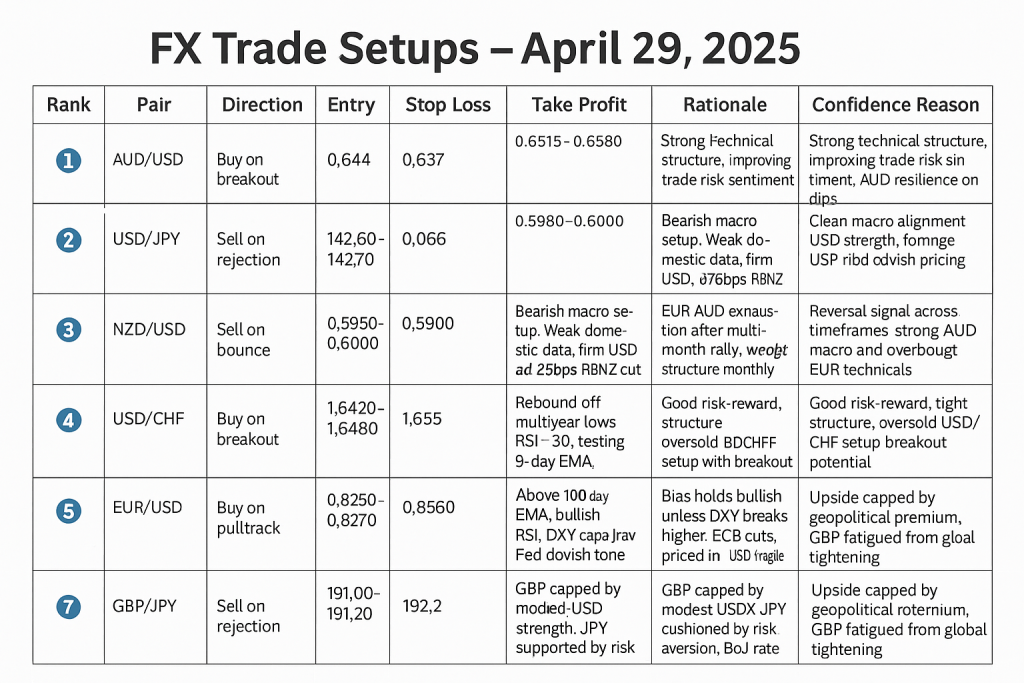

Forex Trade Setups – April 29th The current FX landscape is being shaped by a confluence of macroeconomic crosswinds, central bank divergence, and geopolitical recalibration—particularly around trade dynamics. As optimism surfaces over a potential de-escalation in the US-China trade dispute, risk sentiment has improved, supporting commodity currencies like AUD, while uncertainty surrounding monetary policy normalization continues to influence USD, JPY, and EUR trajectories. With market focus shifting to upcoming inflation data, BoJ guidance, and Fed rate path expectations, technically validated trade setups across major currency pairs offer defined opportunities with disciplined entry, stop, and target parameters. This report outlines seven actionable forex trade setups trades ranked by conviction, incorporating both technical structures and fundamental alignment. The below Forex Trade Setups are ranked in order of confidence in the trade: Forex Trade Setups – April 29th Rank Pair Trade Setup (Direction) Entry Stop Loss Take Profit Rationale Confidence Reason 1️⃣ AUD/USD Buy on breakout 0.644 0.637 0.6515 – 0.6580 Price holds above 9-day EMA; bullish bias with RSI > 50. Trade optimism and risk-on tone support AUD, despite looming RBA rate cut. Strong bullish structure with clear breakout levels, trade war optimism, AUD resilience on dips. 2️⃣ USD/JPY Sell on rejection 142.60–142.70 143.5 141.10 – 140.50 Rejected at 100-SMA and 144.00; RSI negative. Geopolitical risk + dovish Fed = support for JPY. Technical failure at resistance, BoJ meeting risk premium, geopolitical tailwinds to JPY. 3️⃣ NZD/USD Sell on bounce 0.5980–0.6000 0.606 0.5900 – 0.5860 Weak NZD from poor data + RBNZ rate cut expectations. Trade confusion and USD strength pressure kiwi. Bearish macro and sentiment alignment; RBNZ 25bps cut priced in. 4️⃣ EUR/AUD Sell on spike 1.7850 – 1.7900 1.800 1.7520 – 1.7400 Price overextended on monthly and daily; prior reversal levels in play. Weak wedge breakdown failed, but long-term resistance is approaching. Overbought on monthly chart; forming bearish monthly candle. Fading daily momentum with wedge structure. Strong historical reversals at similar structures (2008, 2020); AUD support on macro recovery. 5️⃣ USD/CHF Buy on breakout 0.8250–0.8270 0.818 0.8560 – 0.8650 RSI rebound from oversold; above 9-day EMA. Potential for relief rally toward 50-day EMA. Good risk-reward on technical breakout, short-covering opportunity in oversold USD/CHF. 6️⃣ EUR/USD Buy on pullback 1.1320–1.1330 1.127 1.1400 – 1.1540 Bullish above 100-day EMA. DXY capped by Fed cut expectations and Trump uncertainty. ECB dovishness priced in, but USD sentiment is fragile; bullish momentum holds. 