We consider JOLTs as the market’s vacancy ‘thermometer’, and today’s reading may show the heat coming out of US hiring.

At 15:00 UK time (10:00 ET) markets get a fresh read on US labor-demand momentum via JOLTS Job Openings (Dec 2025).

While JOLTS is a backward-looking “stock” measure which tells us how many vacancies were open at month-end. It has increased relevance because it anchors the debate around whether the labor market is re-tightening or cooling further, and feeds directly into rate expectations, the USD, yields, and risk assets.

The latest published JOLTS data showed openings around 7.146M in November, a level that already signaled meaningful cooling versus prior cycles.

Why this print matters

JOLTS provides a high-level dashboard of US labor churn: job openings, hires, and separations which including quits and layoffs/discharges.

Markets will be watching job openings specifically because vacancies are used, alongside unemployment, to infer labor “tightness” and slack. Both are concepts that show up in the Fed’s policy framework through channels like the Beveridge curve, broader inflation and labor dynamics.

The most recent official release for November showed job openings little changed at 7.1M, but down sharply over the year.

There were notable declines in cyclical/service segments such as accommodation/food services and transport/warehousing, while construction was a pocket of strength. The composition matters as broad-based weakness in openings tends to align with a more cautious hiring posture and softer forward labor demand.

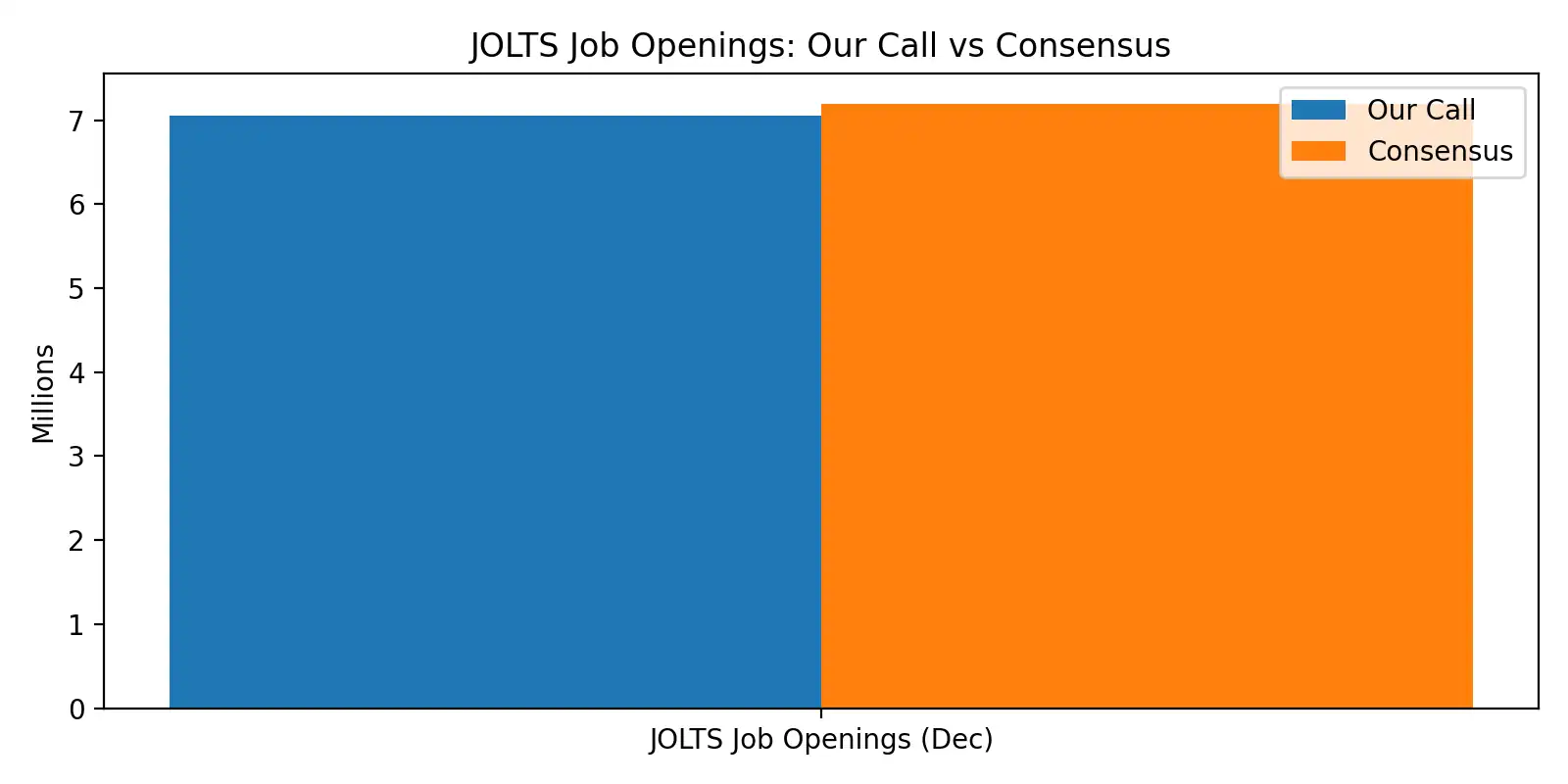

Our Call vs Consensus

The market backdrop going into today is a tug-of-war between “mean reversion”, a bounce after a large prior decline, and “continued cooling”, a grind lower as firms pull back on hiring plans.

Our base case:

| Data (Dec 2025) | Previous | Consensus | Street Expectations | Our Call |

|---|---|---|---|---|

| JOLTS Job Openings | 7.146M | 7.2M | 7.0M | 7.05M (range: 6.95M–7.15M) |

Why below consensus

1) The last “hard” JOLTS signal already downshifted.

Openings at 7.146M (Nov) were the lowest since Sep 2024 and notably under expectations at the time. This reinforced the idea that labor demand has cooled materially from its post-pandemic peak. When JOLTS is this low (relative to the prior regime), rebounds can happen, but the burden of proof shifts to evidence that hiring appetite is returning.

2) The labor narrative into early Feb has been “softening,” not “re-tightening.”

