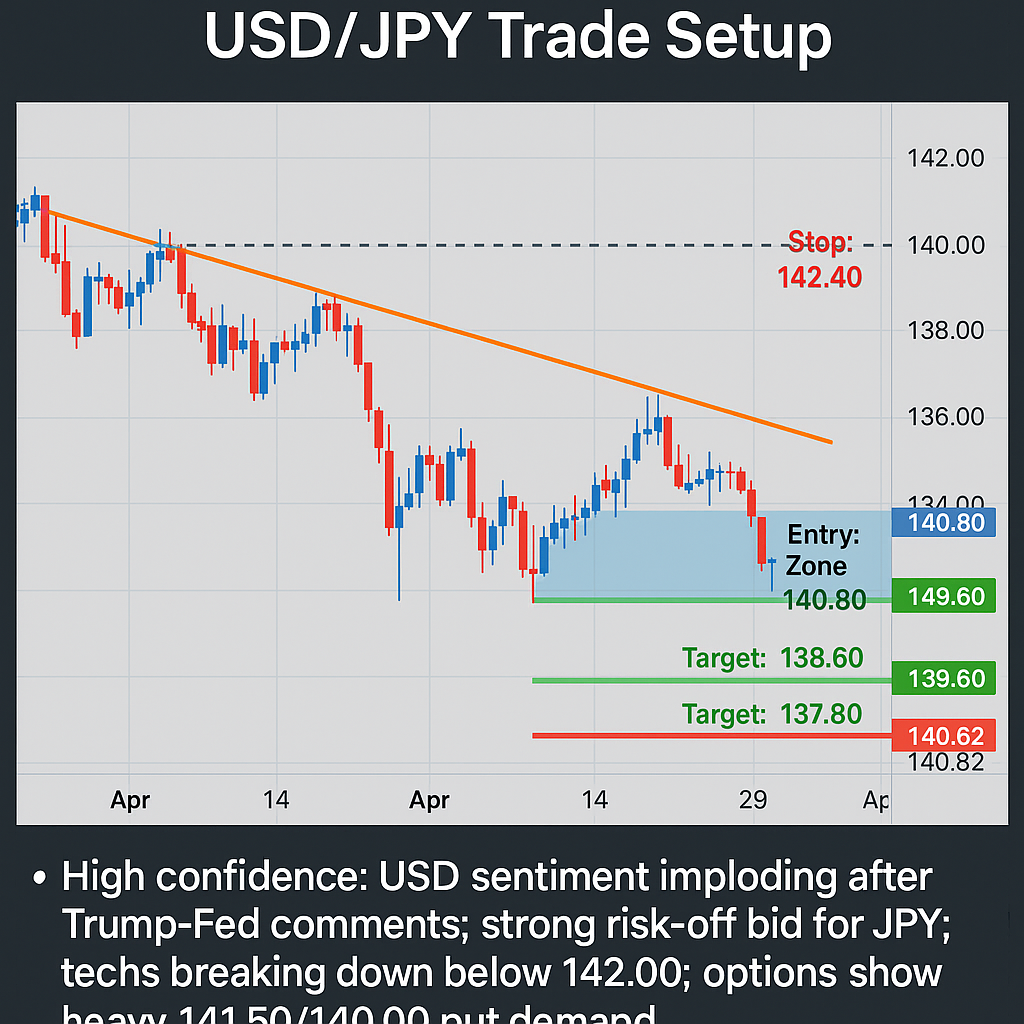

FX Trade Setups April 22nd – Yen Strength & Safe-Haven Rotation The FX market landscape has shifted dramatically over the past 48 hours, with safe-haven flows and political risk taking center stage. Following incendiary remarks by former U.S. President Donald Trump targeting Federal Reserve independence, the U.S. dollar has come under intense pressure. This, combined with mounting geopolitical tension and a surge in risk aversion, is powering a strong bid for the Japanese yen and Swiss franc — while commodity-linked and GBP pairs show selective resilience. Central bank divergence remains a critical theme. The Fed’s credibility is increasingly questioned amid growing political interference, while the ECB and BoE attempt to balance sluggish growth with inflation risk. Meanwhile, the Bank of Japan stands firm with hawkish rhetoric as inflation surprises persist. Against this backdrop, several high-conviction trade setups are emerging across major currency pairs — each backed by strong macro, technical, and options-based flows. Our Highest Confidence Setup USD/JPY – Short Bias (High Confidence): Entry: 140.80–141.20 Targets: 139.60 (S1), 137.80 (S2) Stop Loss: 142.40 The USD/JPY pair offers one of the cleanest setups this week. The pair is breaking down decisively below key resistance at 142.00–142.40 amid a surge in demand for JPY safe-haven exposure. Trump’s renewed attacks on the Fed’s autonomy have fueled a broad USD decline, while U.S. yields continue to sag. Options markets confirm the bearish view — showing concentrated 141.50/140.00 put demand. Technically, MACD has crossed bearish and RSI is nearing oversold, suggesting strong momentum for further downside into 137.80 if 139.60 gives way. Rationale: Trump’s threat to Fed independence fuels USD sell-off; strong JPY demand on safe-haven flows; MACD bearish, RSI near oversold; key resistance at 142.20–142.40. More High Conviction Trade Setups: EUR/GBP – Short Bias: Entry: 0.8600–0.8620 Targets: 0.8530 (S1), 0.8475 (S2) Stop Loss: 0.8650 Sterling strength has surprised to the upside amid optimism over a UK–US trade agreement, even in the face of dovish BoE tones. Meanwhile, the euro is under pressure from slowing EU growth, a dovish ECB outlook, and tariff anxiety. EUR/GBP remains capped at 0.8650, and momentum indicators favor a continued drift lower toward 0.8475. Rationale: UK optimism on US trade deal and stronger GBP despite BoE cut risks; EUR capped by ECB cuts and EU tariff woes; momentum favors GBP. GBP/USD – Long