The Philadelphia Fed Manufacturing Index lands on Thursday, 16 October 2025 at 13:30 UK / 08:30 ET, offering one of the first regionals to shape expectations for October’s factory pulse. After September’s outsized +23.2 headline, the strongest since earlier in the year, consensus estimates are looking for a modest 10 (with a low Street Forecast call near 4).

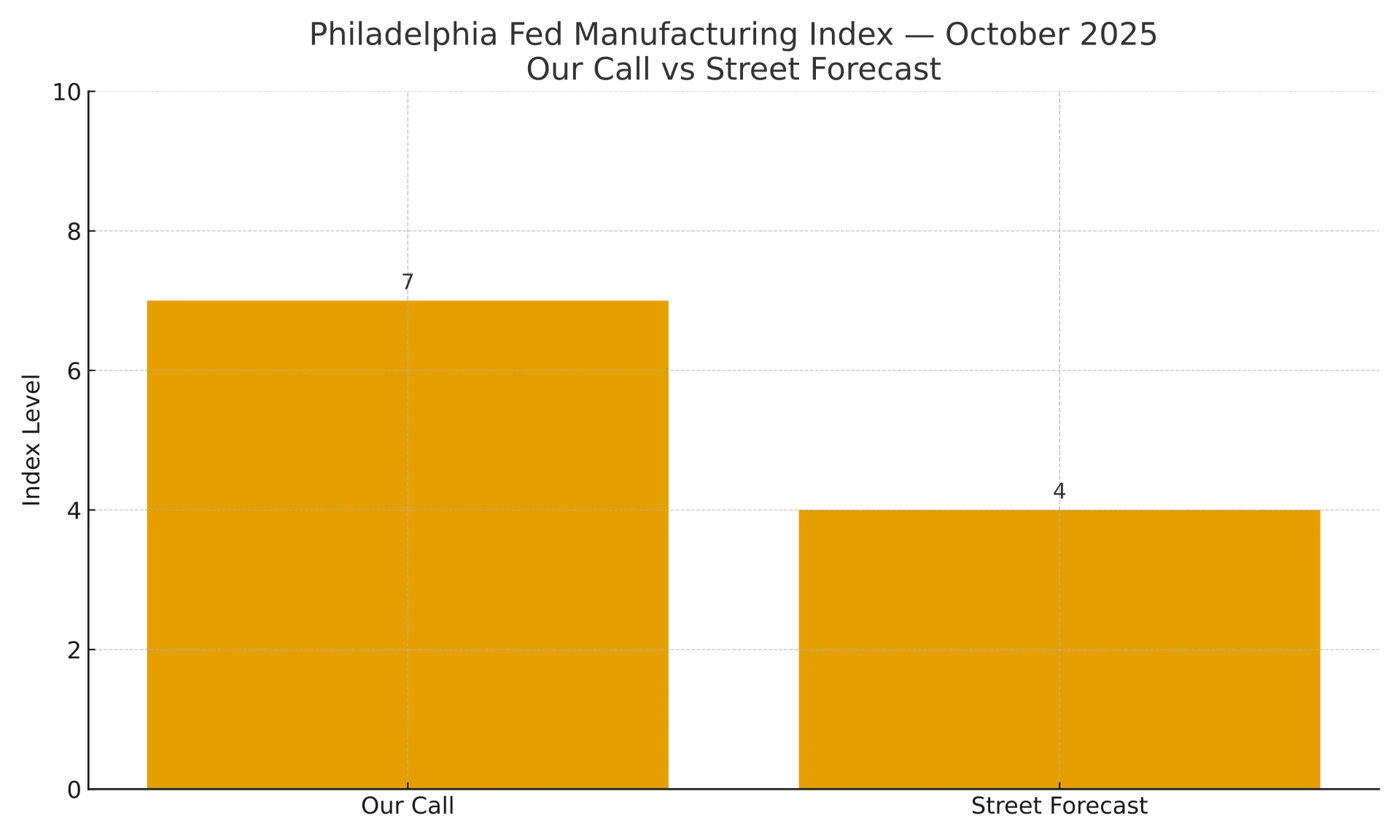

Our read is that momentum cools but remains positive: Our Call: +7. The balance of signals suggests mean reversion from September’s spike amid softer national demand cues, while still-resilient local internals argue against a sudden contraction.

