US Retail Sales What to Expect – 16/9/2025

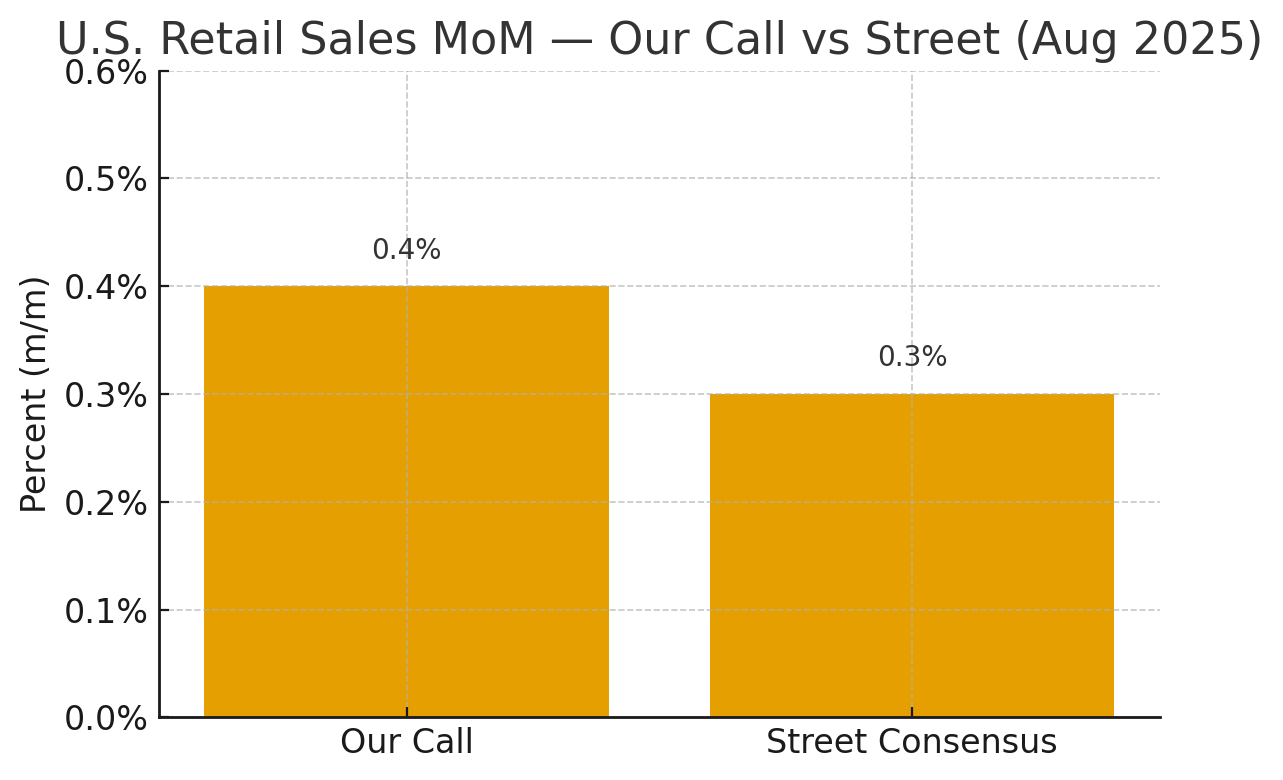

U.S. consumers take center stage on Tuesday, 16 September 2025 at 13:30 BST, when the Census Bureau releases the August US Retail Sales report. After July’s solid +0.5% MoM, the street is looking for a slower +0.3%, while our base case is a slightly firmer +0.4%.

The mix matters as much as the headline: higher gasoline prices should lift nominal receipts at the pump, non-store/e-commerce remains resilient into back-to-school, and autos may give back a touch after July’s pop. With the Fed meeting looming, this print will help shape the narrative around the durability of goods demand following a mixed inflation tableau (firm CPI, softer PPI) and could nudge front-end yields and the dollar accordingly.

