UK Retail Sales Aug – 19/9/2025 – What to Expect

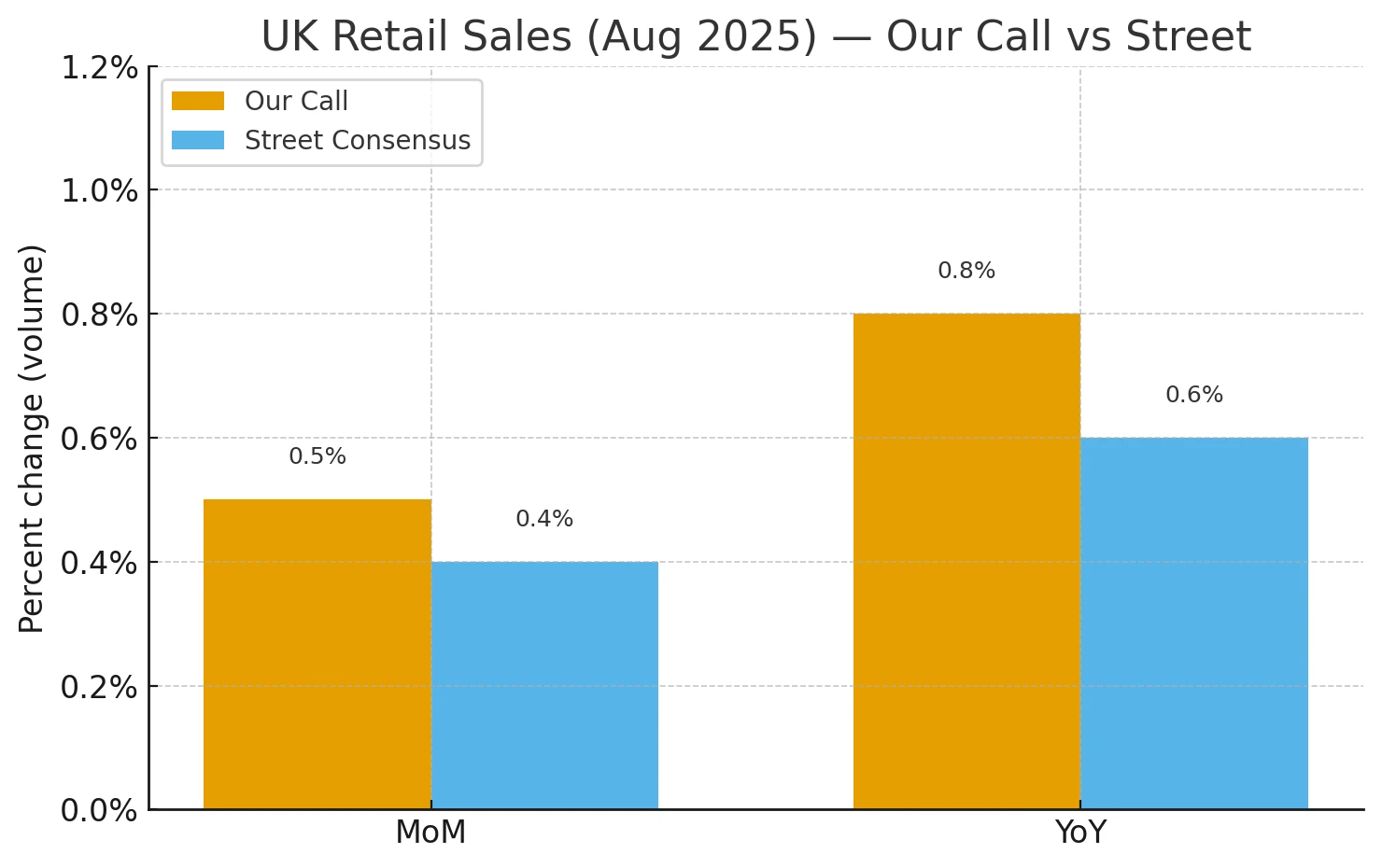

U.K. consumers step back into focus on Friday, 19 September 2025 at 07:00 BST, when the ONS publishes August Retail Sales. After July’s solid +0.6% m/m (+1.1% y/y), the street is looking for +0.4% m/m and +0.6% y/y. Our estimate base case is a touch firmer – +0.5% m/m and +0.8% y/y – reflecting supportive seasonal dynamics (back-to-school, warm weather) and steady non-food momentum, partly offset by still-cautious essentials spending. Softer goods inflation should also help translate value growth into modest volume gains.