Recent coverage of hiring indicators has emphasized sluggish job creation signals and a cooler labor tone. For example, the latest ADP release described a very weak private hiring gain, reinforcing the market’s sensitivity to downside surprises in labor demand. Even if ADP isn’t a perfect predictor of JOLTS, it shapes positioning and how quickly markets react to labor cooling themes.

3) JOLTS can be a noisy guide – so we respect the direction more than the decimal.

Even central bank research and commentary highlights that vacancies are not a “clean” signal in isolation: the nature of openings, true hiring need vs “poaching”/optional postings, can vary over time, which can blur the message of the headline number. That’s why our “Our Call” is paired with a range, and why we’ll focus on confirmation from subcomponents.

What to Watch

-

Hires: If openings fall but hires hold up, the labor market may be cooling more gently than the headline suggests.

-

Quits: Often interpreted as worker confidence; a falling quits trend can reinforce cooling wage pressure narratives.

-

Layoffs/Discharges: If layoffs rise materially, markets tend to react more sharply risk-off.

These components are core to how BLS defines JOLTS and its labor-turnover framework.

Our Market Playbook

-

Clear downside (≤ 7.0M): Typically supports lower yields and a softer USD, tends to be constructive for gold, and can be equity-supportive if it reinforces a “cuts later” path, unless recession fears dominate.

-

In-line (7.05 – 7.15M): Often a “fade” setup, watch price action around key technical levels rather than chasing the first spike.

-

Upside (≥ 7.3M): Usually USD firmer / yields up, gold can soften, and rate-cut pricing may get pushed out.

Conclusion

Our base case is that Dec job openings edge lower to 7.05M, placing us below consensus estimates of 7.2M and near the street’s 7.0M.

The prior JOLTS level already signaled a meaningfully cooler labor market, and the broader hiring narrative coming into today still leans toward continued moderation rather than renewed tightening.

As always with JOLTS, the cleanest edge is rarely the second decimal place of the headline, it’s whether the direction of openings is confirmed by hires, quits, and layoffs.

If the subcomponents validate cooling, the market is likely to keep leaning toward softer labor-tightness expectations, an important driver for USD, yields, and risk into the next macro catalysts.

This analysis is for informational purposes only and does not constitute investment advice. Trading involves risk; manage exposure accordingly.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.