ISM Services PMI Expectations – 4/9/2025

US ISM Services PMI (Aug) — Preview & Market Framing

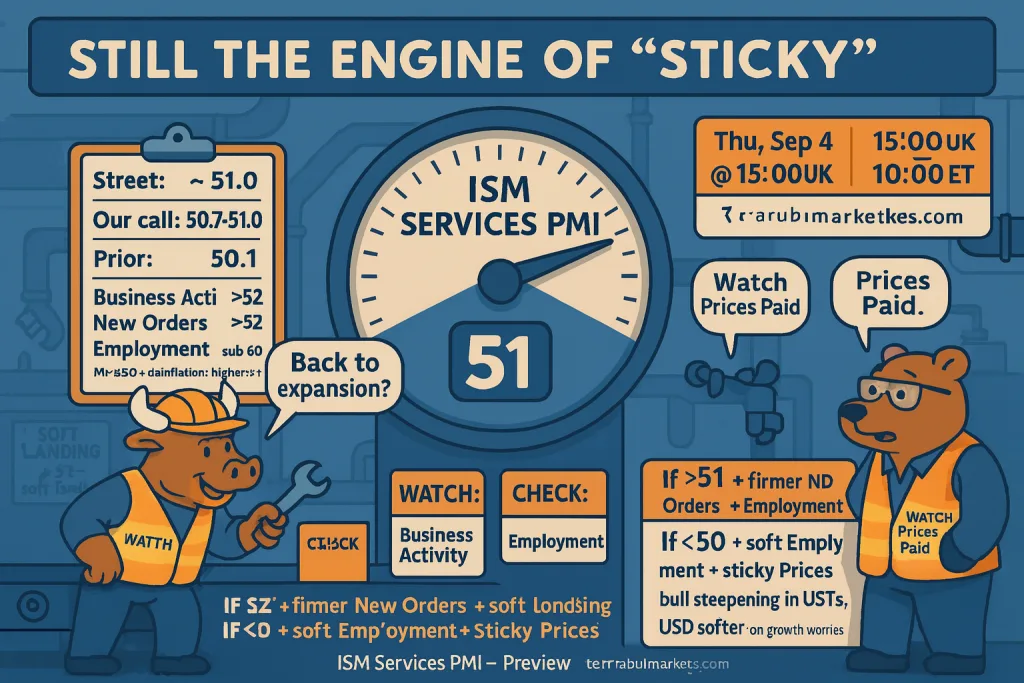

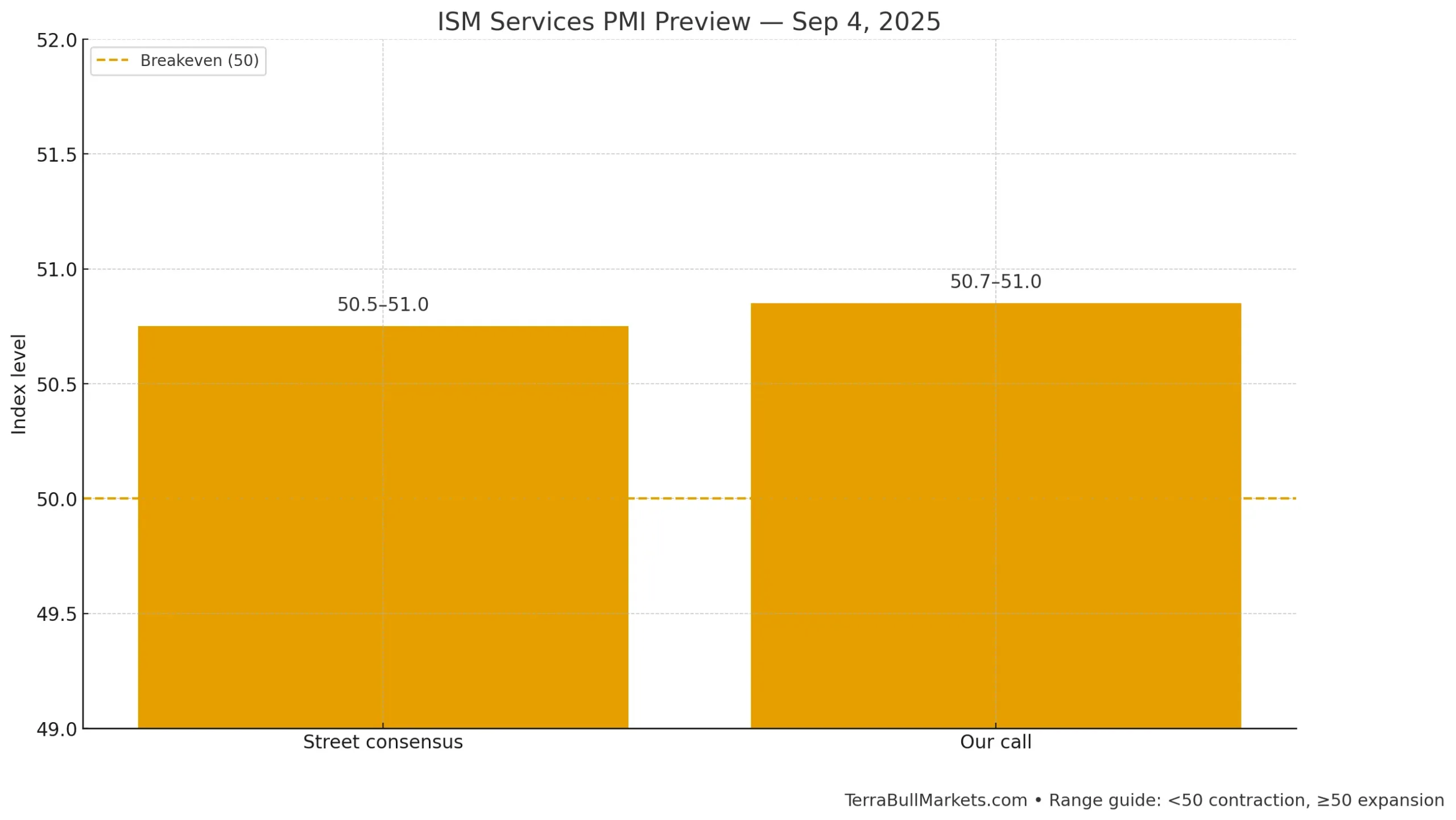

Thursday’s ISM Services PMI release (04 Sep, 15:00 UK / 10:00 ET) lands into a market already parsing mixed signals – manufacturing still sub-50, labor demand has been gradually cooling, and services-led inflation has been proving sticky. Consensus looks for a modest return to expansion near 51.0 (prior 50.1); our base case sits just above the 50 line at 50.7–51.0.

What will matter most isn’t the headline alone but the composition:

- Business Activity and New Orders gauge near-term growth momentum; sustained prints above 52 would further support a soft-landing narrative.

- Employment has been the weak link; another sub-50 outcome would reinforce gradual labor-market loosening even if activity stabilizes.

- Prices Paid remains the policy-sensitive piece; any cooling toward the mid-60s would help the “disinflation in services” story, while a renewed push higher would re-ignite concern about tariff and wage pass-through.

In market terms, a headline above 51 with firmer New Orders and an improving Employment index would likely lift front-end yields and support the Dollar (USD), especially versus low-beta FX. Conversely, below 50 with soft Employment and sticky Prices would read stagflation-ish, favoring a bull-steepening in Treasuries’ (USTs) and a softer Dollar (USD) on growth worries. We anchor our tactical view around these sub-indexes and their implications for services inflation into the September FOMC.

What the Street expects

- Most calendars show consensus ~50.5–51.0 (prev 50.1). The forecast 50.7 sits right in the middle.

- ISM Services is released at 10:00 ET on the third business day each month.

Our call (headline & key sub-indexes)

- ISM Services PMI: 50.7–51.0 (slightly above the 50.5–51.0 consensus midpoint; modest expansion).

- Business Activity: 53 (Jul: 52.6).

- New Orders: 51 (Jul: 50.3).

- Employment: 47–48 (still contracting; Jul: 46.4).

- Prices Paid: 68–70 (very elevated; Jul: 69.9).

Why we’re a touch above consensus on the headline

- S&P Global points to solid services momentum: US Services PMI = 55.4 in Aug (final). ISM typically runs a few points lower than S&P, but the direction rhymes → argues for a small uptick from July.

