Michigan Consumer Sentiment Preview – 10.10.25

The University of Michigan’s preliminary Consumer Sentiment for October 2025 lands on Friday at 15:00 UK, a timely pulse check on the U.S. household outlook just as markets weigh softer activity data against easing fuel costs and a still-uncertain labor backdrop.

September’s final print of 55.1 set the bar; consensus looks for a modest step down toward the mid-54s. In this note, we frame what matters most for traders and macro watchers: the split between Current Conditions and Expectations, the trajectory of one-year and five-to-ten-year inflation expectations, and how rate-sensitive buying conditions might be stabilizing alongside slightly easier mortgage rates.

We also outline the risk skew around the release and the potential cross-asset read-through for USTs, USD, and equities.

Our Call:

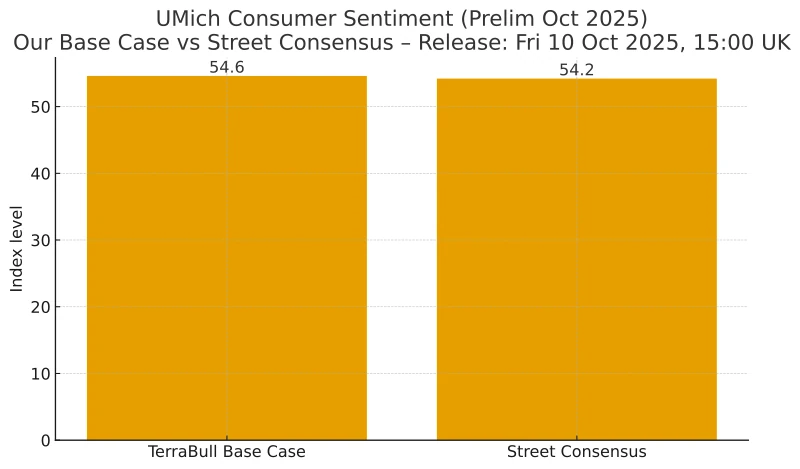

Our Base Case: 54.6 (range 53.5 – 55.5).

Skew: Slightly above your 54.0 – 54.2, but still down a touch from Sep’s 55.1.

We look for Michigan Consumer Sentiment (Prelim Oct) at 54.6 (range 53.5–55.5), a touch below September’s 55.1 yet slightly above the 54.0 – 54.2 consensus band. Cheaper gasoline and marginally easier mortgage rates should lend support, but softer services momentum and cooling labour perceptions keep a lid on gains.

-

Components: Current Conditions 59 – 60 (vs 60.4), Expectations 50–51 (vs 51.7).

-

Inflation expectations: 1-yr 4.6 – 4.8%; 5 – 10yr 3.6 – 3.8%, stickier than markets would like, but not re-accelerating.

Risk skew:

-

Upside: Headline >56 and/or 1-yr >4.9% – front-end USTs firmer, USD bid, equities wobbly.

-

Downside: Headline <53 and/or 1-yr <4.5% – yields softer, USD offered, risk tone steadies.

-

What to watch: Buying conditions (durables/vehicles/housing) for rate-sensitive stabilization; jobs & income expectations for confirmation of weaker labor sentiment.

Trading take: Two-way risk into 15:00 UK with modest topside odds relative to street forecasts. Reaction likely driven more by the inflation-expectations internals than the headline.

Why:

Small lifts from cheaper gas and somewhat easier mortgage rates are likely offset—though not overwhelmed—by deteriorating labor-market perceptions (NY Fed SCE) and softer services momentum (ISM). The interview window ended Oct 6, so later-week headlines won’t swing it.

Component & inflation-expectation markers I’m looking for

-

Current Conditions: 59 – 60 (vs 60.4).

-

Expectations: 50 – 51 (vs 51.7).

-

1-yr inflation exp.: 4.6 – 4.8% (gas is a mild drag, but sentiment about prices hasn’t improved much).

-

5–10yr inflation exp.: 3.6 – 3.8% (watch for stickiness after Sep’s uptick).

Market Take:

Markets will key off inflation expectations as much as the headline.

-

Upside surprise: Headline ≥56 and/or 1-yr infl-exp ≥4.9% → fewer near-term Fed cuts priced, UST 2-yr/5-yr yields up, USD firmer, risk-assets wobbly. (Markets currently lean toward additional 2025 easing; stronger sentiment challenges that.) Reuters+1

-

Downside surprise: Headline ≤53 and/or 1-yr infl-exp ≤4.5% → reinforces growth/inflation cooling narrative, yields lower (10-yr recently ~4.11%), USD softer. Trading Economics

Key “tells” Inside the Release:

-

Buying conditions for durables/vehicles/homes — very rate-sensitive; any rebound would validate the mortgage-rate tailwind.

-

Jobs & income news within expectations subindex — should reflect the NY Fed’s weaker labor vibe.

-

Partisan/stock-owner splits — UMich flagged in Sep that higher-equity-ownership households held up better. If equities steadied, that may cushion the headline a bit.

Conclusion

Into the print, our base case is for sentiment to hover in the mid-54s, fractionally softer than September but not a regime change, reflecting a tug-of-war between cheaper gasoline and cooling services momentum / labor perceptions. The inflation-expectations components will likely drive the market reaction as much as the headline: a rise risks firmer front-end yields and a sturdier USD, while a downtick would reinforce the cooling-inflation narrative.

Watch buying conditions and jobs/income expectations for confirmation. Net-net, we see a balanced tape with a slight downside growth bias; positioning around 15:00 UK should respect two-way risk and focus on the internals as the catalyst for any directional follow-through.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.