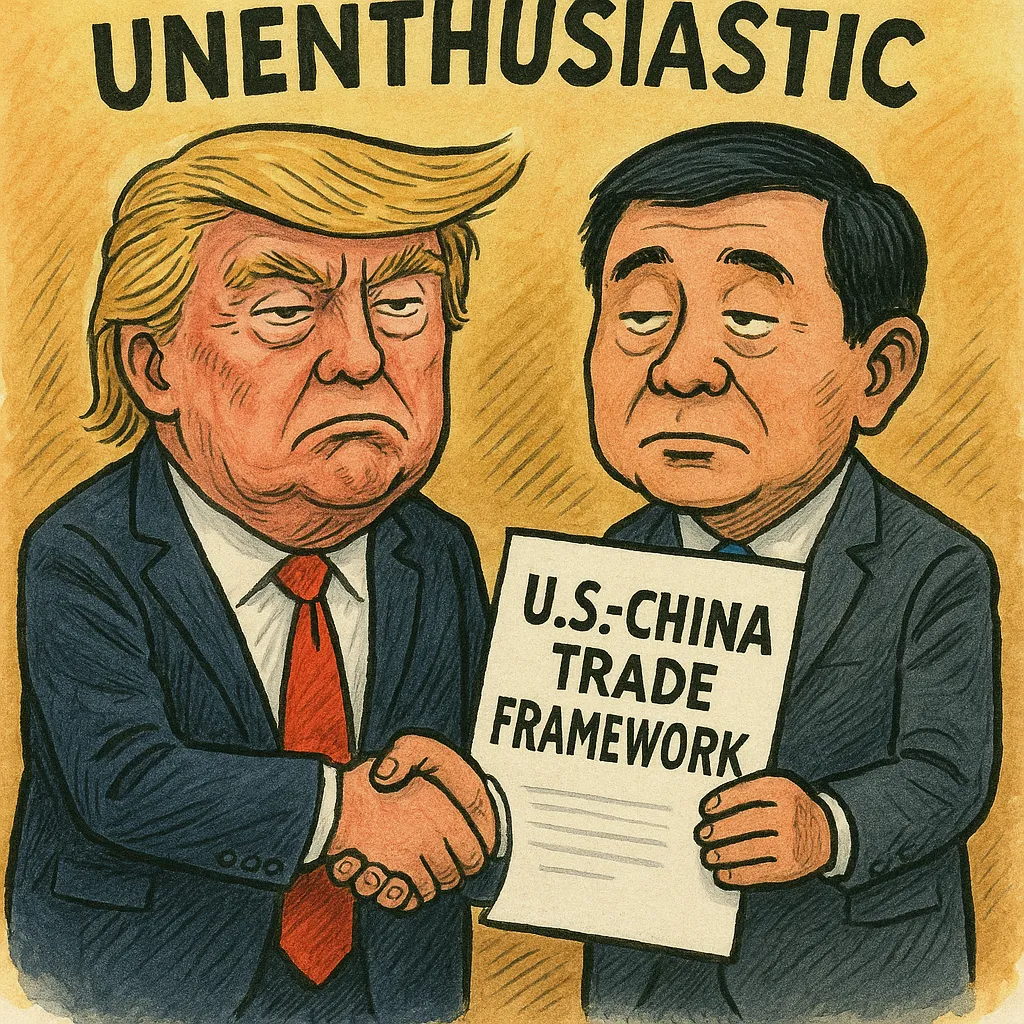

US Dollar Struggles Despite US-China Trade Agreement

The US Dollar Index (DXY) remains capped below 99.20 despite a US-China agreement announced this week. According to reports, Washington and Beijing have reached a “framework” deal to ease restrictions on the trade of rare earth minerals. However, a lack of specific commitments or enforcement mechanisms has left investors skeptical.

The initial optimism during the Asian session quickly faded in European trading, with traders now cautious ahead of the CPI release and a crucial $39 billion auction of 10-year US Treasuries. May’s Treasury auction showed strong demand from indirect bidders (71%), and a repeat would likely support the dollar. However, any signs of weak demand could raise fresh concerns about the US debt market and weigh on the greenback.

Meanwhile, fears of stagflation—a combination of slowing growth and rising inflation—are simmering beneath the surface. A CPI upside surprise may sharpen these concerns, potentially complicating the Federal Reserve’s next moves.

Key Takeaways:

-

BoJ Governor Ueda: Warns of very high uncertainty in both Japan and global economies; policy will remain data-dependent.

-

US CPI expectations: May headline inflation seen rising to 2.5% YoY; core CPI projected at 2.9% YoY.

-

Tariff impact in focus: Investors watching for early signs of inflationary pressures from Trump’s tariff policy.

-

Muted USD reaction to US-China deal: Lack of clarity in trade framework limits market enthusiasm.

-

DXY capped: US Dollar Index struggles to break above 99.20 amid CPI uncertainty and cautious bond market sentiment.

-

10-Year Treasury auction: A critical gauge of investor appetite; weak demand could pressure USD further.

With inflation data and bond market dynamics front and center, Wednesday’s session could prove pivotal for FX markets and central bank rate expectations. Traders are advised to stay alert for sharp swings in the USD and bond yields following the CPI release.

For similar Forex Markets news please visit our forex page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.