US PPI Expectations Preview – 10/9/2025

US PPI Expectations Preview: Producer Price Index (Aug) — Brief Preview

The August PPI (Wed 10 Sep, 13:30 UK / 08:30 ET) is a key pipeline read into core PCE via core‐goods and business services costs. After July’s outsized +0.9% jump, driven largely by services margins – consensus looks for cooler prints (headline +0.3% m/m, core +0.3% to 0.4%, core y/y 3.5 to3.6%).

The market will focus on three things: (1) whether trade services and fee categories mean-revert, (2) the core-core gauge (ex food, energy, and trade) as the cleanest signal for policy, and (3) any revisions to July’s spike. A benign outcome should keep front-end yields contained and the USD slightly softer, while a renewed core surprise (≥0.5% m/m) would re-ignite concern about sticky services inflation and support the dollar.

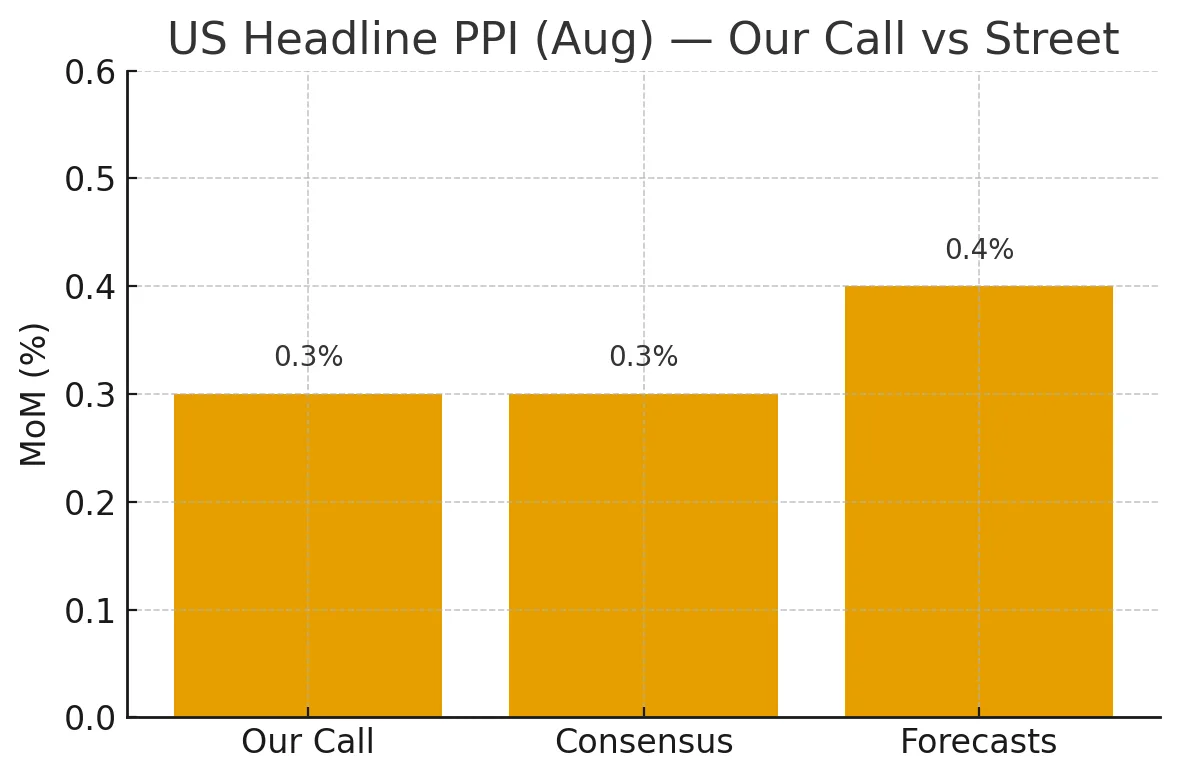

Street Expectations

- Headline PPI MoM: Prev 0.9%, Cons 0.3%, Forecast 0.4%

- Core PPI MoM (ex-food & energy): Prev 0.9%, Cons 0.3%, Forecast 0.4%

- Core PPI YoY (ex-food & energy): Prev 3.7%, Cons 3.5%, Forecast 3.6%

Our calls (and why)

- Headline PPI MoM: 0.3% (range 0.2–0.4), in line/slightly softer than the streets forecast of 0.4.

- July’s +0.9% jump was dominated by services/retail margins (+2.0% trade services) and a broad +1.1% services surge—both volatile and prone to partial payback.

- Energy: August retail gasoline edged higher into month-end while diesel eased—a small net tailwind to headline, but not a repeat of July’s outsized services shock.

- PMIs/prices: ISM Manufacturing Prices eased to 63.7 and Services Prices to 69.2 (still hot but a touch cooler) → pressure remains elevated but off July’s boil.

- Core PPI MoM (ex F&E): 0.3–0.4% (base case 0.3%) vs 0.3% consensus.

- July’s +0.9% core pace is unlikely to repeat; PMI commentary and NFIB pricing indicators suggest firms are passing through tariffs selectively, but momentum isn’t accelerating further in August.

- Core PPI YoY (ex F&E): ~3.5–3.6% (base 3.5%), at/just below consensus.

- Even with a firmer monthly print, base effects vs Aug-2024 should nudge YoY down from 3.7%. July’s “core-core” (ex food, energy and trade) was +0.6% MoM / 2.8% YoY—watch that gauge for a cleaner pipeline read to PCE. Bureau of Labor Statistics

What’s driving our view

- July shock = services/margins: BLS flagged trade services and portfolio management fees among big gainers—classic candidates for partial unwind.

- Input costs stayed elevated, but cooled a touch: ISM Services Prices 69.2 (from 69.9) and Mfg Prices 63.7 (from 64.8) → still inflationary, but less intense than July.

- Energy optics: Gasoline up modestly through late-Aug; diesel down; WTI broadly softer vs early summer → small net positive to headline, limited impulse to core.

- Trade/import prices: Import prices rose in July (core +0.3%), consistent with tariff-sensitive goods pressure feeding the pipeline, but not accelerating in August data we have.

What would move markets at 13:30 UK

- Hawkish surprise: ≥0.5% on headline or core, or core-core (ex F,E,trade) ≥0.4% = front-end USTs up, USD firmer; watch USD/JPY topside.

- Benign read: 0.2% headline and core, core-core ≤0.2%, and limited July revisions = USTs bid, USD a bit heavier (weaker).

- Skew to watch in tables: If trade services margins retrace sharply, headline can still print 0.2% even with firm energy.

Receipts / context

- Schedule (Aug PPI on Sep 10, 08:30 ET).

- July PPI details: headline +0.9%, services +1.1%, goods +0.7%; core ex F&E +0.9%; core-core +0.6% MoM, 2.8% YoY.

- ISM prices (Aug): Mfg 63.7; Services 69.2.

- Energy (Aug): retail gasoline up into 8/25–9/1; diesel down for most of Aug.

- Import prices (Jul): headline +0.4%, core +0.3%; tariff-sensitive goods firmer.

Bottom line

We’re looking for mean reversion after July’s spike: headline PPI 0.3%, core 0.3%, and core YoY 3.5%. Risks are two-sided: modest energy tailwind vs a likely partial unwind in trade-services margins. Net-net, the print should validate sticky—yet not re-accelerating—pipeline inflation unless core re-fires at above 0.5%.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.