OIL Bullish Breakout Potential 21st April

Crude oil is back in the spotlight—this time driven by fresh geopolitical tensions and evolving supply dynamics. With U.S. sanctions tightening the noose on Iranian oil exports and mixed signals emerging from the latest Iran-U.S. nuclear talks, traders are navigating a volatile landscape marked by uncertainty and opportunity. Despite macro headwinds like global tariff escalations, WTI crude has shown impressive resilience, breaking above key Fibonacci levels in recent sessions. But will it sustain the bullish momentum—or stall at trend resistance?

In today’s post, we break down a high-conviction technical trade setup for USOIL, leveraging key levels, fundamental catalysts, and momentum cues to guide your strategy this week.

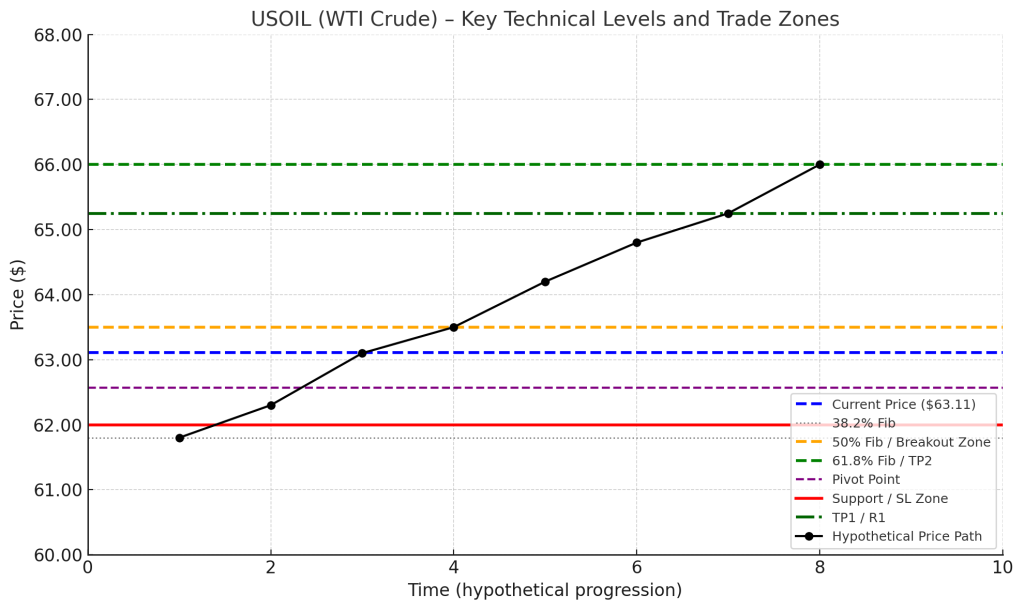

| Setup | USOIL (WTI Crude Oil) |

|---|

| Current Price | $63.11 |

| Bias | Bullish (short-term) – contingent on a clean break and hold above $63.50 |

| Entry | Buy on confirmed break above $63.50 (50% Fibonacci + recent resistance) |

| Stop Loss | Below $62.00 (just under the 4H Pivot Point + recent lows) |

| Take Profit 1 | $65.25 – aligns with R1 Pivot and minor resistance |

| Take Profit 2 | $66.00 – key psychological level + 61.8% Fib + 100 SMA |

| Alternative Bearish Setup | Sell below $62.00 on confirmed breakdown with PMI/demand miss |

| Macro Rationale | – Bullish: U.S. sanctions tightening supply via Iran/China crackdown – Bearish Risks: Iran-U.S. nuclear talks progressing may ease sanctions and pressure prices lower – Flash PMIs this week could shift the demand narrative quickly |

| Technical Factors | – Price consolidating near 50% Fib – Above Pivot Point ($62.57), but under 100/200 SMAs – Oversold RSI suggesting bullish divergence potential – 61.8% Fib + 100 SMA = magnet if breakout occurs |

| News Catalyst to Watch | – U.S.-Iran negotiations this week – Flash PMIs (esp. U.S. manufacturing) – Ongoing China trade policy updates impacting global risk tone |

In Summary

WTI crude oil continues to trade on edge as bulls and bears wrestle for control amid conflicting macro forces. On one hand, supply disruptions from renewed U.S. sanctions and the potential for a breakout above the 50% Fibonacci level point to upside risk toward $66.00. On the other, progress in nuclear negotiations between the U.S. and Iran could ease supply pressures and reintroduce demand concerns as global growth remains fragile.

Technically, a sustained hold above $62.50 strengthens the bullish case, but failure to reclaim this zone convincingly could put the April lows back in play. With the DXY hovering near a key inflection point, any sharp move in the U.S. dollar could tip the scales for oil—so be sure to monitor greenback momentum as a confirming signal.

Whether you’re a short-term momentum trader or a swing strategist, this setup offers clear levels, strong catalysts, and a defined risk-reward profile—all essential ingredients for a disciplined trading plan.

Check out more, FX Trade Setups on our forex page.