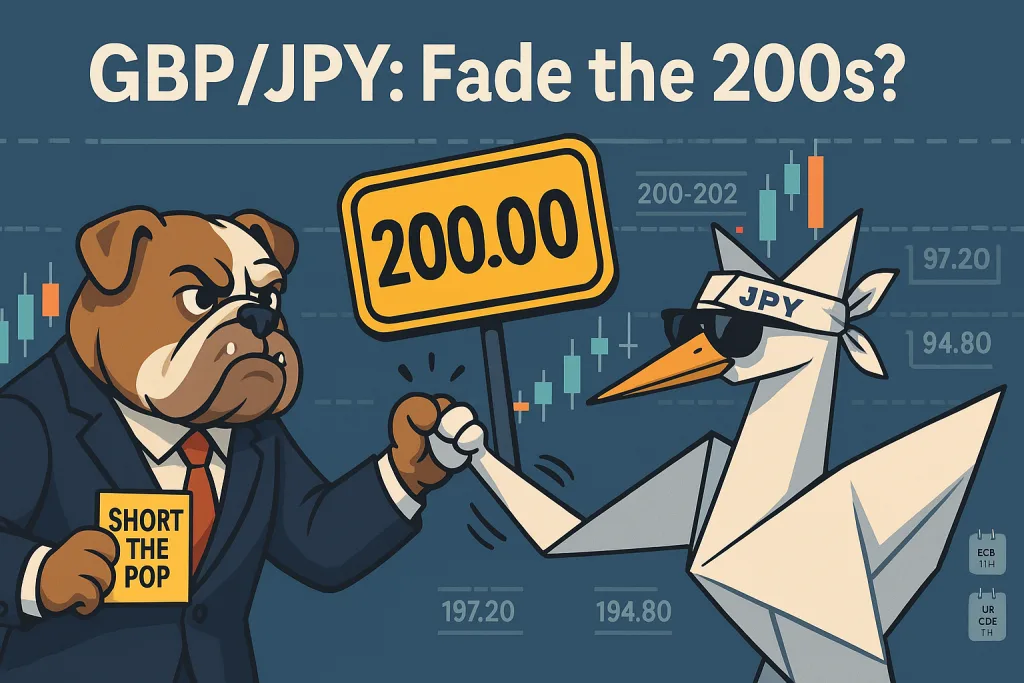

GBPJPY Trade Idea – 8/9/2025 Here’s the framework for this week’s GBP/JPY trade. We’re treating the latest pop as headline-driven and prefer fading strength into the 200.60–201.40 supply zone, with risk defined above 202.00/202.30. The setup scores A+ as it aligns fundamentals (event-heavy week with US PPI/CPI and UK GDP that can restore JPY’s haven bid), technicals (repeated supply between 200–202), and sentiment/positioning (GBP shorts and JPY longs can accelerate downside on risk-off). Execution is tactical: wait for a clear rejection or momentum roll in the zone, then target 197.20 and 194.80, trailing under emerging lower highs. If we close >202.00, stand down and reassess. GBPJPY Trade Idea: Pair / Asset Bias & Entries Stop / Invalidation Targets Why A+ Near-term catalysts (UK time) GBP/JPY (spot ~200.026) Short into strength: 200.60–201.40 (core fade zone). Optional add only on a clear rejection/wick in 201.60–201.90. Hard stop 202.30 (or daily close > 202.00). 197.20, then 194.80 (trail above lower-highs once <198.00 trades). Fundamentals: JPY’s haven bid can reassert if U.S. inflation is benign or risk sours; UK GDP adds domestic risk for GBP after the Ishiba headline pop. Technicals: 200-202 = thick prior supply; first pushes into ~201s often fail intraday—clean level to define risk tightly above 202. Sentiment/positioning: Specs net-short GBP and net-long JPY—a combo that can accelerate downside on risk-off or soft U.S. data. Wed 10 Sep 13:30 US PPI • Thu 11 Sep 13:30 US CPI • Thu 11 Sep 13:45 ECB press conf (risk pulse) • Fri 12 Sep 07:00 UK GDP (July) • Ongoing Japan LDP leadership headlines • Next week BoJ policy (Sep 18–19). Bias & entries Short into strength: 200.60–201.40 (core fade zone). Optional “last push” add only on a rejection/wick in 201.60–201.90. Stop / invalidation Hard stop 202.30 (or daily close > 202.00). Targets 197.20, then 194.80 (trail above lower highs once <198.00 trades). Why it still scores A+ (3/3) Fundamentals: The pop after PM Ishiba’s resignation is JPY-negative near term, but the bigger week is US inflation (PPI/CPI) and UK GDP—both can flip risk and UST yields; softer US inflation or risk-off would re-strengthen JPY and pressure GBP/JPY lower. Technicals: 200–202 is a thick supply area from prior swing highs; first attempt into ~201s often fails on the day—good location to define risk tightly above 202. Sentiment/positioning: Specs are net-short GBP (~−33k) and net-long JPY (~73k)—a mix that can accelerate downside if catalysts turn risk-off (JPY buys/GBP sells). Near-term catalysts (UK time) Wed 10 Sep 13:30 – US PPI. Thu 11 Sep 13:30 – US CPI (Aug). Thu 11 Sep – ECB meeting / press conf 13:45 (risk pulse for FX). Fri 12 Sep 07:00 – UK GDP (July). Ongoing – Japan LDP leadership headlines (unscheduled). Next week – BoJ policy (Sep 18–19) for follow-through. Tactical triggers Let price probe the 200.60–201.40 zone; take the short on a 1H momentum roll or failed breakout (upper-wick close back below ~201.20). If it squeezes 201.60–201.90, only fade on a clear rejection; otherwise stand aside until CPI. If >202.00 daily close, stand down and reassess—structure turns pro-trend. Want me to slot this into your table with the exact levels above? For similar Forex Trade Setups please visit our forex trade ideas page. Please visit our Disclaimer page. Disclaimer Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page. TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted. The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice. GBPJPY Trade Idea TerraBullMarkets...

Premium FX & Commodities

Trade Setups

Professional analysis & signals delivered daily for just