ZEW Economic Sentiment Preview – 14.10.25

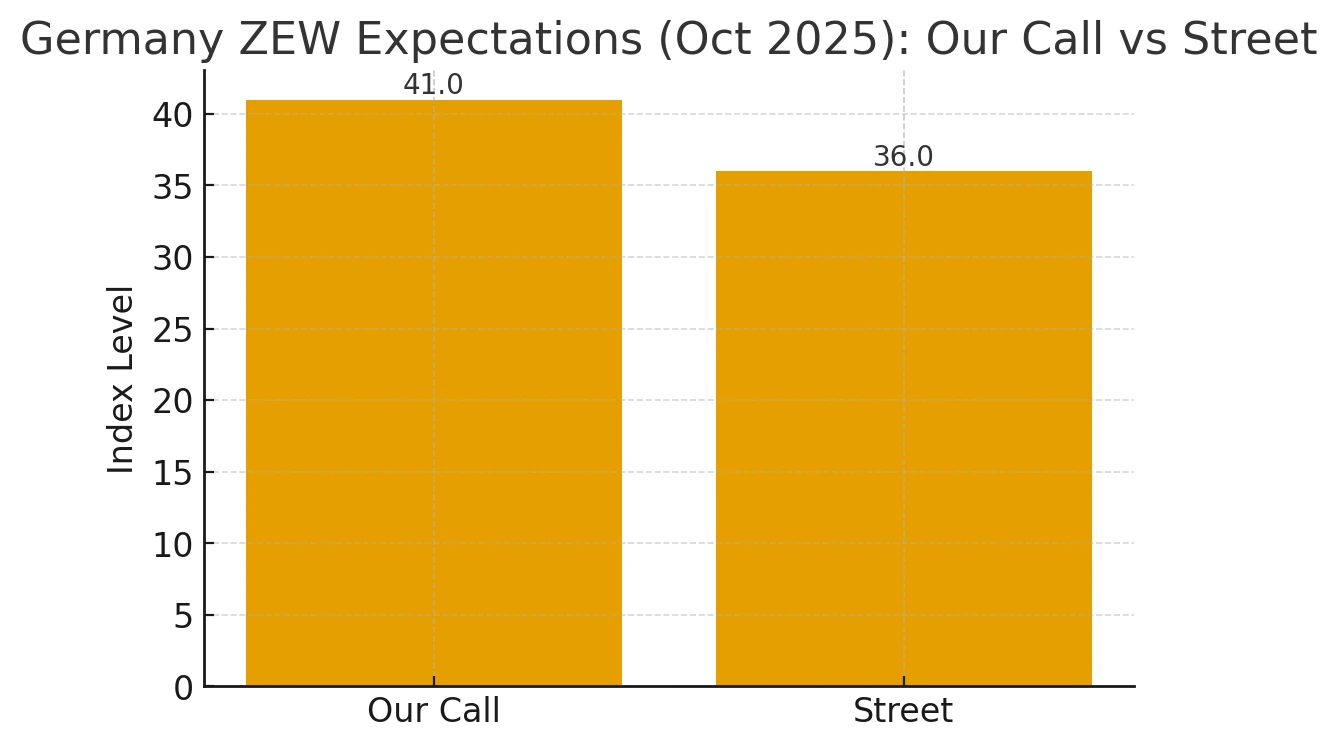

The euro area’s forward-looking pulse gets a fresh read on Tuesday, 14 October 2025 at 10:00 UK, when the ZEW Economic Sentiment surveys land for Germany and the wider bloc. Our base case looks for a modest upside in expectations, Germany 41 (vs 39.5 consensus; 36 street) and Euro Area 30 (vs 30.2 consensus; 25.1 street), tempered by another slide in Germany’s Current Situation.

The mix aligns with what markets have been pricing over the past month: firmer risk appetite and stabilizing PMIs on one side; weak German hard data and still-soft industry on the other. In this note we lay out our calls versus consensus, the macro drivers behind them, and the scenario paths most likely to move EUR crosses, Bunds, and the DAX at the print.

Our Call

-

Germany ZEW Expectations (Oct): 40–42 (base case 41).

– Slight beat vs consensus 39.5 and clearly above “street” 36. Skew is modestly to the upside. -

Euro Area ZEW Expectations (Oct): 29–31 (base case 30).

