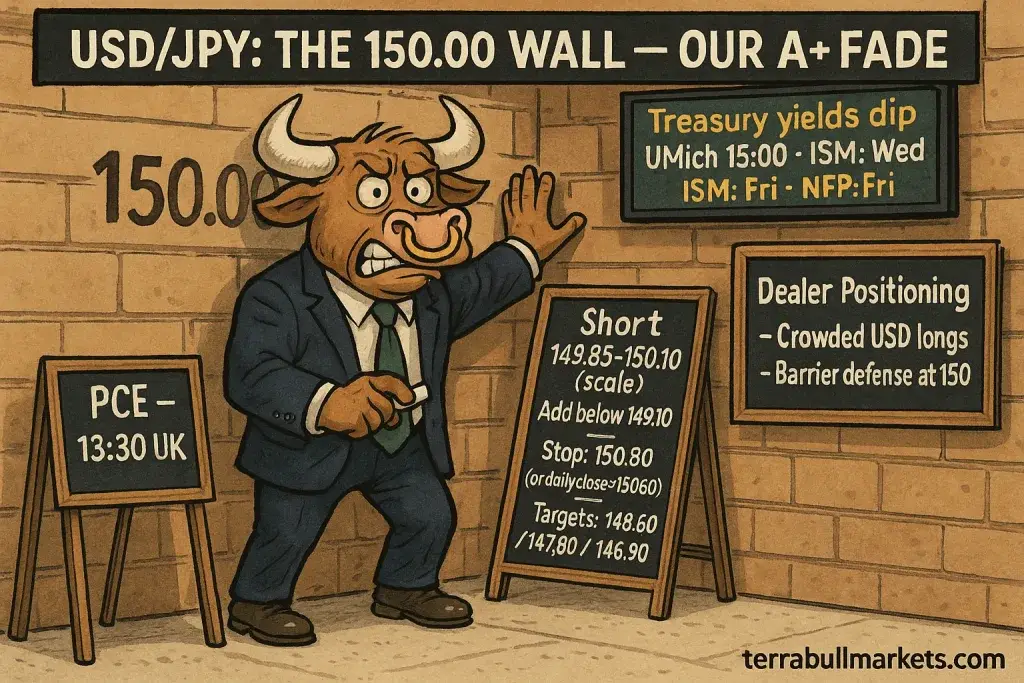

USDJPY Trade Setup – 26.9.25 USD/JPY is hovering just below the marquee 150.00 handle into today’s 13:30 (BST) PCE release. Our base case (core PCE 0.2% m/m, income 0.3%, spending 0.6%) argues for slightly softer front-end U.S. yields, shrinking the rate gap between US and Japan enough to blunt dollar carry without undermining broader risk. Against that, Japan’s policy skew is inching less dovish (BoJ language, steady Tokyo inflation), while the 150.00–150.60 zone remains a well-telegraphed supply / option-barrier area with elevated official sensitivity. Technically, repeated failures into 150 signal distribution, and positioning/flow dynamics (exporter offers, barrier defense, and crowded tactical longs) create asymmetric downside. Net: this is an A+ fade—strong confluence of fundamentals (rate-differential headwind), technicals (structural resistance), and sentiment/positioning (stretched longs + intervention overhang), with clear levels to define risk. USDJPY Trade Setup: Pair / Asset Bias & Entries Stop / Invalidation Targets Why A+ (fundamentals, technicals, sentiment/positioning) Near-term catalysts (UK time) USD/JPY Short – 149.85 – 150.10 (scale); add on 149.10 break 150.80 (or daily close above 150.6) 148.60, 147.80 (stretch 146.90) Fundamentals: Our base-case expectations for today’s core PCE 0.2% leans us towards a slightly lower UST front-end, trimming rate-differential support for USD/JPY. Tokyo CPI firm but easing vs forecasts, and BoJ minutes show rising hike bias = medium-term JPY tailwind. Technicals: 150.00 = marquee level with heavy attention / latent barrier flow; price repeatedly stalls into 150. Sentiment/positioning: USD specs have flipped net short DXY (risk of squeezes, but into 150 we like fade); authorities’ sensitivity around big-figure adds asymmetric downside if headlines hit. Today: PCE (13:30), UMich final (15:00). Next week: ISM Mfg (Wed 15:00), NFP (Fri 13:30). BoJ calendar into Oct 29–30. Chart by TradingView – USDJPY Trade Setup – 26.9.25 USDJPY Trade Setup Conclusion – Plan & Risk Management: Consider a short into 149.85 – 150.10 (scale), with an add on a clean break of 149.10. Invalidation: 150.80 (or a daily close above 150.60). Targets: 148.60, 147.80, stretch 146.90. If the first target prints, trail stops to breakeven and take partials; if 149.10 breaks and holds, press for 147s. Stand down or pare risk if the data comes in hot (core 0.3%) and U.S. 2-year yields lurch higher, those are the conditions most likely to sustain a break above 150.6. Near-term catalysts (UK time) to monitor: 13:30 PCE, 15:00 University of Michigan, then next week’s ISM Manufacturing (Wed 15:00) and NFP (Fri 13:30). The setup remains valid while price continues to reject 150 and U.S. front-end yields fail to make higher highs; any decisive daily close above 150.60 retires the idea until a fresh signal emerges. For similar Forex Trade Signals please visit our forex trade ideas page. Please visit our Disclaimer page. Disclaimer Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page. TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted. The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice. TerraBullMarkets...

Premium FX & Commodities

Trade Setups

Professional analysis & signals delivered daily for just