Initial Jobless Claims What to Expect – 18/9/25

U.S. labor-market momentum gets a fresh read on Thursday, 18 September 2025 at 13:30 BST, when Initial Jobless Claims hit the tape. Following last week’s spike to 263k, the street is looking for 240k, while our base case is a softer-landing 250k, a partial unwind of holiday-related distortions but still above the summer trend.

Beyond the headline, we’ll focus on continuing claims, the four-week average, and any state-level breadth that confirms cooling demand for workers. With rates and the dollar sensitive to signs of slack, a print above consensus would typically favor a front-end rally, meaning lower Treasury yields and a softer USD, while a downside surprise would bolster the “resilient jobs” narrative into the next data run.

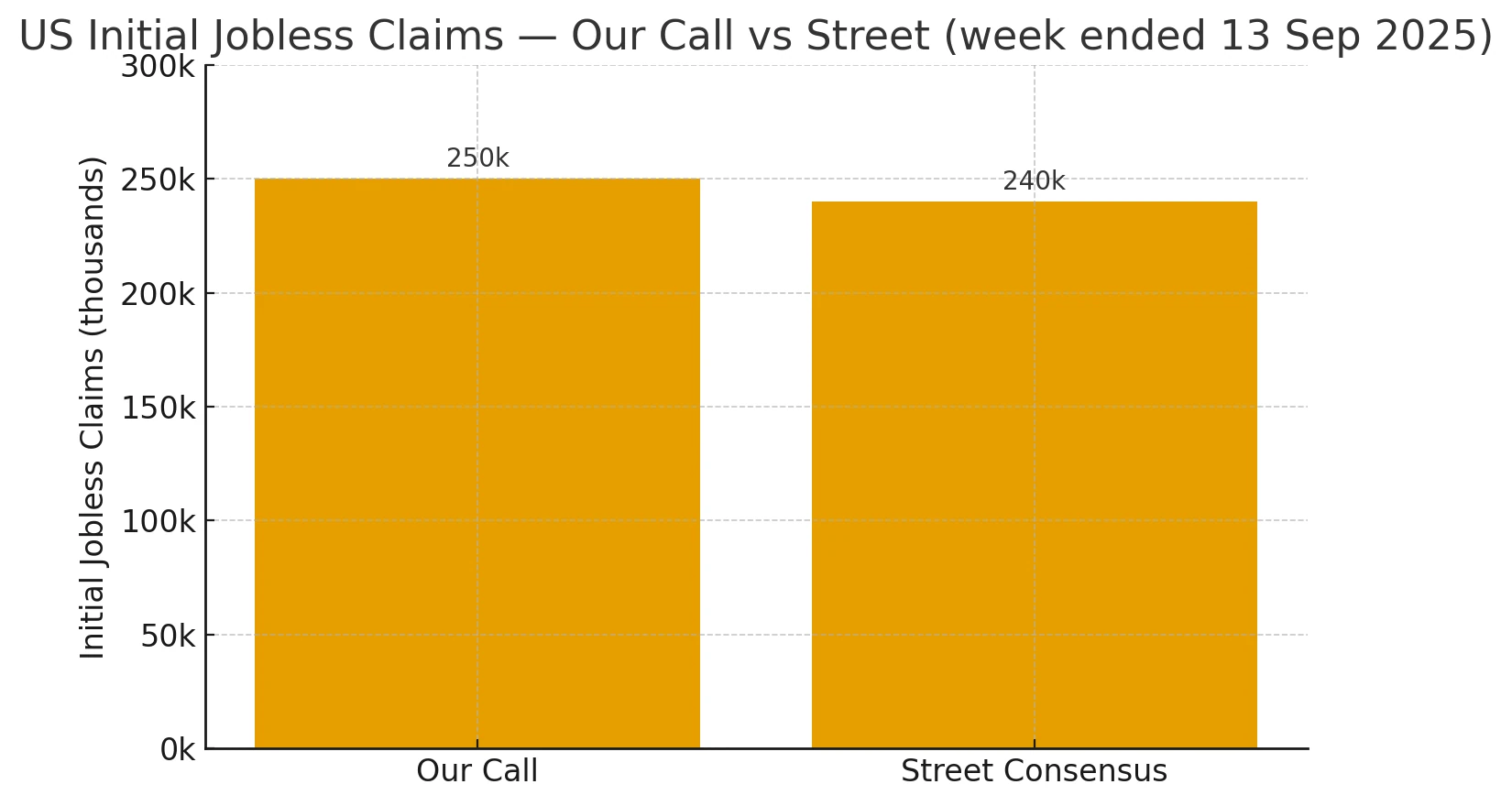

Initial Jobless Claims – Our Call

Our call: 250k (vs 240k consensus; 263k prior). We expect some mean-reversion from last week’s 263k spike, with this week’s initial claims around 250k—still above consensus but off the highs.

Why a still-elevated print

- Last week’s surge was real, not just noise. DOL reported 263k SA claims (4-yr high), with notable state drivers: Tennessee (+2,870, manufacturing layoffs), Connecticut (+2,270), New York (+1,683 across transport/warehousing, construction, arts), Illinois (+1,331). That breadth argues against a full snap-back to sub-240k in one week.

- But some give-back is likely. The DOL cautions that weekly claims are hard to seasonally adjust around holidays/school starts; Labor Day often distorts the SA factor. Mean-reversion toward ~250k fits that pattern.

- Coincident labor signals are softer:

- ISM Services employment stayed in contraction for a third month (46.5).

- Challenger announced 85,979 job cuts in Aug (+39% m/m).

- NFIB: hiring plans subdued; unfilled openings continue to decline. NFIB – NFIB Small Business Association+1

These point to a cooling labor demand backdrop that keeps claims from retracing too far.

- Continuing claims were 1.939m in the latest week available (Aug 30), stable but trending up vs spring; I’d look for a drift higher to 1.950m Consensus in tomorrow’s update .

Range & Risks

- Base: 245k–255k; print around 250k.

- Upside (>260k): more follow-through from manufacturing layoffs (see TN/IL) or fresh transport/warehousing cuts.

- Downside (<235k): if the prior spike was mostly seasonal-factor noise that fully unwinds (less likely given the state detail).

Market take (FX/rates)

- >consensus (≥250k): leans USD softer, front-end yields lower; watch USD/JPY downside and EUR/USD topside bleed.

- <consensus (≤235k): trims labor-weakness narrative → USD firmer, especially vs EUR/GBP ahead of next growth prints.

Bottom line:

We expect a cooling but not collapsing labor market to show through in a 250k claims print — slightly above street and consistent with broader evidence of softer hiring and rising layoffs, while unwinding some of last week’s holiday-skewed jump.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.