ISM Manufacturing PMI Expectations – 2/9/2025

Our ISM Manufacturing PMI’s Analysis

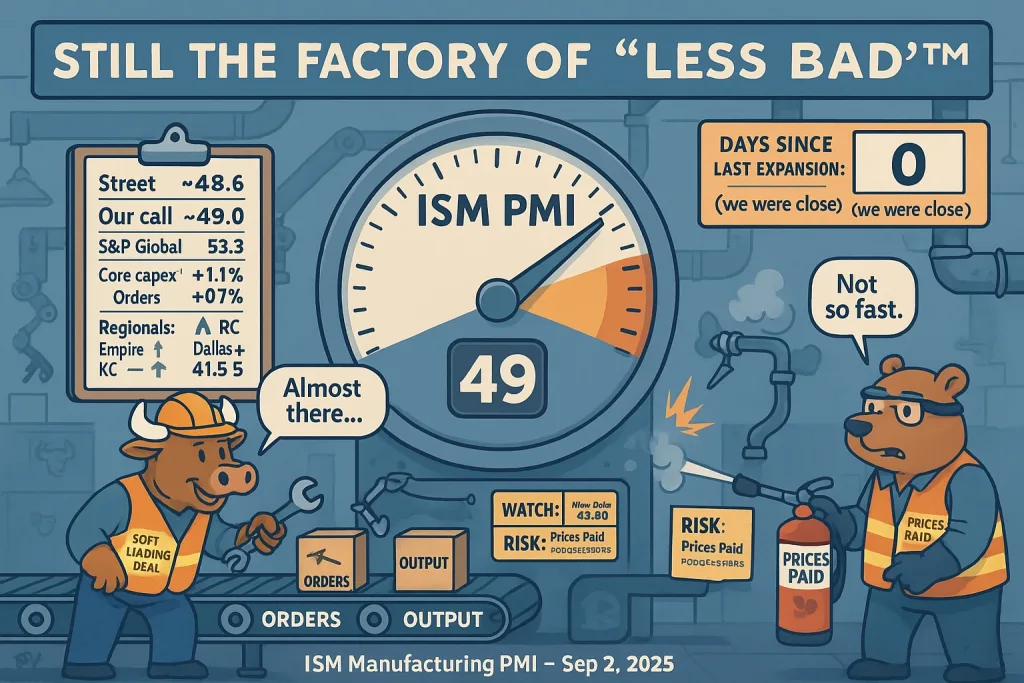

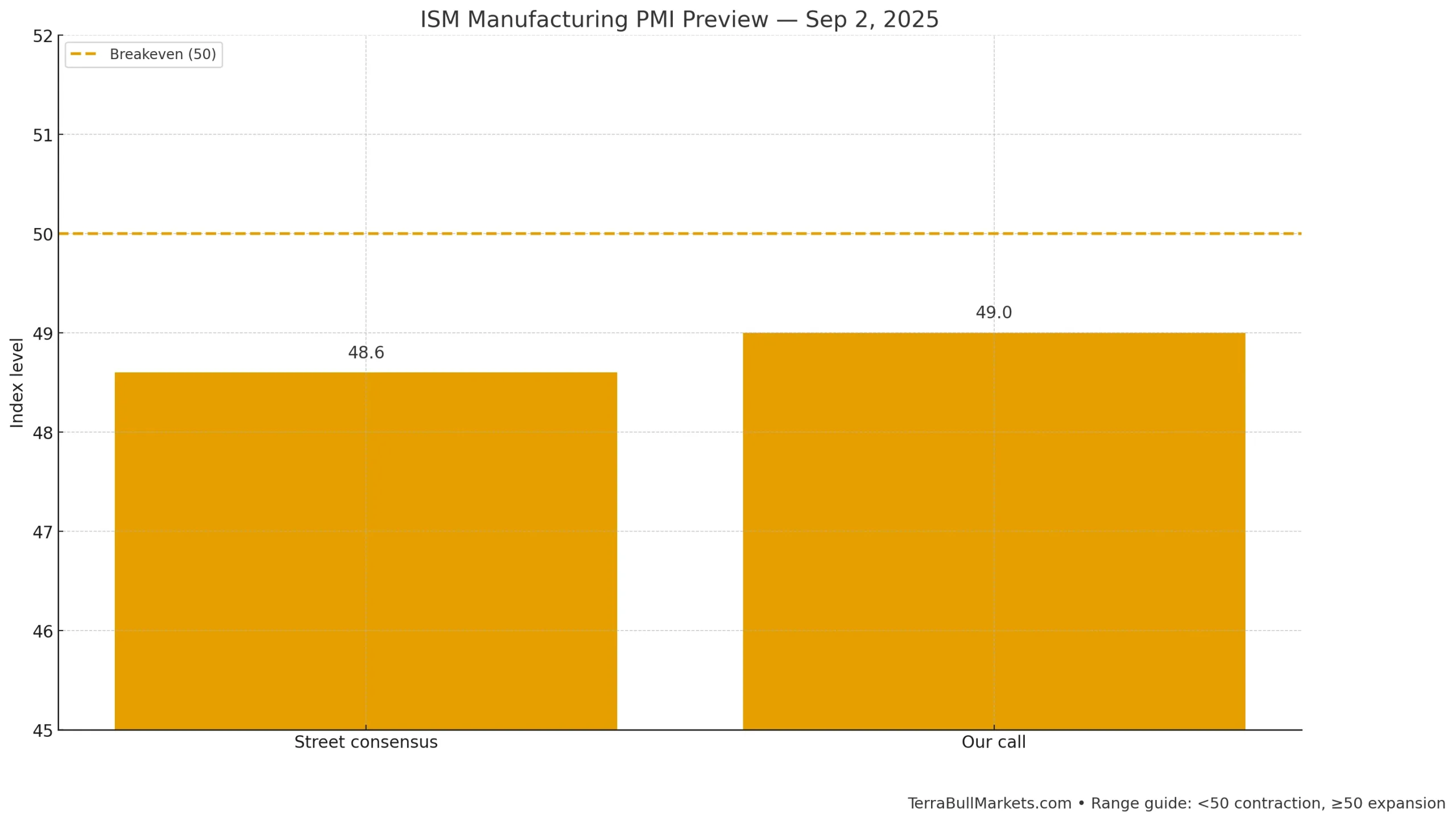

The August ISM Manufacturing PMI lands into a messy—but improving—backdrop. The Street sits around 48.6 (vs. 48.0 in July), while our call is a touch firmer at 49.0 (48.5–49.5): still contractionary, but edging closer to the 50 break-even. What nudges us above consensus isn’t a single blowout print, but a mosaic: the S&P Global flash at 53.3 (which typically runs hotter than ISM) points to firmer orders and output; core capex orders +1.1% m/m and shipments +0.7% in July hint at steadier equipment demand; and the regional picture, though mixed, is net less bad—with Empire back in expansion, Dallas still growing, and Kansas City essentially steady, offset by Richmond softness and a weak Chicago PMI. Price dynamics keep a lid on the optimism: ISM Prices Paid cooled to 64.8 from 69.7, but remains elevated, and a firmer July PPI alongside tariff pass-through chatter argues against a swift return to expansion.

ISM Manufacturing PMI

- Street: 48.6 (from 48.0 in Jul).

- Our call: 49.0 (48.5–49.5): above consensus, still sub-50.

Why we’re a shade higher than 48.6

- S&P Global flash jumped to 53.3 on stronger orders/output; ISM typically runs lower than S&P, but direction usually rhymes.

- Core capex (non-defence ex-aircraft) +1.1% m/m and shipments +0.7% in July hint at firmer equipment demand feeding sentiment.

- Regionals are mixed but net less bad: Empire State returned to expansion (11.9); Dallas still expanding (production 15.3); Kansas City characterizes conditions as “mostly unchanged.” Offsetting: Richmond composite −7 and Chicago PMI 41.5. Net: sideways-to-slightly-better nationally.

- Prices/tariffs: ISM Prices Paid cooled to 64.8 in Jul (from 69.7), still elevated; July PPI surprised hotter, with tariff pass-through cited—keeps ISM below 50 despite better momentum.

In Conclusion

Taken together, the signal is “less bad” rather than “strong”: momentum has improved enough to justify 49.0, but sub-50 remains the base case as input-cost pressure and patchy regional demand restrain a broader turn. For trading lenses, the New Orders component is the swing factor—an approach toward 49–50 would validate a marginally firmer headline, while a relapse <47 would argue for a miss. Prices Paid is the risk flag; any re-acceleration would revive tariff-pass-through concerns. Net-net, we look for an incrementally better ISM that stops short of expansion, keeping the “soft landing” narrative alive but unconfirmed.

For similar Forex Markets news please visit our forex page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.