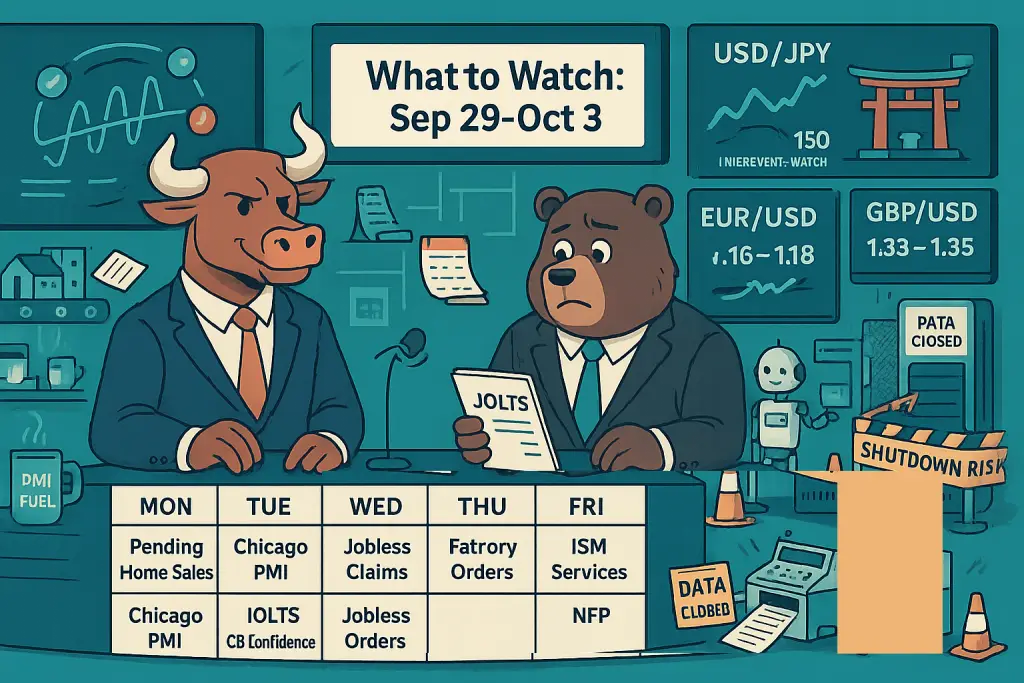

Macro Data Week Ahead – 29 Sep – Fri 3 Oct 2025

Following the Fed’s September cut, markets are now hyper-sensitive to signs that growth is cooling without re-accelerating inflation. The week ahead stacks US housing, regional manufacturing, confidence, ISM Manufacturing & Services, JOLTS, claims, factory orders, and culminates in NFP. All under the cloud of a potential U.S. government shutdown that could delay or disrupt releases. The balance of evidence into quarter-end: manufacturing subdued, services steady, labor loosening, and housing constrained by affordability, even with mortgage rates off their peaks.

Big Picture Setup (why this week matters)

-

Fed reaction function: After September’s 25 bp cut, the bar for follow-ups shifts to labor softness and contained inflation. Flash PMIs show growth cooling in September (Composite 53.6 from 54.6), hinting at slower services momentum heading into ISM. Prices-charged cooled in the flash, which helps the “softening without re-heating” narrative.

-

USD & rates context (as of Fri, Sep 26): The dollar is firmer week-over-week with markets trimming late-year cut odds; EUR/USD ~1.17, GBP/USD 1.33–1.34, USD/JPY near 150; U.S. 10y 4.17%. Expect direction to hinge on ISM & NFP beats/misses.

-

Shutdown risk: A lapse in funding from Oct 1 could delay key data (including NFP) and gum up regulator ops. Should be treated as a volatility wild card and planning risk for Friday’s trades and hedges.

Macro Data Week Ahead:

Monday (Sep 29)

US Pending Home Sales (Aug)

-

Why it matters: PHS leads Existing Home Sales by 1–2 months; a firmer August print would hint at a modest autumn turnover pickup after August existing sales slipped just 0.2% to a 4.00m pace amid still-elevated prices. Mortgage rates have eased from 2024 highs but affordability remains tight.