7️⃣ GBP/JPY Sell on rejection 191.00–191.20 192.2 188.80 – 187.50 GBP pressured by USD strength, JPY cushioned by risk aversion. BoJ may surprise with upward guidance. Geopolitical risk supports JPY, GBP weighed by global tightening fatigue. Macro-Thematic Highlights Behind the Setups AUD/USD is benefiting from risk-on flows tied to US-China trade thaw speculation. While the RBA is still expected to cut rates, AUD remains technically firm above 0.6400. A break of 0.644 signals a likely run to 0.6515 and possibly 0.6580. USD/JPY faces a hard cap at 144.00. Despite recent USD strength, JPY is propped up by BoJ inflation pressures, trade war hedging, and the potential for policy normalization. Price failure near 142.70 and negative RSI suggest further downside. NZD/USD remains the cleanest bearish play. With weak domestic data, dovish RBNZ expectations, and a conflicting US-China narrative, rallies toward 0.6000 are likely to be sold. EUR/AUD has overextended technically. With monthly RSI at multi-year highs, a rising wedge, and AUD supported on dips, the pair is primed for a corrective leg lower. The macro backdrop favors AUD over EUR as trade-linked sentiment improves. USD/CHF is a speculative but structured long. While broader USD sentiment is mixed, the pair is attempting to break out from a multi-year low with a supportive RSI bounce. A relief rally toward the 50-day EMA is plausible. EUR/USD continues to benefit from USD fragility, despite looming ECB cuts. The pair holds above the 100-day EMA, with bullish RSI momentum and capped DXY helping keep a constructive tone. Pullbacks remain buying opportunities. GBP/JPY remains constrained. While JPY is not in full safe-haven mode, geopolitical risk, global slowdown, and BoJ upward policy risks limit GBP/JPY upside. Spikes toward 191.20 should find selling interest. Summary AUD/USD leads the high-conviction long bias following a breakout supported by a resilient bullish structure and improving risk appetite. USD/JPY and NZD/USD present compelling short setups, with macro divergence and technical resistance reinforcing downside scenarios. EUR/AUD reflects a contrarian sell on exhausted upside momentum, while USD/CHF offers a speculative but well-defined breakout long. EUR/USD remains supported on dips within a bullish framework, assuming DXY remains capped by dovish Fed expectations. GBP/JPY, although range-bound, presents tactical short opportunities on rallies due to geopolitical risk premiums and tightening fatigue in GBP. Together, these setups provide a diversified mix of directional exposure grounded in macro-themes and technical clarity. Check out more FX Trade Setups on our forex page. TerraBullMarkets...

Premium FX & Commodities

Trade Setups

Professional analysis & signals delivered daily for just