Bias: Entry: 1.3380–1.3410 Targets: 1.3500 (R1), 1.3600 (R2) Stop Loss: 1.3280 Despite some overbought signals, the broader bullish structure for GBP/USD remains intact. The pair is riding momentum from the USD’s implosion, combined with improving GBP sentiment from trade optimism. Pullbacks are expected to be shallow, with 1.3280 offering solid structural support. Rationale: USD collapse continues amid political chaos; GBP supported by trade optimism and trend momentum; overbought RSI may cause pullbacks but structure remains bullish. GBP/JPY – Short Bias: Entry: 188.20–188.60 Targets: 186.00 (S1), 184.00 (S2) Stop Loss: 189.40 A compelling tactical short, GBP/JPY is poised for further downside as BoE dovishness clashes with rising BoJ hawkish risk. The pair rejected 188.75 and is now coiling for a drop into the 184.00s, in line with growing risk-off positioning globally. Rationale: BoE dovish divergence vs. hawkish BoJ; JPY inflows on risk aversion and rising real yields; technicals favor downside under 188.75. EUR/JPY – Short Bias: Entry: 161.50–161.80 Targets: 160.00 (S1), 158.80 (S2) Stop Loss: 162.60 The yen is again asserting its dominance as EU macro data deteriorates and ECB cuts loom. EUR/JPY remains vulnerable under 162.00, with fresh downside flows emerging. Rationale: Safe-haven JPY outperforms as EU growth outlook weakens; ECB dovish, BoJ likely to hike again; bearish trend emerging below 162.00. USD/CHF – Short Bias: Entry: 0.8070–0.8100 Targets: 0.7900 (S1), 0.7780 (S2) Stop Loss: 0.8180 As the dollar unravels on credibility concerns, CHF has gained sharply. With SNB unlikely to intervene near multi-year highs and CHF seeing strong bid amid global tension, USD/CHF looks set to retest 0.7780. Rationale: USD collapse on Fed credibility issues; CHF boosted by safe-haven demand; SNB intervention unlikely near current levels; fresh 14-year lows in play. In Summary This is a market turning on themes of Fed credibility erosion, geopolitical risk, and safe-haven rotation. The USD/JPY and USD/CHF shorts rank highest in conviction, driven by clean technicals and strong options flow confirmation. GBP remains a tactical outperformer — particularly against the EUR and JPY — as UK trade optimism outweighs rate cut risk. In all, this is a moment for macro-driven, momentum-aligned trades with tight risk management and a clear eye on volatility. Check out more FX Trade Setups on our forex page. TerraBullMarkets...

Premium FX & Commodities

Trade Setups

Professional analysis & signals delivered daily for just