- July ISM Services internals were mixed, notably Business Activity 52.6 and New Orders 50.3, suggesting underlying growth that was masked by weak Employment (46.4). If orders/activity firm a bit, the composite can tick above 50 even with employment still sub 50.

- Manufacturing read-across: Tuesday’s ISM Manufacturing = 48.7 showed new orders back in expansion (51.4) and prices still high (63.7) a combo consistent with “demand stabilizing, cost pressure sticky,” which normally maps to services holding near/just above 50.

Why Employment likely stays below 50

- Labor cooling signals: the Conference Board “jobs plentiful minus hard to get” gap narrowed again in August; insured unemployment ~1.95m remains elevated vs early-year levels. That’s consistent with services hiring restraint even if top-line activity inches up.

Why Prices likely stay hot

- ISM Services Prices jumped to 69.9 in July and manufacturing input prices remained lofty in August (63.7). Tariff-linked cost pass-through risk is still there, so I’d expect only marginal relief at best.

What would move markets most at 15:00 UK

- Headline ≥51.5 with New Orders ≥52 & Employment ≥49: supports a “soft-landing not dead” narrative → front-end USTs up / USD firmer (especially vs JPY).

- Headline ≤50 with Employment ≤46 & Prices ≥69: stagflation-ish mix (weak growth, sticky prices) → curve bull-steepening / USD mixed (risk-off tilt).

- Prices Paid ≤65 with headline ~51: “better growth, easing inflation” → USTs bid / USD softer, equities like it.

Cross-checks to watch before the release

- ADP (Thu 08:15 ET) could sway sentiment on the Services Employment component. ADP Media Center

- Weekly claims (Thu 08:30 ET): last print 229k / continuing 1.95m—a further rise in continuing claims would keep a lid on ISM-Services Employment. DOL

Receipts / prior detail

- July ISM Services PMI: headline 50.1; Business Activity 52.6, New Orders 50.3, Employment 46.4, Prices 69.9. Institute for Supply Management

- Consensus snapshots for Aug: ~50.5–51.0 (MarketWatch & Investing.com calendars).

- S&P Global US Services (Aug): 55.4 (final).

- ISM Manufacturing (Aug): headline 48.7; New Orders 51.4; cost pressure elevated.

I’m looking for ISM Services ~50.7–51.0 (just above consensus), employment still sub-50, and prices uncomfortably high. That mix keeps the Fed focused on inflation progress in services while acknowledging a gradually cooling labor market.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.