With U.S. PPI dropping at the same time, the market reaction will hinge on the mix of new orders, employment/workweek, and prices paid/received as much as the headline number itself.

| Our Call | Consensus Estimates | Street Forecast | |

| Philadelphia Fed Manufacturing Index – Oct | 7 | 10 | 4 |

Our Call

Base case: +7 – a cooling but still-positive read yet below consensus and a touch above bearish street calls.

Why +7?:

-

September’s Philly surge was outsized and typically mean-reverts.

-

Forward cues are mixed: national PMIs show demand softness (ISM new orders back sub-50), regionals outside Philly have skewed weaker recently and Empire State for October is roughly flat/soft, arguing for a pullback.

-

Still, September’s Philly internals (orders/shipments positive, workweek up, future index firm) argue against a collapse to negative.

Our Call – Outlined

-

Last month (Sep): headline surged to +23.2 (highest since Jan). New orders flipped positive (+12.4), shipments jumped (+26.1), employment modestly positive (+5.6), and prices paid cooled but stayed elevated (46.8). The future activity index also improved to 31.5.

-

National reads since then: ISM Manufacturing PMI ticked up to 49.1 but new orders slid back to 48.9 (contraction). S&P Global’s Sept PMI also flagged softer demand momentum.

-

Other regionals around the turn of the month:

-

Empire State (Oct) improved from Sept’s slump but is roughly flat to slightly negative (vs. -8.7 in Sept). That points to cooling after summer strength.

-

Richmond (Sep) fell further (-17), Dallas (Sep) weakened (-8.7), and Chicago PMI (Sep) stayed deep sub-50 (40.6). Together they flag softer breadth into October.

-

-

Macro context into the print: price pressure moderated in Sept PPI (Aug y/y cooled to 2.6%; Sept PPI is scheduled for release at the same time as Philly), while CPI has been pushed to Oct 24 due to the shutdown. Philly will publish on time (it’s a Fed survey).

What We’ll be Watching

-

New Orders: Expect low-single-digit positive (roughly +2 to +6). A drop back <0 would be the clearest “cooling” signal. (Last: +12.4).

-

Shipments: Likely moderate lower from last month’s jump (Last: +26.1).

-

Employment / Workweek: Small-positive to flat (Last: +5.6 / +14.9). A dip negative would echo Richmond/Dallas softness.

-

Prices Paid/Received: Bias to sideways/slightly lower after Sept’s cool-off, consistent with softer national price momentum. (Last: 46.8 / 18.8).

Distribution / Risks

-

< 0: 25% (Empire State softness + weak regionals win out)

-

0 to 10: 45% (my base: +7)

-

10 to 20: 25% (lingering momentum from Sept)

-

> 20: 5% (another outsized upside surprise)

Upside risk: local idiosyncrasies (Philly can whipsaw) or tariff-related front-loading supporting orders. Downside risk: tariff uncertainty and softening domestic demand weighing on orders (mirrored in the other regionals).

Market Reaction

-

Print > 15: modest bear-steepening impulse; USD bid on the margins (look to USDJPY topside & EURUSD dips) unless the PPI (same time) contradicts.

-

0–10 (base): limited market impact; micro-moves fadeable; focus shifts quickly to PPI and Fed-speak.

-

< 0: risk-off tilt; USD softer vs JPY/CHF, USTs bid – especially if prices paid also cool.

Our Call – Conclusion

We expect the October Philly Fed to ease to +7, a touch below consensus but above the most cautious calls, cooling, not cracking. For trading implications, the components will do the heavy lifting: a low positive new-orders print would validate a soft-landing narrative, while a slide back below zero, especially alongside cooler prices paid, would skew risk-off and support duration.

Conversely, a surprise above 15 would revive momentum and nudge USD and front-end yields higher unless contradicted by PPI.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.

Dan Patrick

Dan Patrick is the founder and lead analyst at TerraBullMarkets, publishing high-conviction, “A+ only” FX trade setups and concise London-session macro briefings. Views are his own; this is not investment advice.