The October NY Empire State Manufacturing Index prints on Wednesday, 15 Oct 2025 at 13:30 UK time.

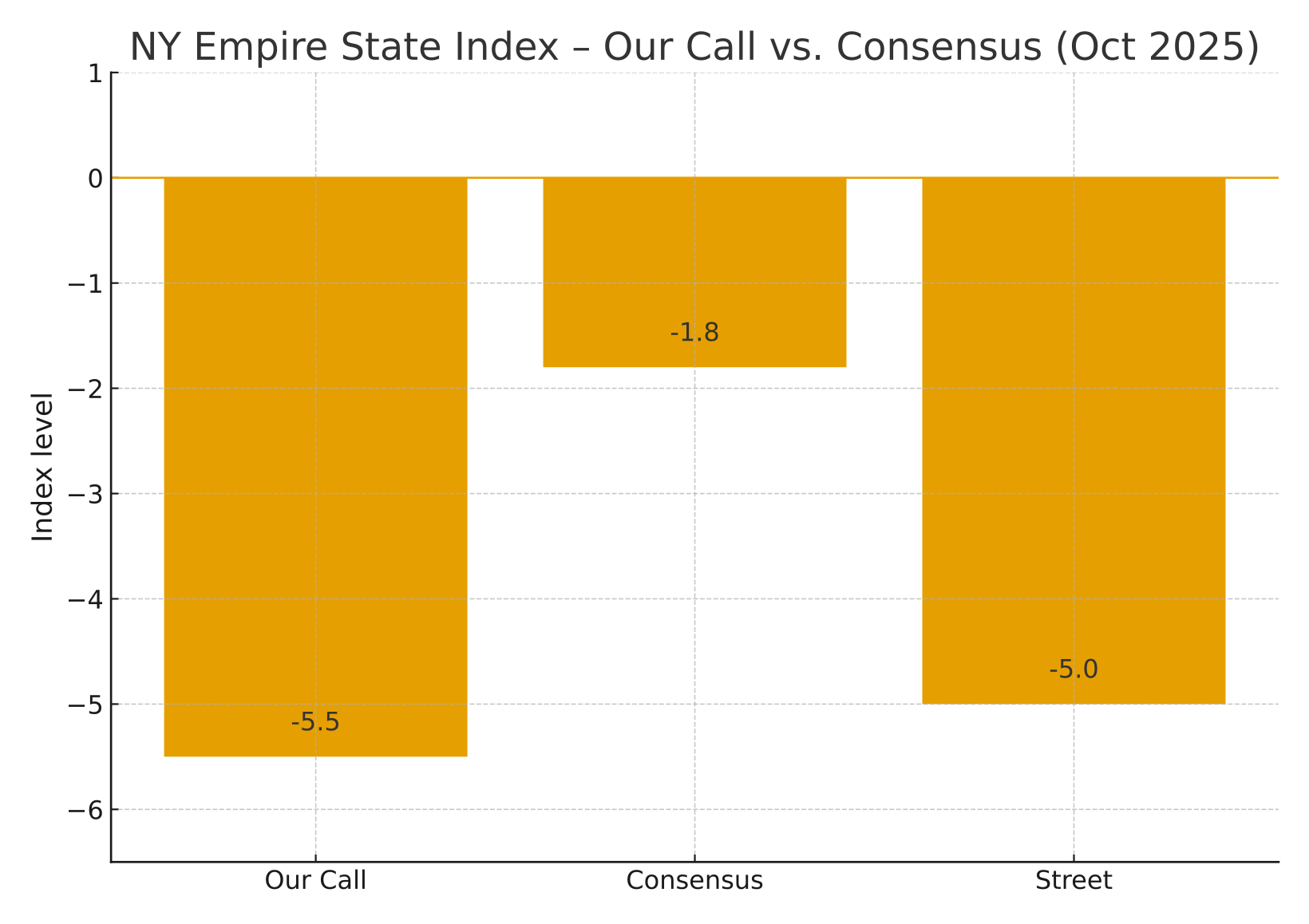

The market’s first regional read on current-month factory activity. With September’s headline at −8.7, the street is looking for a rebound (Consensus −1.8; Street Forecast −5). Our read leans more cautious: we call −5.5 (range −10 to 0), reflecting still-soft demand and only tentative signs of stabilization.

This note frames Our Call vs. Consensus, what to watch inside the report (new orders, shipments, prices, employment, and 6-month expectations), and the likely cross-asset reaction path in USTs, the USD, and cyclicals.

Snapshot & Schedule

-

When: Wed 15/10/2025 at 13:30 UK / 08:30 ET.