We can unpack the category-level drivers, map the implications for the control group and Q3 consumption tracking, and lay out market scenarios with actionable setups across EUR/USD, USD/JPY, and GBP/USD heading into the release.

US Retail Sales (MoM)

Our call: +0.4% m/m (vs street +0.3%, prior +0.5%). Mild upside skew (0.4–0.5%).

Reasoning – Hard data & High-Frequency Reads:

- July base was solid: headline +0.5%, with autos +1.6% m/m, non-store +0.8%, gas stations +0.7%, while restaurants dipped −0.4%. That mix matters for how August comps.

- Gasoline tailwind in August: EIA weekly averages nudged up through the month (all-grades $3.25-$3.27-$3.30 late August; then $3.32 on 09/08). This should add a small positive to nominal sales at gas stations.

- Autos likely a small drag vs July: industry trackers point to ~16.0m SAAR in August (down from July’s ~16.4m), so dealer receipts probably flat-to-slightly lower after July’s pop.

- Card data points to modest growth: Bank of America’s September “Consumer Checkpoint” shows card spending per household +0.4% m/m (SA) in August (YoY +1.7%). That’s consistent with a modest positive read in goods.

- Retail Monitor (Affinity/NRF) says August rose: ex autos & gas +0.5% m/m SA; their “core” (ex autos, gas, restaurants) +0.26% m/m — points to steady, not hot, underlying goods demand. Ajot+1

- Prices help the nominal print: August CPI had gasoline +1.9% m/m, food at home +0.6%, shelter +0.4%. While retail sales aren’t price-adjusted, higher sticker prices at pumps and groceries lift the nominal headline.

- Services/soft data: ISM Services PMI 52, new orders 56 (expansion) but employment 46.5 (weak). Demand is there, labor softens — not a headwind to goods in August, but it caps exuberance.

Category expectations for August (directional)

- Gas stations: small + (price-led).

- Motor vehicles & parts: flat/− after July’s surge given the lower SAAR.

- Nonstore (e-commerce): + (ongoing strength; some buy-ahead of tariffs/back-to-school).

- Grocery: + nominal (food CPI).

- Restaurants: mild rebound after July’s −0.4% (CPI “food away from home” +0.3% helps nominal).

- Building materials/electronics/furniture: mixed; not central to the headline skew this month.

Why I’m a touch above consensus

- Gas price uptick + e-commerce momentum + back-to-school should just offset a softer auto line, keeping headline around +0.4% rather than +0.3%. The NRF/Affinity and BofA reads both point to positive but not hot spending – exactly a 0.3 – 0.5% style month, with risks tilted to 0.4%.

- Upside (>0.5%): larger auto resilience than industry SAAR implies, or a bigger gas-price pass-through; would clash with the soft labor tone but could happen if promotions pulled demand forward.

- Downside (<0.2%): if August’s auto payback is heavier and non-store cools more than card data suggests.

Control metrics to watch on the release

- Ex-autos: I’d look for +0.4–0.6% (NRF had +0.5% ex autos & gas).

- Control group: +0.3–0.5% (NRF “core” +0.26%; BofA narrative supportive). A stronger control print will lift Q3 goods consumption tracking.

Trading/market context (FX & rates)

- Markets are primed for a Fed cut next Wednesday; a clean beat (≥0.6%) could trim cut-after-path pricing and pop 2y yields/USD (DXY), while a soft miss would do the opposite.

- With CPI hot at +0.4% m/m but PPI soft (−0.1% m/m), a firm retail headline would revive the “consumer still OK” narrative and likely support USD intraday (watch USDJPY topside if yields jump; miss favors EURUSD bounce).

Bottom line

- Base case: Headline US Retail Sales +0.4% m/m (slightly above consensus +0.3%).

- Skew: Mildly to the upside vs street; gas prices and non-store strength offset a softer auto line.

- What moves markets: A strong control group (>+0.5%) would be the cleanest USD-positive surprise; a <0.2% headline with weak control would lean USD-negative ahead of the Fed.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.