US Pending Home Sales AUG – What to Expect

On Monday, 29 September 2025 at 15:00 UK (10:00 ET), the National Association of Realtors releases the August Pending Home Sales report, an MLS-based gauge of contract signings that typically leads existing-home closings by one to two months.

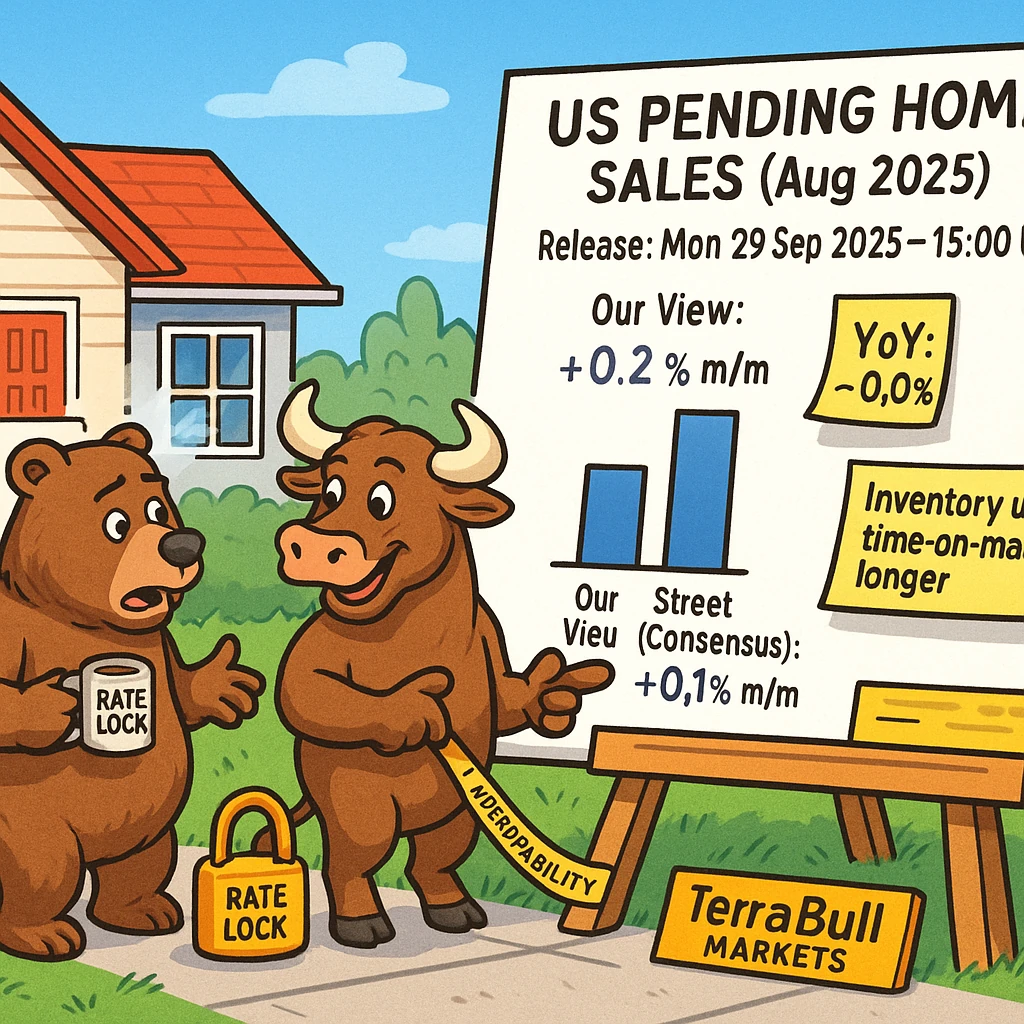

Against a backdrop of slightly easier mortgage rates, higher active inventory, and softening new-listing flow, our base case looks for modest stabilization rather than a surge in demand. Specifically, we expect MoM +0.2% (vs Street +0.1% and your +1.7% forecast) and YoY roughly flat (0.0%) (vs your +1.9%).

The drivers are a small lift from rate relief and purchase applications, offset by fading momentum in listings and longer time-on-market.

Our Call

-

MoM: +0.2% (Street +0.1%, Your forecast +1.7%).

Rationale: modest late-summer rate relief and slightly better purchase apps offset by fading new-listing flow and rising time-on-market. Net: a glancing gain, not a pop. 2MBA+2 -

YoY: 0.0% (flat) (vs. your +1.9%).

