ISM Services PMI – What to Expect – 03.10.25

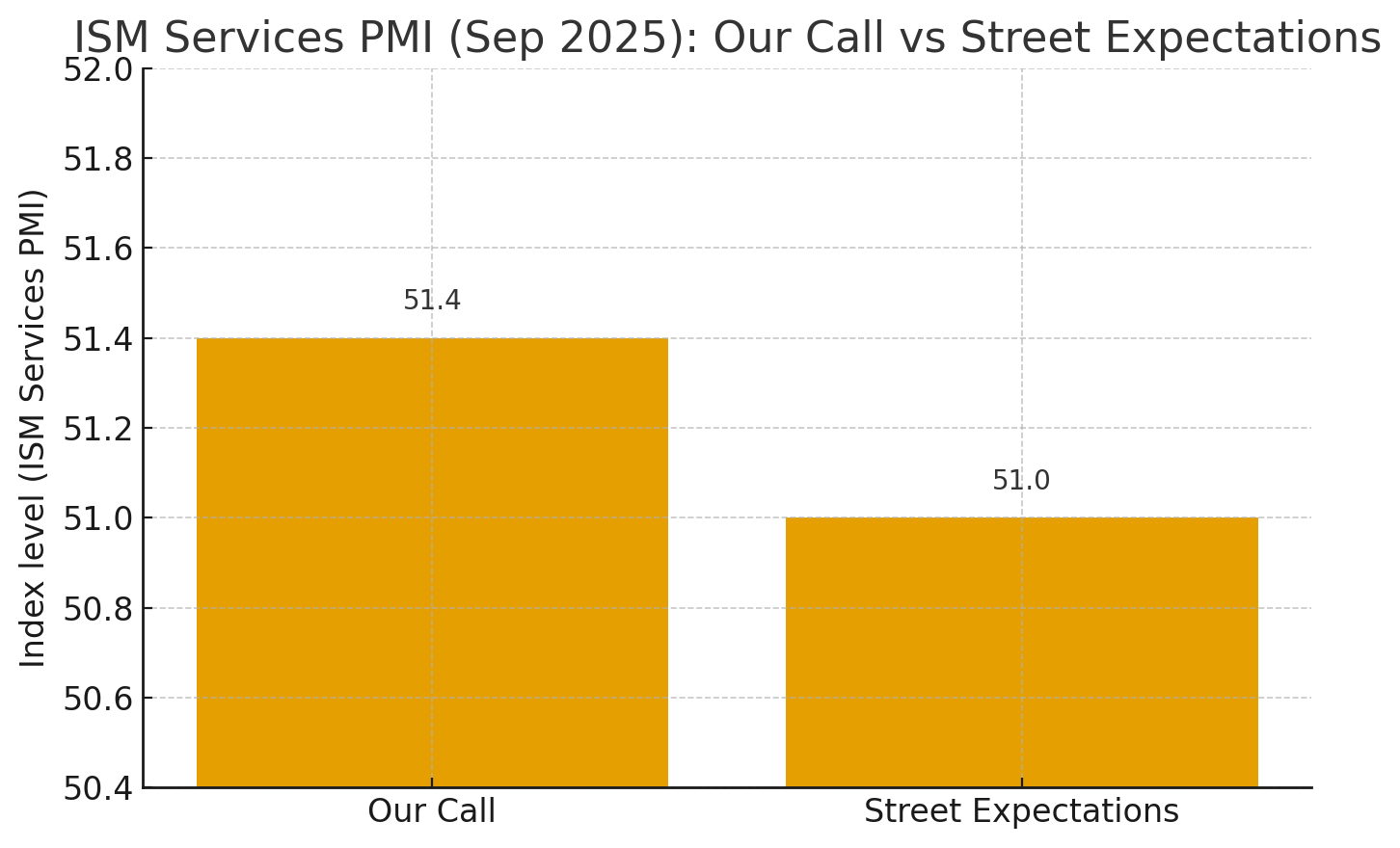

The September ISM Services PMI report (Fri, 03 Oct 2025; 15:00 UK / 10:00 ET) lands into a mixed macro backdrop: activity remains expansionary but momentum has cooled, hiring signals have softened, and price pressures in services are still sticky. Against that context, our base case is for the headline to dip modestly to 51.4 (vs 51.7 consensus; 51.0 street).