-

Our read: With new-home incentives doing the heavy lifting and resale affordability stretched, risks skew to only a mild bounce vs consensus.

-

FX lens: A soft PHS print is USD-neutral/slightly negative via lower yields; USD/JPY most sensitive if yields dip.

Dallas Fed Manuf. Index (Sep)

-

Why it matters: Texas is a high-beta, energy-heavy hub; the survey captures new orders, employment & price pressures. Beige Book flagged a recent rebound in new orders but mixed hiring. Watch for tariff-related cost commentary.

-

Our read: Expect cautious tone: production resilient, but employment & outlook subdued.

Tuesday (Sep 30)

Chicago PMI (Sep)

-

Signal value: Good (imperfect) ISM lead. August plunged to 41.5 with broad weakness in new orders, employment and backlogs. Another sub-45 print would create downside risk the Wednesday’s ISM Manufacturing data.

JOLTS Job Openings (Aug)

-

Why it matters: Openings vs unemployed is a key labor slack gauge. July openings 7.2M with quits rate at 2.0%, consistent with cooler churn. A drop toward 7.0M strengthens the cooling labor narrative into NFP.

Conference Board Consumer Confidence (Sep)

-

Focus: Present Situation vs Expectations. In August, headline dipped to 97.4; Expectations stayed sub-80 (recession-watch zone). A weaker September would align with softer hiring signals.

-

Market angle: Soft CC + weak JOLTS → bullish duration, USD-softer, curve bull-steepening risk.

Wednesday (Oct 1)

ISM Manufacturing PMI (Sep)

ISM Mfg Employment (Sep)

-

Context: August headline 48.7 with new orders back above 50 (51.4) but employment deeply sub-50 (43.8) and prices paid high (63.7), a tricky stagflation-ish mix for the Fed.

-

What to watch:

-

New Orders sustainment below 50 signals continued softness

-

Employment index still below 50 signalling continued labor softness

-

Prices Paid easing from 63 – 64 would signal inflation relief

-

-

Trading bias:

-

Below 48.5: USD offered, 10y yields down, risk-off helps JPY/CHF.

-

>50: USD pops, yields up, USD/JPY may test 150s.

-

Thursday (Oct 2)

Japan Consumer Confidence (Sep)

-

Why it matters: Household sentiment is a BoJ watchpoint alongside wages & inflation. August ticked to 34.9, still pessimistic; Tokyo CPI held 2.5% y/y in Sep, and services PPI firmed, keeping BoJ tightening risk alive later this year. Stronger confidence would support JPY at the margin into NFP.

US Initial Jobless Claims (w/e Sep 27)

-

Why it matters: Near-term labor momentum read heading into NFP. Watch for an uptick consistent with JOLTS softening.

US Factory Orders (Aug)

-

Nowcast cues: Durable goods +2.9% in August (ex-trans +0.4%), but core capex shipments -0.3%, pointing to mixed business spending. A positive headline led by transport is likely; ex-transport is the quality check.

Friday (Oct 3)

US Nonfarm Payrolls (Sep)

Unemployment Rate (Sep)

ISM Services PMI (Sep)

-

Context into payrolls: August added just +22k, jobless 4.3%, wages +0.3% m/m; the labor market has downshifted since spring. A shutdown could delay NFP; build contingency tactics.

-

Services ISM focus: August new orders 56.0 (solid) but employment 46.5 (weak)—if employment stays sub-50 and business activity softens, services could join manufacturing in a slower growth regime.

Conclusion

Next week is a clean audit of the soft-landing narrative into Q4. Housing should stabilize only at the margin, manufacturing is still below trend, and services’ resilience is increasingly dependent on labor. The sequence – Chicago PMI – JOLTS/Confidence – ISM Manufacturing – Claims/Factory Orders – ISM Services and NFP. All will set the path for yields, the dollar and risk appetite.

The tells are relatively simple: ISM new orders holding near/below 50, employment sub-50 across both ISMs, prices paid easing, JOLTS drifting lower with quits subdued, and a modest NFP that keeps unemployment anchored around 4.3%. That mix argues for a gently softer USD, bid duration, and a topside cap near USD/JPY ~150, unless a decisive upside surprise in ISM or payrolls breaks the range.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.