Michigan Consumer Sentiment Preview – 12th September

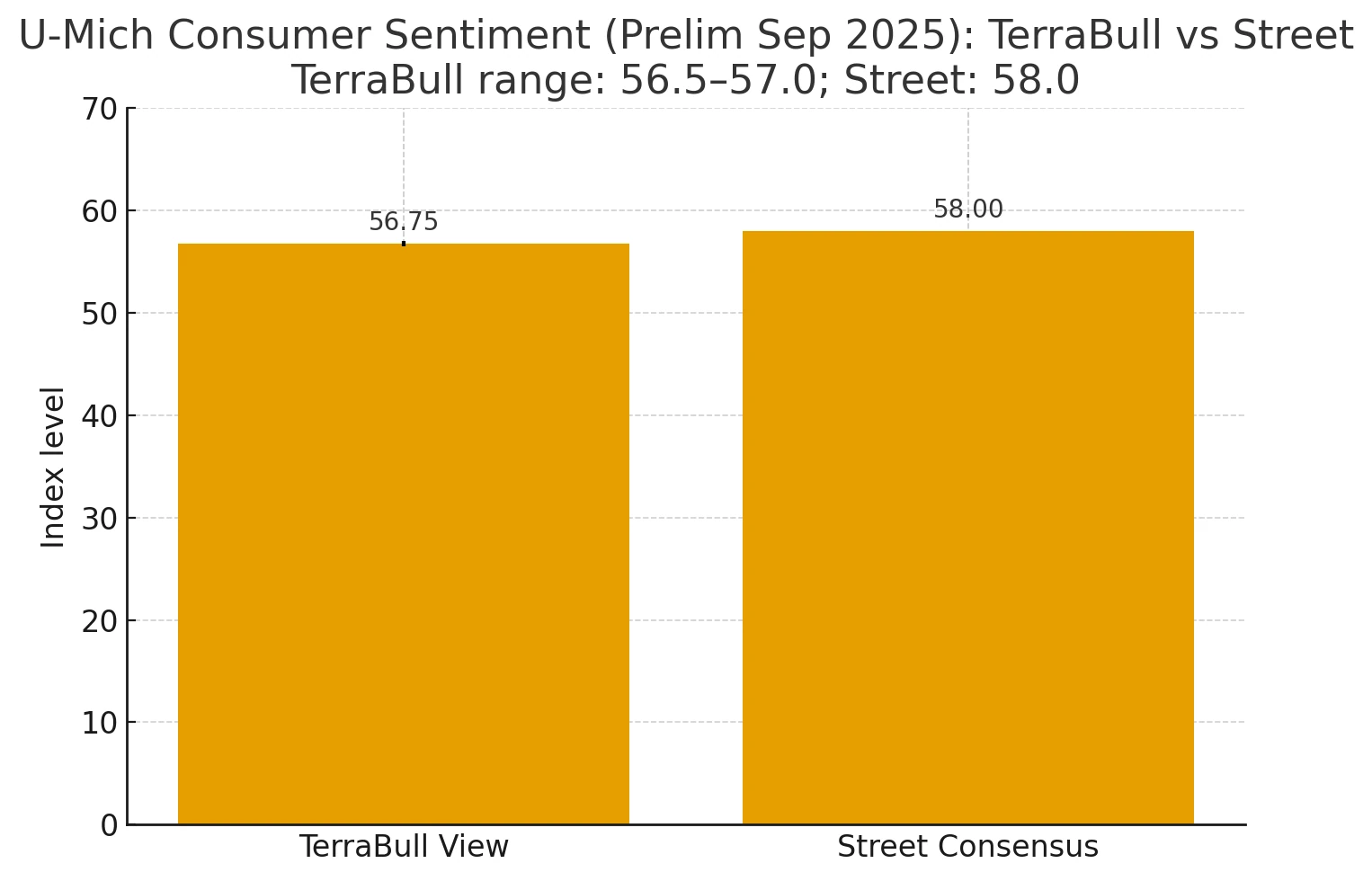

We head into tomorrow’s print looking for a modest softening in sentiment following August’s downtick. The prior headline was 58.2; consensus is currently 58, and we are looking look for slightly below at 56.5 – 57.0.