We expect Business Activity/New Orders to ease but stay in expansion, Employment to remain in mild contraction (47 – 48), and Prices Paid to hold elevated (67 – 69). This reflects the combination of weaker private sector hiring and regional services prints, softer consumer confidence, and the tendency for ISM to run below S&P Global when labor sub-indices weaken, even as supply chains and manufacturing remain far from overheated.

Our Call

-

Headline ISM Services PMI (Sep): 51.4 vs previous 52.0, consensus 51.7, street 51.0, slight downside vs consensus, modest upside vs street.

Why

-

Private-sector labor soft: ADP showed –32k private payrolls in Sep (largest drop since 2023), dampening services momentum into month-end.

-

Regional services slowed: Dallas Fed Texas Service Sector revenues turned negative; Richmond Fed services cooled; Philly Fed non-manufacturing softened. These typically correlate with weaker ISM new orders/employment.

-

Demand pulse easing (but still expanding): S&P Global US Services PMI 53.9 for Sep implies continued growth but off August’s pace; ISM often runs lower than S&P Global when employment is weak.

-

Macro tone mixed: Consumer Confidence fell again in Sep (jobs-availability gauge at a multi-year low) – softer services demand backdrop.

-

Goods side not a boost: ISM Manufacturing improved to 49.1 but stayed in contraction with new orders sub-50, so spillovers to services likely limited.

-

Inflation stickiness: ISM Manufacturing Prices stayed high (61.9), and Aug Services Prices were near 70. That mix keeps the Prices Paid index elevated even if activity cools.

Sub-index Range Expectations

-

Business Activity: 53 – 54 (down from 55 in Aug).

-

New Orders: 53 – 54 (down from 56).

-

Employment: 47 – 48 (still contracting; ADP/regionals align).

-

Prices Paid: 67 – 69 (sticky; tariffs/cost passthroughs keep it high).

-

Backlogs: 46 (Aug hit a multi-year low; likely still weak).

-

Supplier Deliveries: 50 – 51 (marginal slowing noise rather than strong demand).

Skew & Risks

-

Downside risks (to <51): broad softening in regional services, confidence slide, and continued hiring restraint.

-

Upside risks (to >52): S&P Global services resilience and any tariff-related lengthening in deliveries can mechanically lift the composite.

Market Reaction

-

52.5+ with Prices >70 and Employment >50 – USD & UST yields higher, curve bear-steepen; USD/JPY up, EUR/USD down. Equities wobble on “sticky services inflation.”

-

51 (+/-0.5) with Employment <47 (our base) – yields drift lower, USD mildly softer vs. EUR/JPY, equities neutral-positive (Fed cut expectations lean intact given softer labor signals).

-

Sub-50 – risk of a broader risk-off growth scare (yields drop; USD up vs EM Currencies, firmer vs EUR; USD gains vs JPY can be mixed if equities slide hard).

Release Logistics

-

When: Friday Oct 3, 2025 at 15:00 UK (ISM Services Sep). FXStreet calendar also flags the timing window.

If you want, I can layer this into your pre-release playbook with triggers (e.g., fade USD on 50.8 – 51.2 with sub-47 Employment; chase USD on >52.7 with >70 Prices)

Conclusion

Netting it all up, we see a slight downside risk versus consensus with the more market-relevant mix being sub-50 Employment alongside still-firm Prices Paid. In that base scenario, front-end UST yields should lean lower and the USD may soften modestly versus EUR/JPY. Upside risks come from a resilient activity pulse (>52) or any lengthening in supplier deliveries that props up the composite; a print north of 52.5 with Prices >70 and Employment ≥50 would likely lift yields and the USD.

For FX execution, anchor on the internals: fade USD on 51 with Employment <47, and consider chasing USD strength only if you see a >52.7 headline paired with sticky prices and non-contracting employment. Be ready at 15:00 UK; the first read-through of Employment and Prices should drive the initial move more than the headline itself.

For similar Forex Markets news please visit our Markets News page.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.