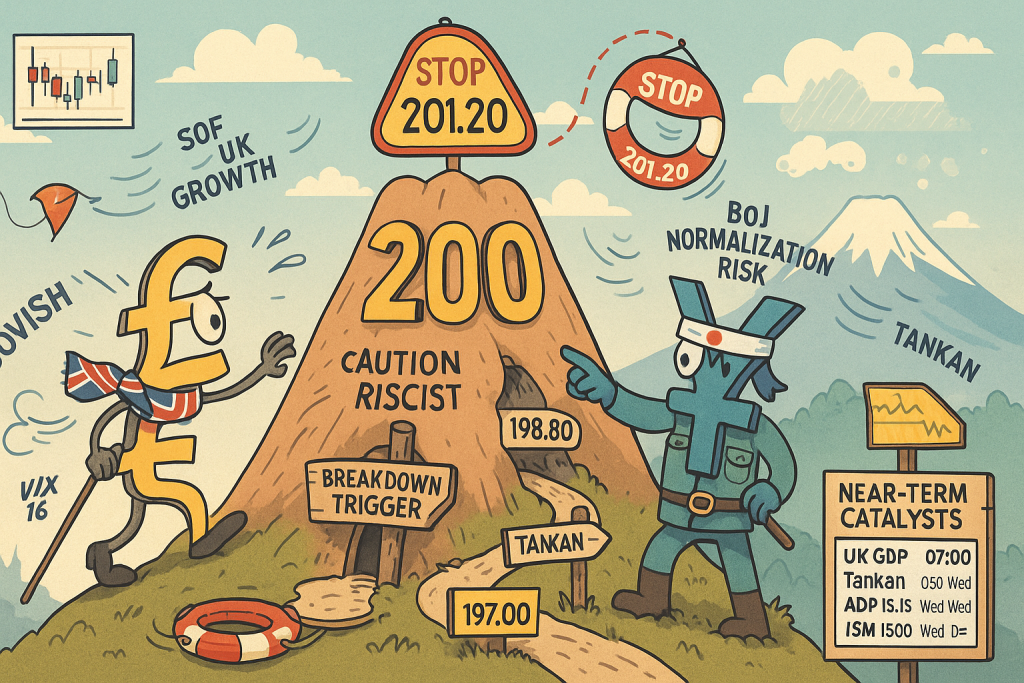

GBPJPY Trade Setup – 30.9.25 As of Tuesday, 30 September 2025 (05:17 UK), GBP/JPY is hovering just below the psychologically important 200 handle after repeated intraday rejections. We are initiating a tactical short, looking to sell into 199.80–200.30 with an add-on below 198.80. The trade’s edge is threefold: Fundamentally, the BoE’s recent shift toward a more dovish, growth-sensitive stance reduces sterling’s carry appeal, while Japan’s policy trajectory and improving corporate sentiment keep a risk of further BoJ normalization in play—supportive of the yen on dips. Technically, the pair has carved out lower momentum highs into a well-defined supply zone around 200, with 198.80 acting as a pivotal structure level; a sustained break below it would confirm a reversal from the big figure. Sentiment/Positioning adds fuel: speculative JPY shorts remain elevated, making the cross vulnerable to a squeeze if UK data underwhelms or global risk wobbles (VIX is elevated relative to recent lows). Near-term catalysts that can unlock follow-through include the UK Q2 GDP (final) at 07:00 UK, Japan’s Tankan (00:50 UK Wednesday), and U.S. labor/ISM prints mid-week that could dent risk appetite and favor JPY. GBPJPY Trade Setup: Pair / Asset Bias & Entries Stop / Invalidation Targets Why A+ (fundamentals, technicals, sentiment/positioning) Near-term catalysts (UK time) GBP/JPY 199.49 Short: sell 199.80–200.30 (psych 200); add on < 198.80. 201.20 (above recent swing & options barrier risk). 197.00 – 195.00 Fundamentals: BoE’s Ramsden flagged cooling labour and disinflation glidepath; UK growth soft into today’s Q2 revisions, less GBP carry support if BoE tilts dovish into Q4. BoJ hawkish bias underpins JPY. (Reuters) Technicals: Rejections at 200 big-figure; divergent RSIs vs USD/JPY. Sentiment: IMM shows JPY shorts added last week; stop pockets likely under 199/198.80 and above 200/201.20. (Saxo Bank) Tue: UK Q2 GDP (final) 07:00; US JOLTS 15:00. Wed: Tankan 00:50; ADP 13:15; ISM Mfg 15:00. (Office for National Statistics) Chart by TradingView – GBPJPY Trade Setup – 30.9.25 GBPJPY Trade Setup Conclusion: We rate this an A+ (3/3) setup because the fundamental narrative (BoE drift dovish vs. BoJ normalization risk), the technical map (clear rejection at 200 with 198.80 as the trigger), and positioning dynamics (crowded JPY shorts) all point in the same direction. Execution is straightforward: scale in at 199.80–200.30, add on a confirmed daily break of 198.80, stop at 201.20 (above recent swing and options gravity), and target 197.00 initially, then 195.00 if momentum accelerates. Manage the position around data: if price is not in profit heading into high-vol events (e.g., Tankan, ADP/ISM, NFP), consider trimming to reduce gap risk; if price closes below 198.80, trail stops above successive lower highs to lock in gains. Invalidation is a decisive daily close above 201.20 or a material BoJ back-pedal that removes the yen-supportive tailwind. Absent those, the path of least resistance is lower, with clean stop pockets and favorable asymmetry into the week’s catalysts. For similar Forex Trade Signals please visit our forex trade ideas page. Please visit our Disclaimer page. Disclaimer Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page. TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted. The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice. TerraBullMarkets...

Premium FX & Commodities

Trade Setups

Professional analysis & signals delivered daily for just