Our bias reflects softer labor perceptions and a small uptick in gasoline prices keeping inflation expectations sticky, partly offset by equity strength and easier mortgage rates. Market impact should be contained unless we see an outsized move in 1-yr inflation expectations (above 5%) or a headline below 55, which would carry clearer implications for front-end rates and USD risk pairing.

Here’s our read:

Tomorrow’s U-Michigan Consumer Sentiment (prelim Sep) is due out Fri 12 Sep, at 15:00 UK / 10:00 ET).

Headline prior was 58.2; street 58. We’re slightly below consensus, looking for 56.5–57.0, with a downside tilt.

Why a touch below:

- Last print deteriorated & inflation expectations rose: August fell to 58.2 with 1-yr inflation expectations up to 4.8% and 5 – 10yr to 3.5%, the survey explicitly flagged price worries and weaker buying conditions. That tone usually bleeds into the next prelim unless there’s a clear offset.

- Labour sentiment is wobbling: August payrolls were a downward +22k with unemployment up to 4.3%, and the BLS just disclosed big historical job revisions. Separately, the NY Fed SCE shows job-finding expectations at a series low and short-term inflation expectations ticking up. All of that tends to weigh on the Michigan expectations sub-index.

- Gasoline has edged up from mid-August: National average regular is $3.19/gal today vs $3.14 a month ago. EIA weekly shows a mild early September rise. Michigan sentiment is historically sensitive to gas prices, so even small bumps can move the headline.

- Price data backdrop: August CPI came in 2.9% y/y with core 3.1% y/y (in line with expectations), while PPI surprised -0.1% m/m. Consumers feel prices at the pump more than producer margins, so this mix doesn’t reduce the risk that U-Mich inflation expectations stay elevated.

- Offsets (not enough, in our view): Equities set fresh highs and mortgage rates dipped to ~11-month lows, which can support higher-income cohorts’ sentiment and housing-related “buying conditions.” Helpful, but typically less powerful than fuel prices + job worries for the Michigan series.

Component bias into tomorrow

- Current Conditions: Down (tight budgets from prices; softer personal finances; slightly higher gas).

- Expectations: Down/modestly down (weaker job-finding perceptions; persistent price anxiety).

- Inflation expectations: Base case sticky-elevated (1-yr around 4.6 – 4.9%; 5 – 10yr – 3.5%). Gas + tariff chatter nudge up; PPI softness is unlikely to register with households.

Markets take for FX rates

Michigan usually isn’t a primary market driver unless the surprise is big or inflation expectations jump. Here’s the grid I’m using:

- <55 headline and/or 1-yr infl-exp >5.0%: Growth scare vs. inflation mix. Front-end yields ↓ on growth, but breakevens/long end could resist if expectations pop. USD softer vs. EUR/CHF; USDJPY ↓ (JPY bid on risk-off).

- 56 – 59 (our base): Near consensus; muted market impact. Micro-moves fade; USD/rates track CPI/Fed expectations instead.

- >60 and infl-exp tame: Risk-on impulse. Yields firm a touch, USD firmer vs. JPY/CHF; EURUSD/GBPUSD slip modestly.

What could swing it

- Gas price prints into the survey window (marginal uptick). AAA Fuel Prices

- News about jobs & Fed cuts shaping consumer narratives (job revisions; easing mortgage rates). Reuters+1

- Equity wealth effect at records (partial offset). Reuters

Our call

- Headline: 56.5–57.0 (below the 58 consensus; broadly in line with your 57).

- Bias: Downside if the expectations sub-index reflects the NY Fed’s “harder to find jobs” signal and if 1-yr inflation expectations stay sticky.

Conclusion

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.