Rationale: inventory is up YoY, but buyer activity is soft and pending sales ran below last year’s pace in August on Realtor.com’s tracker. That tempers the YoY print toward flat rather than a clear positive.

Pending Home Sales AUG:

Why Signals into August

-

Release & Methodology Check

NAR’s PHS Index (contract signings on existing homes) leads existing-home closings by 1–2 months. August PHS is scheduled for Mon Sep 29, 10:00 ET. -

Mortgage Rates & Demand Pulse

-

Freddie Mac’s survey shows rates drifted down through late summer, then inched up the week of Sep 25; AP pegs the 30-yr near 6.3%, an 11-month low regionally, helping but not transforming affordability. MBA’s August prints were mixed (one week up, one down), consistent with only a small lift to contracts.

-

Supply, pricing and time-on-market

-

Active listings +20.9% YoY in August, but new listings decelerated and time on market rose to 60 days (+7 YoY). Realtor.com’s flows show pending sales fell 1.3% YoY and momentum “fading”, a combination that argues against a large MoM jump.

-

Closely related prints

-

Existing-home sales (Aug): -0.2% m/m to 4.00m SAAR, inventory 1.53m (4.6 months); still tough affordability with prices up 2% YoY. This squares with tepid contract signings rather than a surge.

-

New-home sales (Aug): +20.5% m/m to 800k SAAR amid incentives and buydowns—helpful for housing overall but less indicative for PHS (which covers existing stock).

-

Builder sentiment: NAHB HMI 32 in Aug/Sep—still subdued; near-term demand hopes improved but foot traffic weak. Again, no signal of a big PHS pop.

-

Regional context to watch

July PHS fell 0.4% m/m with weakness in the Northeast & Midwest, flat South, and a rise in the West; August existing sales rose in the Midwest/West but fell in the Northeast/South. Expect August PHS internals to echo that affordability and inventory bifurcation (West/Midwest steadier, NE/South softer).

What would move the tape

-

Upside risk (your +1.7% scenario): would likely require broad regional gains plus a noticeable bounce in contracts in the South (largest share) — something high-frequency data didn’t flag. If realized, it would challenge the “buyers hesitating” narrative and skew YoY into the +1–2% zone.

-

Downside risk: If NAR’s MLS-based measure mirrors Realtor.com’s August softness more fully, MoM could slip to -0.5% with YoY slightly negative, especially if delisting’s and price-cut dynamics weighed on conversions from showing to contract.

Market take

-

Our Base case (MoM +0.2 / YoY 0): Narrative remains gradual normalization, neither an affordability-led air-pocket nor a rate-cut-driven snapback. Limited macro spillover; small bearish bias to home-improvement retail vs. neutral/slightly positive homebuilders given the new-home surge and incentives.

-

Surprises: A >+1% MoM beat would support a mild risk-on response in housing-beta equities; a <-0.5% miss would reinforce the “buyers still balking” line despite lower rates.

Sources & scheduling

-

NAR: Pending Home Sales hub (+schedule), July -0.4% MoM; PHS leads EHS by 1–2 months.

-

Freddie Mac PMMS & AP: late-Sep rates ~6.3%, after several weeks of decline.

-

Realtor.com (Aug 2025 trends): Pending -1.3% YoY, active listings +20.9% YoY, 60 days time-on-market, rising delistings.

-

NAR Existing-Home Sales (Aug): -0.2% m/m, 4.00m SAAR; months’ supply 4.6.

-

Census/HUD New-Home Sales (Aug): 800k SAAR, +20.5% m/m; median price $413,500.

-

NAHB/Wells Fargo HMI: 32 in Aug/Sep—low, traffic weak.

Conclusion

Netting the signals, we see August Pending Home Sales edging up only slightly, consistent with a market normalizing but still constrained by affordability. A +0.2% MoM / 0.0% YoY outcome would align with tepid existing-home closings into early Q4 and should have limited macro spillover, leaving the bigger narrative to new-home strength and incentives.

Upside risk to your +1.7% call would require broad regional gains, especially in the South, while downside risk remains if the MLS data mirror private trackers’ softer August pendings. For markets, treat the print as a fine-tuning data point: constructive for homebuilders only at a clear beat, and otherwise neutral to slightly negative for housing-linked consumer names.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.