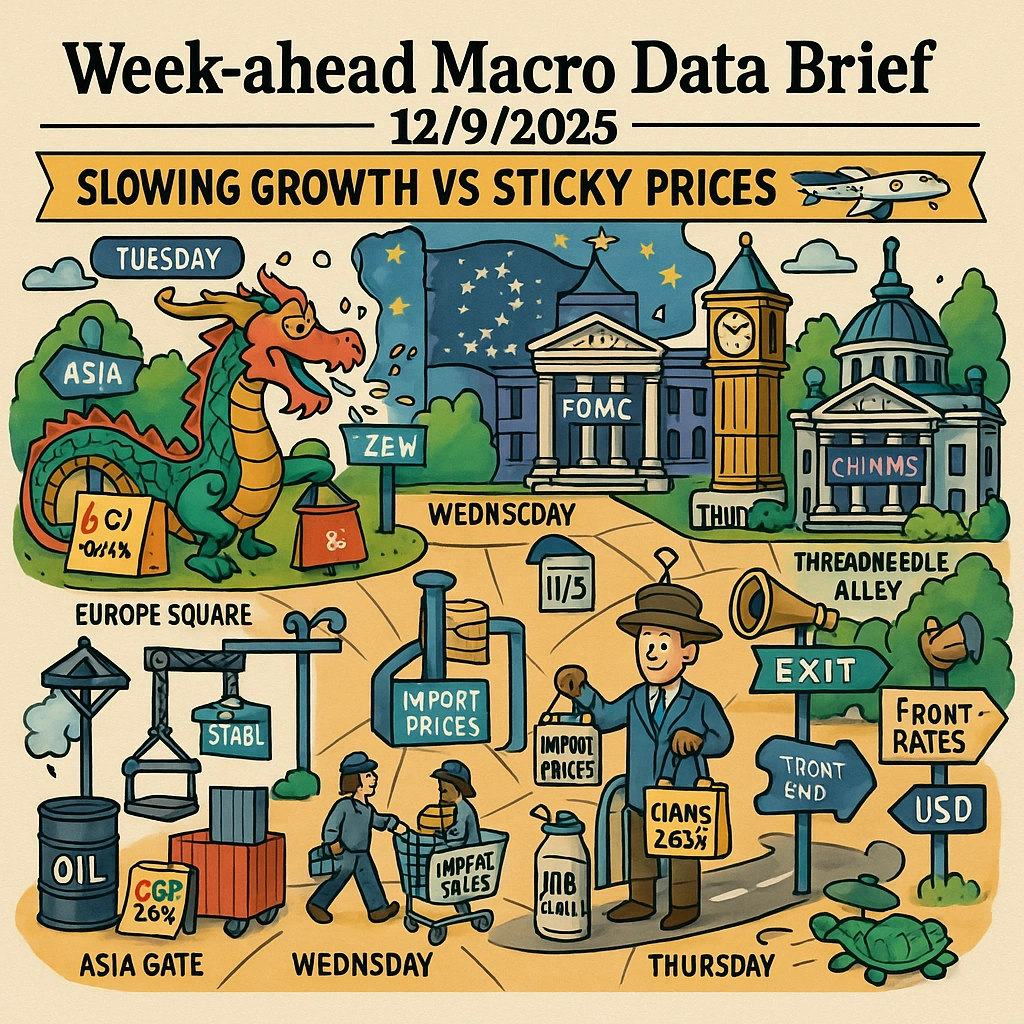

Week-ahead Macro Data Brief 12/9/2025

Next week is book-ended by demand checks and dominated by central banks. Asia opens with China retail sales, a quick read on the strength of domestic consumption that will set the tone for commodities and cyclicals.

Europe follows with Germany’s ZEW survey, a clean gauge of sentiment as industry and exports struggle to regain traction.

In the U.S., retail sales and import prices refine the growth–inflation mix just hours before the main event: the FOMC decision and updated SEP/dot plot on Wednesday with the Bank of England on Thursday and weekly jobless claims as a timely cross-check on labor cooling.

Markets are currently priced for slower growth and only gradual disinflation. Putting a premium on:

- Whether China shows any convincing consumption rebound;

- If ZEW stabilizes, hinting at an improving European outlook;

- How U.S. retail momentum and import-price pressures line up with easing goods inflation but sticky services;

- The Fed’s path (pace and depth of 2025 cuts) and the BoE’s tolerance for residual wage/price pressure.