-In-line to tiny beat vs consensus 30.2; comfortably above “street” 25.1. -

Germany ZEW Current Situation: likely falls further to about -80 to -83 (Sep was -76.4).

| Indicator (Oct) | Our View (Base Case) | Our Range | Consensus Est | Street Forecast | Previous Reading |

| Euro Area ZEW Expectations | 30 | 29 – 31 | 30.2 | 25.1 | 26.1 |

| Germany ZEW Expectations | 41 | 40 – 42 | 39.5 | 36 | 37.3 |

Euro Area ZEW:

German ZEW:

Why We Expect a Small Upside (especially Germany):

Forward-looking sentiment has already improved into October.

-

The Sentix expectations gauge for the euro zone rose more than expected in October (survey 2 – 4 Oct), with Germany’s expectations moving higher too, classic lead-in for ZEW’s financial-expert panel.

-

Euro area PMI momentum has kept edging up (Sep Composite 51.2, 4th monthly rise), consistent with improving 6-month expectations that ZEW tracks.

Markets are supportive for ZEW respondents.

-

European equities set record highs at the start of October, even after some wobble later in the week, typically a tailwind for ZEW expectations.

-

Policy backdrop: The ECB is on hold and communicating that the current stance is “appropriate/robust,” reducing near-term tightening risk. Stable rates often buoy expectations.

-

Energy inputs are benign: Dutch TTF gas €32/MWh lately and storage above 80% into October, much calmer than prior years, easing cost anxiety.

But the current situation should keep sliding (and caps the upside).

-

Germany’s hard data have been poor: Aug industrial production -4.3% m/m (worst since 2022), with an 18.5% plunge in autos; and factory orders -0.8% m/m with export orders weak. That’s textbook pressure on the Current Situation index.

-

Ifo Business Climate fell in September, signaling corporate-side caution even as financial-market sentiment improves.

-

ZEW itself flagged in September that expectations stabilized (37.3) but the situation deteriorated (-76.4). I expect that pattern to continue.

Macro cross-currents to factor:

-

Inflation ticked up in September (EA flash HICP 2.2%), supporting “hold” at the ECB but not scaring markets—net neutral to mildly positive for expectations.

-

Tariff/political noise (US–China headlines; France’s instability) created late-week risk-off, but overall equity levels remain elevated, so the net effect into the ZEW survey window still leans positive. Reuters+1

How Our Calls Compare

-

Germany Expectations: Jul 52.7 – Aug 34.7 (tariff shock) – Sep 37.3 – Oct call 41 (gradual repair, not a surge).

-

Euro Area Expectations: Sep 26.1; I look for 30 on improving risk sentiment and PMIs.

Risk Skew & What Would Flip Our Call

Upside surprise risk (Germany >45 / EA >33):

-

If respondents overweight the equity highs and soft-landing narrative (PMIs >50, gas cheap, ECB steady), the expectations jump could be larger.

Downside surprise risk (Germany ≤35 or a bigger drop in Current Situation <-85):

-

If auto-sector weakness and orders slump dominate respondents’ thinking, or if late-week risk-off bled into the survey period more than I assume.

Trading/market implications to prep for

-

EUR (esp. EUR/USD, EUR/GBP): ZEW is not a top-tier mover but does punch above its weight when it diverges from consensus and when it confirms/contradicts PMI/Ifo.

-

Beat (Ger >42; EA >31): mild EUR pop and Bund yields +2–4 bps; DAX better bid.

-

Miss (Ger <35 or Current Situation lurches sub–85): EUR soft, Bunds bid; equities fade.

(Based on typical post-ZEW beta and the current macro narrative; size will depend on concurrent headlines.)

-

Nuts & bolts to watch in the release

-

Germany “Current Situation” headline (I expect new cycle lows).

-

ZEW commentary (Achim Wambach often name-checks key drivers—tariffs, reforms, energy—useful for read-through).

-

Euro area expectations vs Germany gap: narrowing would add confidence to any EUR-positive read.

Conclusion

On balance, we expect ZEW expectations to nudge higher and validate the “gradual repair” narrative, while the Current Situation likely carves new cycle lows—a combination that argues for measured, not euphoric, risk follow-through. A beat (Germany ≥42; EA ≥31) should bias EUR modestly firmer with yields 2–4 bps higher, whereas a miss (Germany ≤35 or Current Situation <-85) would likely see EUR soften and duration bid. Into the release, anchor your playbook on these thresholds and the tone of ZEW’s commentary: confirmation of improving expectations alongside acknowledgement of industrial weakness is the most probable outcome. As ever, position sizing and discipline matter more than the first headline—trade the magnitude of the deviation and the direction of the narrative, not just the number.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.