Headline calls

-

Retail Sales MoM (volumes): +0.5% (street +0.4%, prior +0.6%).

-

Retail Sales YoY (volumes): +0.8% (street +0.6%, prior +1.1%).

We’re estimating a touch above consensus on both, looking for a steady but unspectacular August as warm weather, back-to-school and home-related categories offset softness in essentials and a still-cost-conscious consumer.

Why We’re Above Consensus

-

High-frequency retail points to a decent August in value terms. The BRC-KPMG Retail Sales Monitor reported total sales +3.1% y/y, with food +4.7% and non-food +1.8%, and noted strength in homeware/DIY and computing ahead of the school term. That’s supportive for volumes once you adjust for prices.

-

Card-spend signals were softer overall, but the mix helps goods. Barclays’ report showed consumer card spending +0.5% y/y (down from +1.4% in July), with discretionary +2.0% and essentials weaker—consistent with clothing/home/tech doing the work while food/fuel contribute less. This tempers, but doesn’t negate, the BRC signal for volumes.

-

Prices: inflation steady, goods disinflating. August CPI stayed at 3.8% y/y; the goods component has cooled versus last year. That means a given pound of nominal sales buys a bit more “volume” than earlier in the year—helpful for the ONS volume print even if tills weren’t roaring.

-

Category color from July baseline. July ONS volumes rose +0.6% m/m and +1.1% y/y, giving August a solid base. I expect non-food (clothing, household goods, computing) to carry August again, while food and fuel are more subdued.

-

Timing & scope check. We’re previewing the ONS Aug-2025 release due Fri 19 Sep, 07:00—this is the official volumes series the market trades.

MoM mechanics (why +0.5%)

-

Tailwinds: sunshine/back-to-school, BRC non-food momentum (home/DIY, computing), and a modest lift from clothing/beauty.

-

Headwinds: weak essentials card-spend, food price stickiness (value ≠ volume), and only marginal help from fuel.

YoY logic (why +0.8%)

BRC value +3.1% y/y minus August goods-price inflation (lower than last year) suggests small positive volumes on a 12-month look-through, but not a surge—hence a print just under 1% y/y.

Risk skews & “watch fors”

-

Upside (MoM ≥0.7%, YoY ≥1.0%): stronger online/non-food and bigger back-to-school lift in computing/clothing than card-data implies.

-

Downside (MoM ≤0.2%, YoY ≤0.4%): Barclays’ soft overall spend proves the better guide, with essentials drag outweighing non-food strength.

-

Ex-fuel and non-store lines: a firm non-store gain would validate the BRC/KPMG narrative around computing and back-to-school; a weak ex-fuel would argue the opposite.

Market take

-

A beat (e.g., MoM ≥0.6 / YoY ≥1.0) should support GBP on the margin and nudge front-end gilts higher (yields up) if traders read it as resilience post-CPI.

-

A miss would lean the other way, especially after the BoE’s cautious hold and sticky headline CPI.

Bottom line: We expect another solid-but-not-hot month +0.5% m/m, +0.8% y/y, a hair above the street as non-food and back-to-school categories do just enough to offset weak essentials and still-elevated food prices.

Conclusion

We expect another steady but not hot month for retail volumes—+0.5% m/m, +0.8% y/y, a shade above consensus. Strength in non-store and selected non-food categories should outweigh a subdued read on food and fuel. Upside risks come from a stronger back-to-school lift; downside risks stem from weak essentials/card-spend translating more fully into volumes. For markets, a beat would modestly support GBP and nudge front-end gilt yields higher, while a miss would do the opposite. Keep an eye on ex-fuel and non-store lines for the cleanest signal on underlying demand.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.