-

Prior (Sep): -8.7 (first negative since June) with new orders -19.6 and shipments -17.3; inventories edged lower; workweek shortened; supply availability worsened somewhat.

-

Street Numbers: Consensus -1.8, Street -5

Our Call:

| Our Call | Consensus Estimates | Street Forecast | |

| NY Empire State Manufacturing Index | -5.5 | -1.8 | -5 |

Forecast: −5 to −7, point estimate −5.5, a modest contraction and weaker than consensus.

Skew: Downside risk persists; a pop back to 0 isn’t impossible, but would likely require a sharp bounce in new orders.

Why Below Consensus?

1) September’s slump was led by demand (hard to snap back in one month).

The NY Fed’s own detail showed a steep drop in new orders (−19.6) and shipments (−17.3), plus a shorter workweek and softer inventories, classic signals of near-term production softness that often bleed into the next print.

2) National manufacturing still looks soft.

-

ISM Manufacturing (Sep): Headline 49.1; new orders back in contraction at 48.9; employment 45.3, not the backdrop for a swift Empire rebound.

-

S&P Global US Manufacturing PMI (Sep): Slowed to 52.0 from 53.0, still expansionary but cooling, consistent with tepid order books.

3) Regional Fed surveys lean negative outside a few bright spots.

-

Dallas Fed (Sep): General business activity −8.7.

-

Richmond Fed (Sep): Composite −17 with shipments/new orders weaker.

-

Kansas City (Sep): Composite +4 (improvement, but new export orders cooled).

-

Philadelphia (Sep): +23.2 (clear outlier strength last month).

Net: breadth is mixed, but the median regional tone points to ongoing softness in demand.

4) Hard data not convincingly strong ex-transport.

Durable goods (Aug) rose 2.9% m/m, but that was led by transportation; ex-transport +0.4%, a better read than July but not “booming.” Chicago PMI stayed very weak (40.6) in September.

5) Macro backdrop not especially supportive of capex now.

Broader survey work shows consumers and firms turning a bit more cautious into September/October (NY Fed SCE: weaker spending plans, higher job-loss risk), and services activity cooled in September, both consistent with guarded order pipelines at manufacturers.

What to Watch For

-

New Orders & Shipments: If orders climb back toward −5 to 0, headline can print near flat; if they stay sub-10 negative, headline likely sits around my −5 to −7.

-

Employment & Workweek: September held employment roughly steady but cut hours, any slip into negative employment would reinforce a softer Q4 output path.

-

Prices Paid/Received: ISM showed mfg prices mixed; if Empire prices paid pop while orders lag, that’s margin-squeeze risk.

-

Six-month expectations & capex plans: A bounce here could cushion risk assets even if the current conditions index stays negative.

Market Impact

-

Upside surprise (> 0): Implies a fast orders rebound. Likely bearish USTs / modest USD bid, USD/JPY up, EUR/USD/GBP/USD softer on the print, but follow-through may fade without corroboration from Philly/industrial production later in the week.

-

Base case (−5 to −7): Below consensus; risk-off knee-jerk (yields down, USD mixed). Pairs sensitive to rates (USD/JPY) could dip first, then stabilize.

-

Downside tail (< −10): Confirms demand slump; UST rally / USD mixed-lower, cyclicals underperform; raises questions about Q4 manufacturing momentum.

Given the demand-led deterioration in September, the soft national/most regional signals, and only modest hard-data support ex-transport, we expect October Empire State to print below consensus, around −5.5 (range −10 to 0). Showing a modest bounce is possible (these regional indices are volatile), but it probably doesn’t fully erase September’s drop unless new orders snap back sharply.

Conclusion

Bottom line: we expect a modest contraction and a miss vs. consensus, unless new orders snap back more decisively than recent signals suggest. A print around –5.5 should keep the near-term growth narrative cautious, with USTs supported, USD reaction mixed, and follow-through hinging on orders and prices.

If the headline surprises toward zero or better, we’d fade any knee-jerk reaction unless confirmed by a broad improvement in new orders and employment.

For any trade execution we initiate we’ll be focusing on levels flagged in our playbook and be ready to adjust on the sub-indices. Orders and prices paid will set the tone more than the headline alone.

Please visit our Disclaimer page.

Disclaimer

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these or any financial instrument or instruments.

TerraBullMarkets.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets or any financial instrument involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of TerraBullMarkets.com nor any of its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

TerraBullMarkets.com and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. TerraBullMarkets.com and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and TerraBullMarkets.com are not registered investment advisors and nothing in this article is intended to be investment advice.