It’s a week where forward guidance may matter as much as the prints themselves. Expect front-end rates and the USD to take their cues from the Fed & BoE tone and any surprise in U.S. retail or initial jobless claims, with risk assets tracking whether “soft-landing” credibly endures.

So, into a central-bank-heavy week, the macro tone is “slowing growth vs sticky prices.” August US CPI surprised higher (+0.4% m/m headline; core +0.3%), while initial claims just spiked to 263k (partly Texas-related), tilting policy expectations toward a Fed cut on Wed and a cautious BoE on Thu.

Monday — China: Retail Sales YoY (Aug)

- Consensus/backdrop: July slowed to 3.7% y/y; calendars flag ~3.8% for August, released in the Asia overnight window. Cooling domestic demand and softer EV momentum argue for only a modest uptick.

- What to watch: Auto & home-related categories; any lift from local stimulus. A beat (>4%) would help regional risk and cyclicals; a miss (<3.5%) would reinforce China-demand drag for commodities.

Tuesday — Germany: ZEW Economic Sentiment (Sep)

- Context: ZEW fell sharply in Aug to 34.7 from 52.7; timing for Sep release is Tue 16 Sep ~11:05 CET. With ECB holding rates and German data still tepid, base case is low-to-mid 30s (stabilization, not recovery).

- Market angle: A rebound back >40 would aid DAX/EUR via improved expectations; a slip toward 25 would underline domestic weakness and keep Bunds bid.

Tuesday — US: Retail Sales (Aug)

- Consensus: ~0.3% m/m headline after +0.5% in July; control-group cooled to +0.5% in July. Release Tue 16 Sep, 08:30 ET (13:30 UK).

- Read-through: Value-seeking consumers (grocery/discounters) still spending, but higher financing costs and weaker hiring temper durables. A soft print (≤0.1%) would reinforce the “Fed cuts into slowdown” narrative; ≥0.6% would challenge that.

Tuesday — US: Import Prices (Aug)

- Recent: +0.4% m/m in July surprised to the upside; oil has since wobbled on oversupply/demand worries. Base case flat to +0.2% as fuel pullback offsets tariff-related goods pressures.

- Why it matters: Feeds the pipeline to core goods; a tame print would help the disinflation story despite CPI’s services stickiness.

Wednesday — Federal Reserve: Rate Decision & FOMC Projections

- What markets price: A 25 bp cut (target 4.00–4.25%) is widely expected; a 50 bp risk tail remains but is small. The driver is labor cooling (claims spike, weak NFP), despite CPI at 2.9% y/y. Reuters+2Reuters+2

- SEP (dots & forecasts): Watch for a lower 2025 median funds-rate path, higher unemployment path, and core PCE ~3% near-term before drifting lower—consistent with June SEP ranges. Any signal of multiple 2025 cuts (not just September) would bull-steepen USTs and weigh on USD.

- Market sensitivities:

- Hawkish twist: One-and-done tone, shallow 2025 path. → Front-end yields and USD up.

- Dovish twist: Dots show at least two more cuts this year. → USTs rally; USD softer.

Thursday — Bank of England: Rate Decision

- Set-up: After the Aug 7th 25 bp cut to 4.00% (5–4 vote), guidance has stressed gradual, data-dependent easing. For Sep 18, odds lean to HOLD at 4.00%, with a minority pushing for another trim; markets are split on a further 2025 cut. Announcement 12:00 UK. Bank of England+2Reuters+2

- What to read first: Vote split and language on wage momentum; any nod to slower pace of cuts after the CPI blip would support GBP and cheapen short-sterling.

Thursday — US: Initial Jobless Claims

- Latest: 263k—highest since 2021—skewed higher by Texas flooding, but trend has been edging up since July. Another 250–270k print would cement the “labor cooling” narrative into the Fed’s easing path.

Bottom line

- Growth vs prices: Expect a mixed week—soft China demand, guarded German sentiment, and US consumption decelerating but not collapsing.

- Policy: Fed likely delivers a 25 bp cut with a cautiously easier dot-path; BoE likely on hold after August’s cut. If US retail sales underwhelm and claims stay elevated, expect USTs bid and USD softer; upside surprises would curb that move.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.