Markets head into Friday’s US Non-Farm Payrolls report on edge, with the data set to test the Fed’s “soft-landing” narrative after a string of subdued employment readings.

Consensus expects a modest rebound to +55k from September’s meagre +22k, but the tone across leading indicators suggests hiring momentum remains weak heading into Q4.

ISM employment gauges in both manufacturing and services are entrenched below 50. ADP’s latest private-sector print showed only a +42k rise, and job openings continue to trend lower.

Taken together, the mosaic of data points to a labor market that is losing steam rather than stabilizing, a critical inflection for policymakers and USD positioning alike.

Our analysis integrates the latest survey data, claims dynamics, and sector-level employment trends through early November. Our emergent view point argues for a sub-consensus payroll outcome, further validating the view that the US economy has decisively shifted from “resilient” to “cooling.”![]()

Bottom line

-

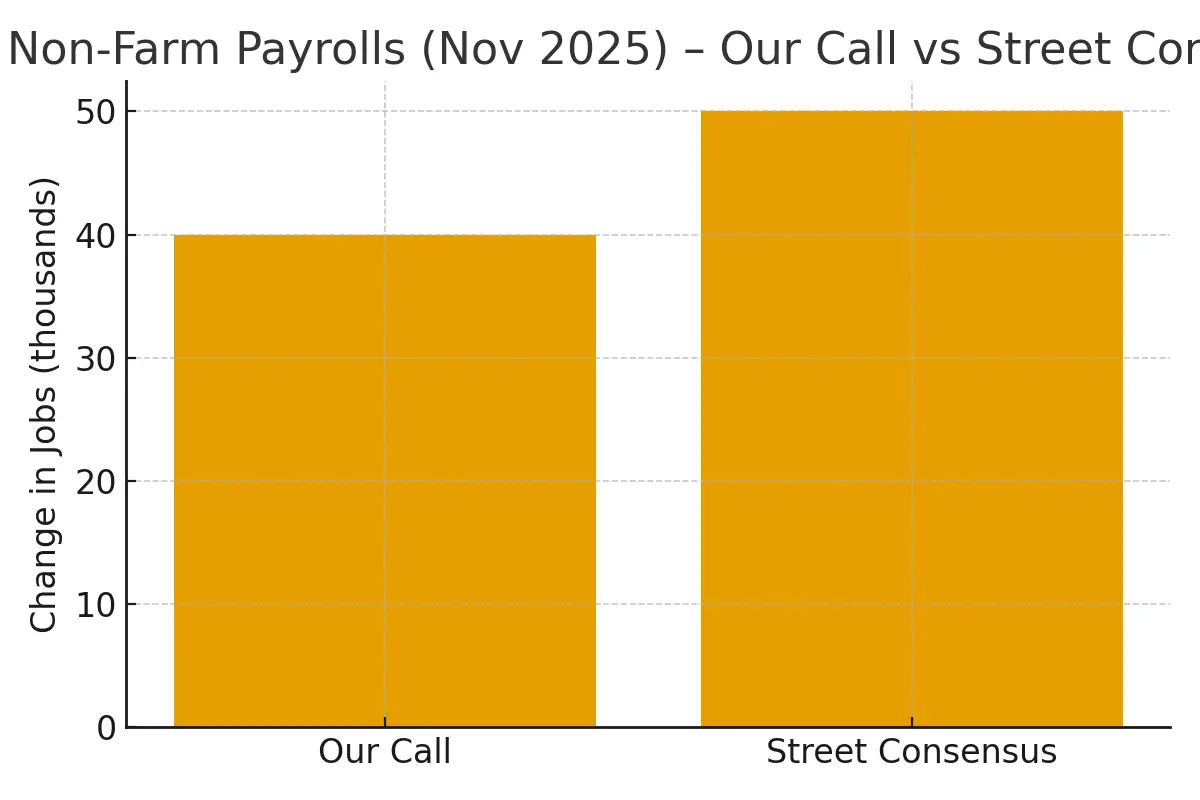

Our Call: +35 – 45k (modal +40k), i.e., a miss vs consensus +55k and in line with a very soft hiring trend.

-

Risk skew: Downside (20 – 30k) if government payrolls subtract and recent private-sector softness carries through; limited upside to 60k.

-

Revisions risk: Negative (prior “22k” likely to be revised a touch lower, given broad softening across indicators).

Why below 50k:

-

ADP private payrolls (Oct): +42k, a weak rebound from 29k in September; historically noisy, but directionally consistent with a very soft official print sub-50k.

-

ISM employment is in contraction in both sectors: Manufacturing Employment 46.0 (9th straight month <50) and Services Employment 48.2 (5th straight <50). That combination typically aligns with sub-trend NFP.

-

Claims remain elevated vs 2023/24 norms and are being estimated by banks around 219k (week to Oct 25) amid data gaps, consistent with softer payroll creation than consensus.

-

Layoffs & hiring plans: September Challenger cuts 54k (cooling from Aug’s spike), but the pace of planned hiring is the weakest since 2009, pointing to a thin gross-hiring pipeline into the autumn.

-

JOLTS and broader tone: Job openings have been trending lower into late Q3/early Q4, signaling demand for labor cooling ahead of this report.

Recent Data

-

ISM Services (Oct) headline rebounded to 52.4, but the employment sub-index stayed in contraction (48.2), consistent with output holding up while staffing is trimmed/left unfilled.

-

ISM Manufacturing (Oct) at 48.7; Employment 46.0, manufacturers continue to pare headcount or replace slowly.

-

Private-sector hiring dataflow (ADP, weekly ADP pilot estimates) points to very small net gains, reinforcing a sub-consensus bias.

-

Conference Board signals (confidence & ETI) have softened, consistent with slower job creation.

What To Expect Inside The Report

-

Private vs Government: Private likely +25–35k; government could be flat to slightly negative given recent headlines and uncertainty, keeping the total near +40k. (Inference based on ADP & ISM employment breadth.)

-

Revisions: Soft survey tapestry + recent patterns argue for downward revisions to the already-weak prior +22k. (Direction inferred from multi-series softening; official revision sizes are uncertain.)

Market Implications

-

Base case: A 40k print with soft internals should pressure USD initially (especially vs JPY and CHF), support front-end USTs, and favor risk if wages are tame.

-

Downside surprise (<25k or a negative revision bundle): Sharper USD selloff, bull-flattening in USTs; risk mixed if recession fears pop.

-

Upside tail (>75k): Requires a meaningful government or services surprise; would squeeze USD higher and cheapen the front end, but probabilities look low given surveys.

Our Call Summary

We expect headline NFP at +35 – 45k, a miss versus consensus (+55k) with a downside risk bias to the low-30s range.

The unemployment rate should tick slightly higher, while wage growth likely eases further amid softness in services hiring. The prior +22k print may also face downward revision, compounding a picture of slower job creation.

Conclusion

A print in line with our call would reinforce the narrative that labor-market deceleration is now structural, not transitory, giving the Fed space to lean dovish into year-end.

For markets, a sub-50k outcome should pressure the dollar, bull-flatten the Treasury curve, and support risk assets if wage growth moderates. Conversely, only a material upside surprise above 75k, which current data simply do not support, would challenge that dovish repricing.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.